Are You a Veteran? You Might Be Overlooking One of the Most Powerful Home Loan Benefits Available

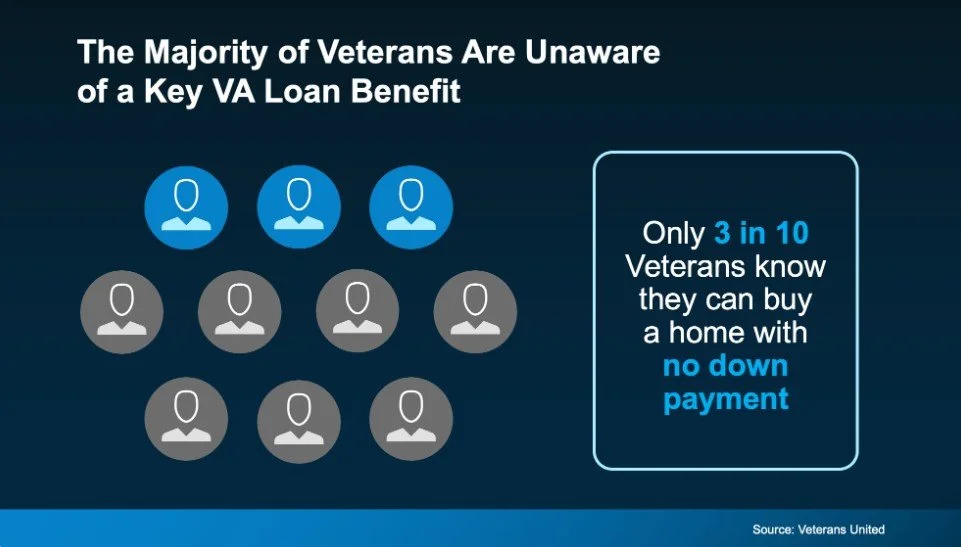

If you're a Veteran or currently serving in the military, there’s a strong chance you qualify for a VA home loan—but you might not be using it to its full potential. In fact, recent data shows that only 3 out of 10 Veterans know they can buy a home with no down payment using a VA loan.

That means 7 out of 10 Veterans could be missing out on a unique opportunity to invest in real estate with minimal upfront costs and powerful financial advantages.

Why VA Loans Matter—Especially Now

In today’s market—whether you're eyeing high-end homes in San Francisco, exploring new builds in Redding, or planning to invest in multi-unit properties across California—smart financing makes a big difference. With rising home values and competitive demand, having access to $0 down payment and no mortgage insurance (PMI) can give you a serious edge.

Top Benefits of a VA Loan

Whether you’re buying your first home, upgrading to a luxury property, or building a long-term portfolio, VA loans offer distinct advantages:

No Down Payment Required

One of the biggest perks—especially for newer investors or first-time buyers—is that you may be able to purchase a home with zero down. That frees up your capital for renovations, future investments, or simply building equity faster.Lower Monthly Costs

Unlike traditional loans, VA loans don’t require PMI, which can save hundreds per month—translating into better cash flow for owner-occupants and investor-Veterans alike.Fewer Closing Costs

The VA limits what lenders can charge you in closing costs, helping you keep more of your money working for you.Flexible Credit Guidelines

Even if you’ve had a few financial missteps, VA loans are known for their forgiving criteria, opening the door for more Veterans to own or invest.

Investing and Living with Purpose

Whether you're interested in building generational wealth through real estate or simply planting roots in a home that reflects your service and success, VA loans are a gateway to long-term opportunity.

Locally, we’re seeing strong interest in new construction in areas like San Francisco and increased appreciation in well-established neighborhoods like Redding. If you're a Veteran looking to leverage your benefits into a smart real estate move, now is the time to explore your options.

Let’s Talk Strategy

Curious if you qualify? Want to know how a VA loan could work for your investment or lifestyle goals?

Reach out today—my team and I work closely with trusted VA-approved lenders and local builders to help Veterans like you make confident, wealth-building moves in the California real estate market.