Still Sitting on a 3% Mortgage? Here’s Why It Might Be Time to Rethink That

Let’s face it — if you locked in a 3% mortgage rate, you made a smart move. And understandably, you're not eager to give that up. But here’s the real question: is staying in your current property actually serving your long-term goals?

Most of the time, people don’t move just because of interest rates. They move because their life — or their investment strategy — is evolving.

Whether you're eyeing a larger home for a growing family, looking to downsize, want to upgrade to a luxury property in a better location, or are thinking about expanding your real estate portfolio, it's worth zooming out and asking:

Where do you see yourself — or your investments — five years from now?

If your lifestyle or investment plan is likely to shift, even slightly, it may be time to start planning your next move now — before market conditions price you out of the best opportunities.

Home Prices Are on the Rise — Slowly but Steadily

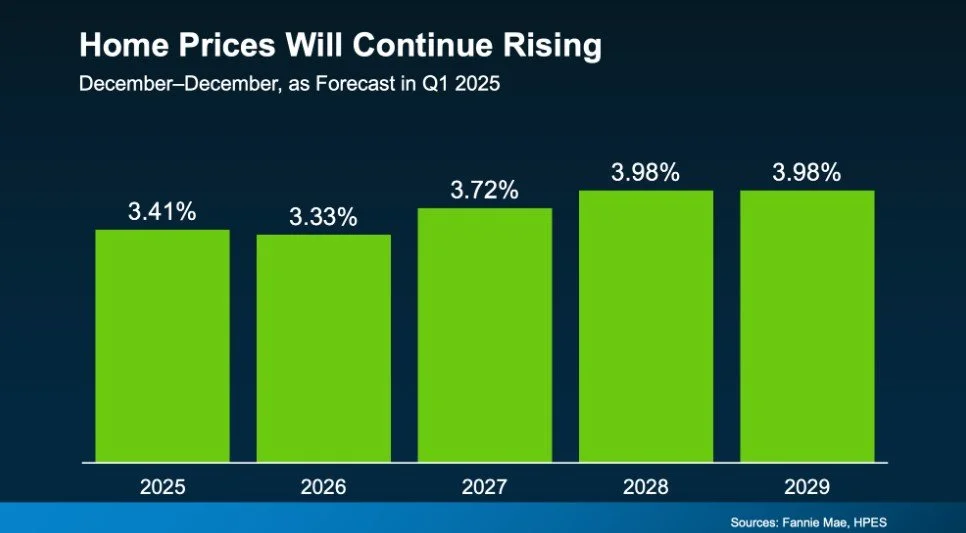

Nationally, and especially in high-demand regions, home prices are projected to keep rising over the next several years.

According to Fannie Mae, expert forecasts show consistent price growth through at least 2029. It’s not explosive — but it’s steady. And in real estate, that kind of appreciation is gold.

Here’s the math:

Say you’re eyeing a $400,000 property today. If you wait five years, that same property could run you nearly $480,000 based on current projections. That’s $80,000 in missed equity — and that doesn’t account for rising construction costs, potential bidding wars, or lower inventory down the road.

Rates May Not Drop as Much as You Think

Yes, rates have ticked up from pandemic-era lows. But holding out for another 3%? Most experts agree: that ship has sailed. While mortgage rates may come down slightly in the next year or so, it’s unlikely we’ll return to rock-bottom levels.

In other words, waiting for the "perfect" rate might cost you more in home value increases than you'd save on interest.

So, What Should You Do?

If you’re already thinking about upgrading, relocating, or acquiring new investment properties — now’s the time to run the numbers.

Even if you don’t plan to make a move today, it’s wise to start mapping out your strategy before the market shifts further. Remember, timing is everything in real estate — especially when it comes to long-term wealth building.

Final Thoughts

Yes, a 3% mortgage is a great rate — but not if it keeps you from making your next smart move.

If you’re serious about growing your portfolio, moving into a luxury home, or simply planning for what’s next, let’s talk. I can help you compare scenarios and make a decision that works for you both financially and personally.

Let’s crunch the numbers for your price point and goals — and figure out the best timeline for your next real estate move.