MarketTracker North Bay - August 2025 from CharlieBrownSF

The Big Story

Quick Take:

The median home in the US is surprisingly appreciating at a slower rate than inflation.

Mortgage rates remain stagnant, in the high 6-percent range that we’ve seen for a couple of years at this point.

Inventory is continuing to build, as existing home sales remain stagnant on a year-over-year basis.

Another FOMC meeting has come and gone, and the federal funds rate remains unchanged.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

Median home sales price grew by just 1.97%

In the not-so-distant past, housing price growth outstripped inflation growth by a wide margin. However, now that the housing market has normalized, we’re seeing more modest levels of appreciation, with the median home sale price increasing by just 1.97% on a year-over-year basis in June. This represents great news for home buyers, and the housing market as a whole, considering that the June CPI reading came in at 2.7%. It’ll be worth paying attention to this over the course of the next few months, especially considering that many analysts are expecting a rate cut from the Fed in the September FOMC meeting.

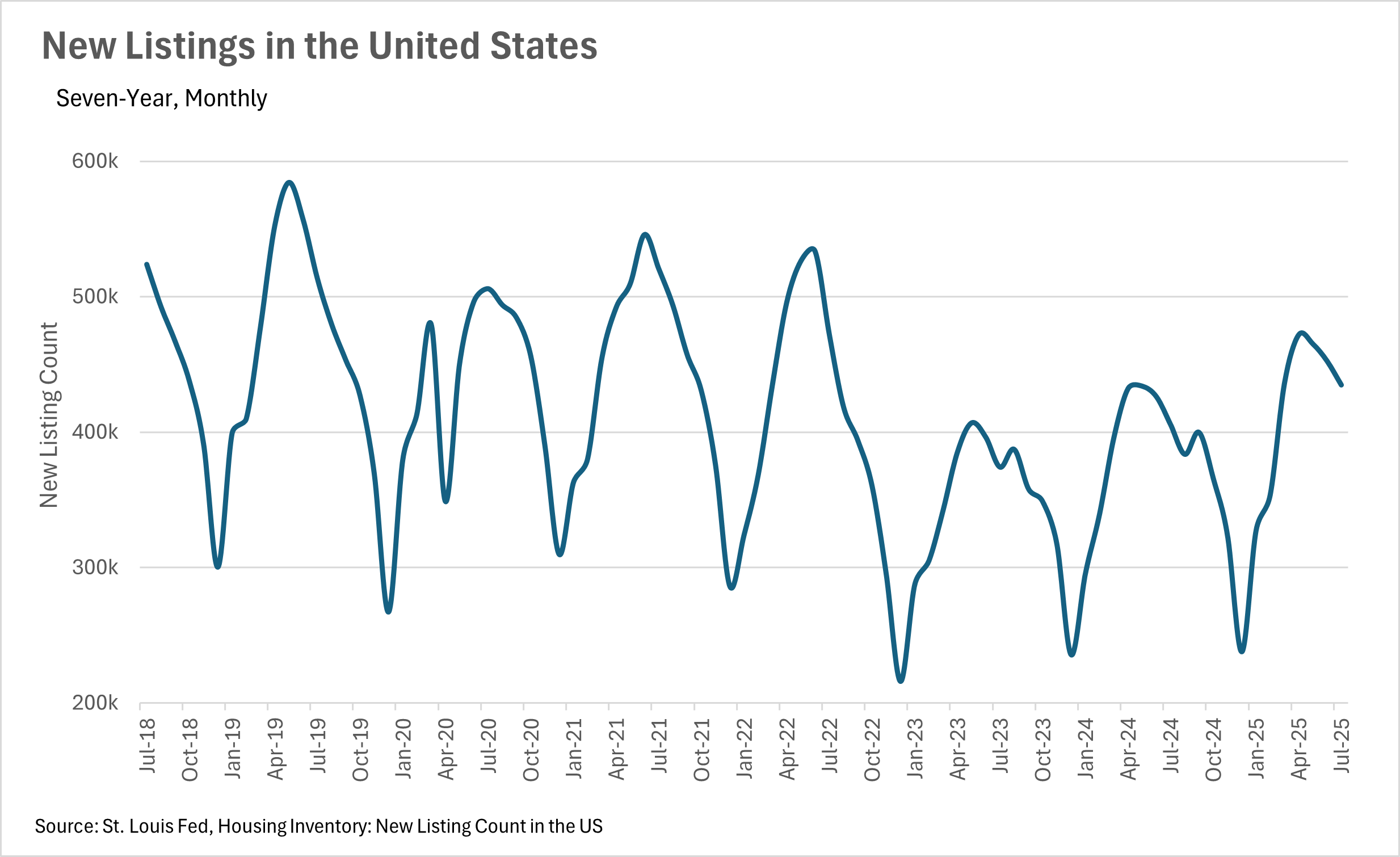

Inventory levels continue to build as more new homes hit the market

The trend of growing inventories has continued this month, with 15.91% more inventory on the market in June on a year-over-year basis. This growth in inventories can be attributed to the fact that the new homes are hitting the market at a much faster rate than new buyers are entering the market. In June, we saw a 0.77% increase in the number of existing homes sold on a year-over-year basis, while at the same time, we saw a 7.25% increase in the number of new listings hitting the market. Although there are still some buyers entering into the market every month, there is still a rather large contingent of people holding out until rates come back down.

The Fed is holding rates steady due to economic uncertainty

This past month, we saw the Fed hold rates steady once again, as they brace for the consequences of the newly minted tariff policies that went into effect in early August. Although inflation data has led many to believe that we need to see substantial rate cuts in the not-so-distant future, Fed officials are incredibly concerned about the potential impacts of the freshly enacted tariff policy. Additionally, the Fed has a dual mandate; it’s responsible for controlling inflation and promoting maximum employment. At this point in time, we’re seeing relatively low inflation, and a very low unemployment rate, so Fed officials seemingly aren’t in a hurry to cut the federal funds rate.

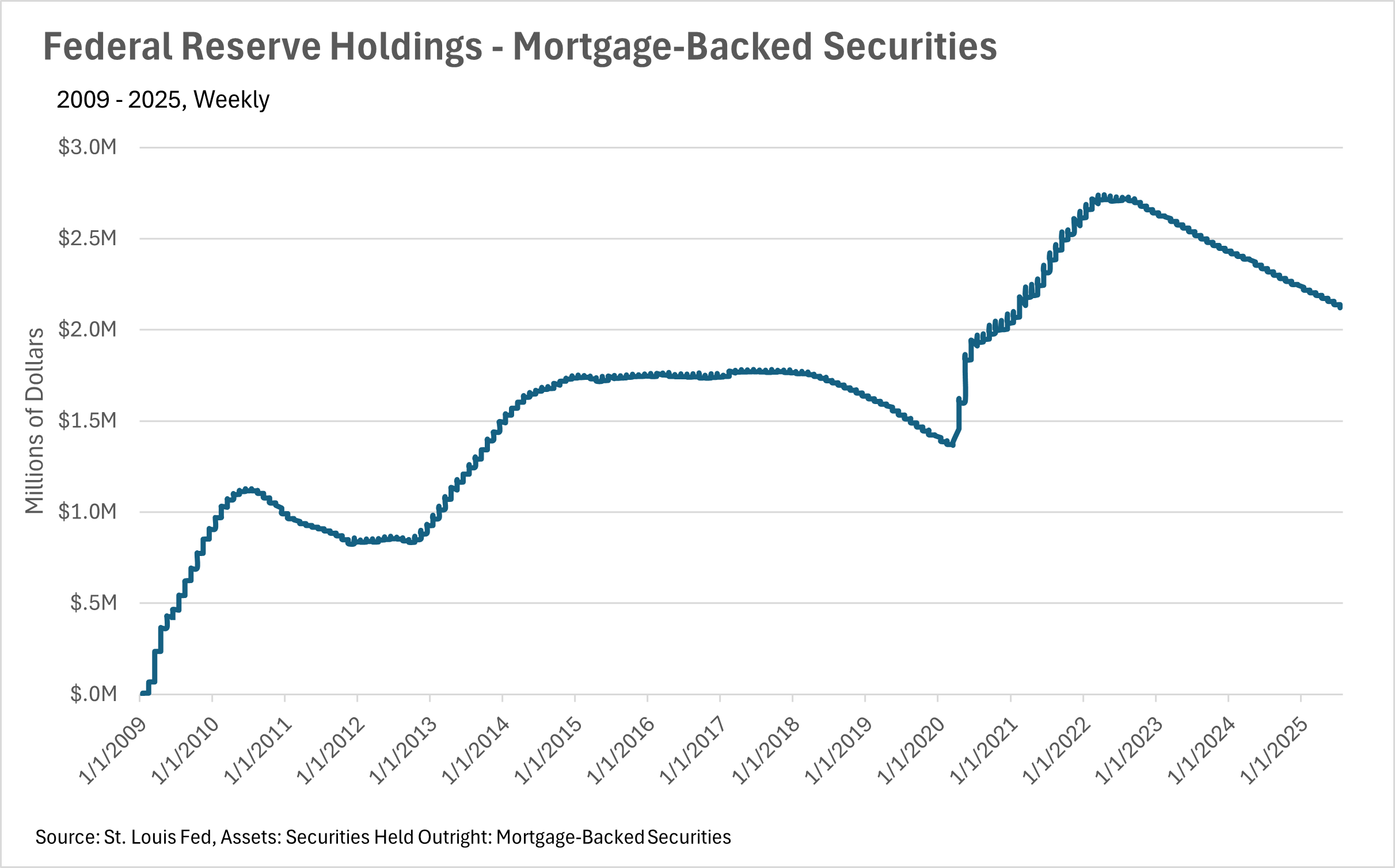

Mortgage rates remain stagnant, but comparatively high

It probably isn’t much of a surprise that inventories are building and median sale prices have remained relatively stagnant, given the lack of movement in rates. Many believe that there is a very large contingent of people who simply aren’t willing to pay a comparatively very high interest rate to purchase a home, especially given that many have locked into rates in the 2-4% range on existing homes. The consistently high mortgage rates that we’ve seen have led people to stay in their homes for longer, resulting in more sellers on the market than buyers. However, we might see some movement if we see some positive commentary from the Fed in the upcoming FOMC meeting.

However, it’s important to remember that this is what we’re seeing at a national level. Oftentimes, what we see in California can be quite a bit different than the nation as a whole. We’ve done a deep dive into California markets in the local lowdown section below.

Big Story Data

What’s Moving: Sold Homes & Upcoming Listings in SF

Looking to buy or sell? Interview me for the job...

Call Charlie 415-722-3493.

The Local Lowdown

Quick Take:

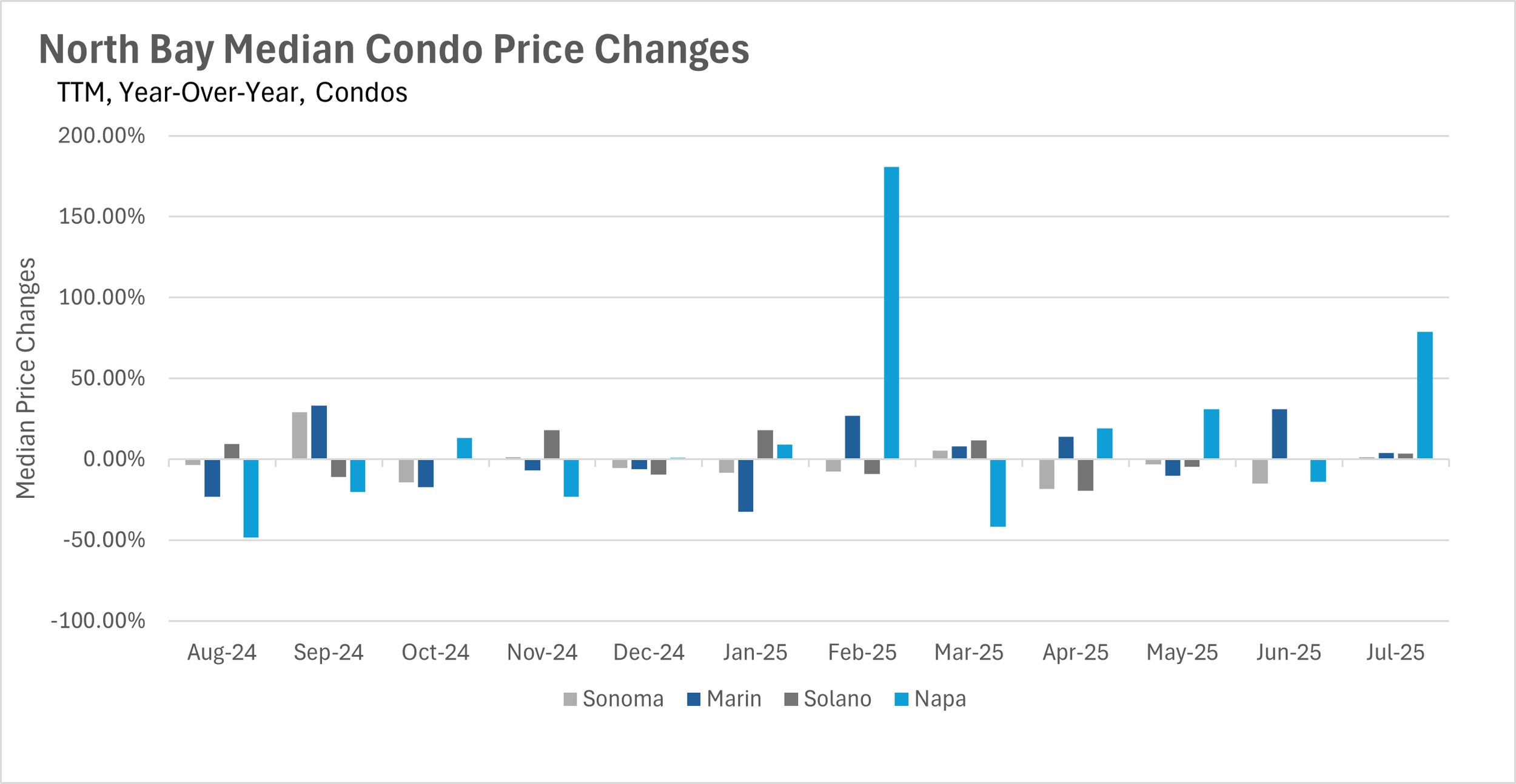

While median sale prices remain volatile in Napa County, they’re relatively stable in surrounding counties.

Inventory levels have bucked the trend and fallen precipitously

Despite falling inventory levels, listings are spending quite a bit more time on the market than they were last year.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Median sale prices throughout the North Bay have remained relatively stable

Despite the trends that we’re seeing in other datasets, the median sale price of a home in the North Bay has remained relatively stable (outside of Napa County). The median sale price of single-family homes in Solano and Marin Counties increased by 0.85% and 3.43% on a year-over-year basis, respectively. In contrast, median sale prices decreased by 0.06% and 14.94% year-over-year in Sonoma and Napa Counties. In the condo market, we saw median sale price increases across the board, with Sonoma seeing a 1.39% increase year-over-year, Solano seeing a 3.60% increase, Marin seeing a 4.00% increase, and Napa seeing a 78.75% increase. We’ll be keeping our eyes on these metrics moving forward, as it’ll be interesting to see where sale prices go in the ever-evolving market that we’re in.

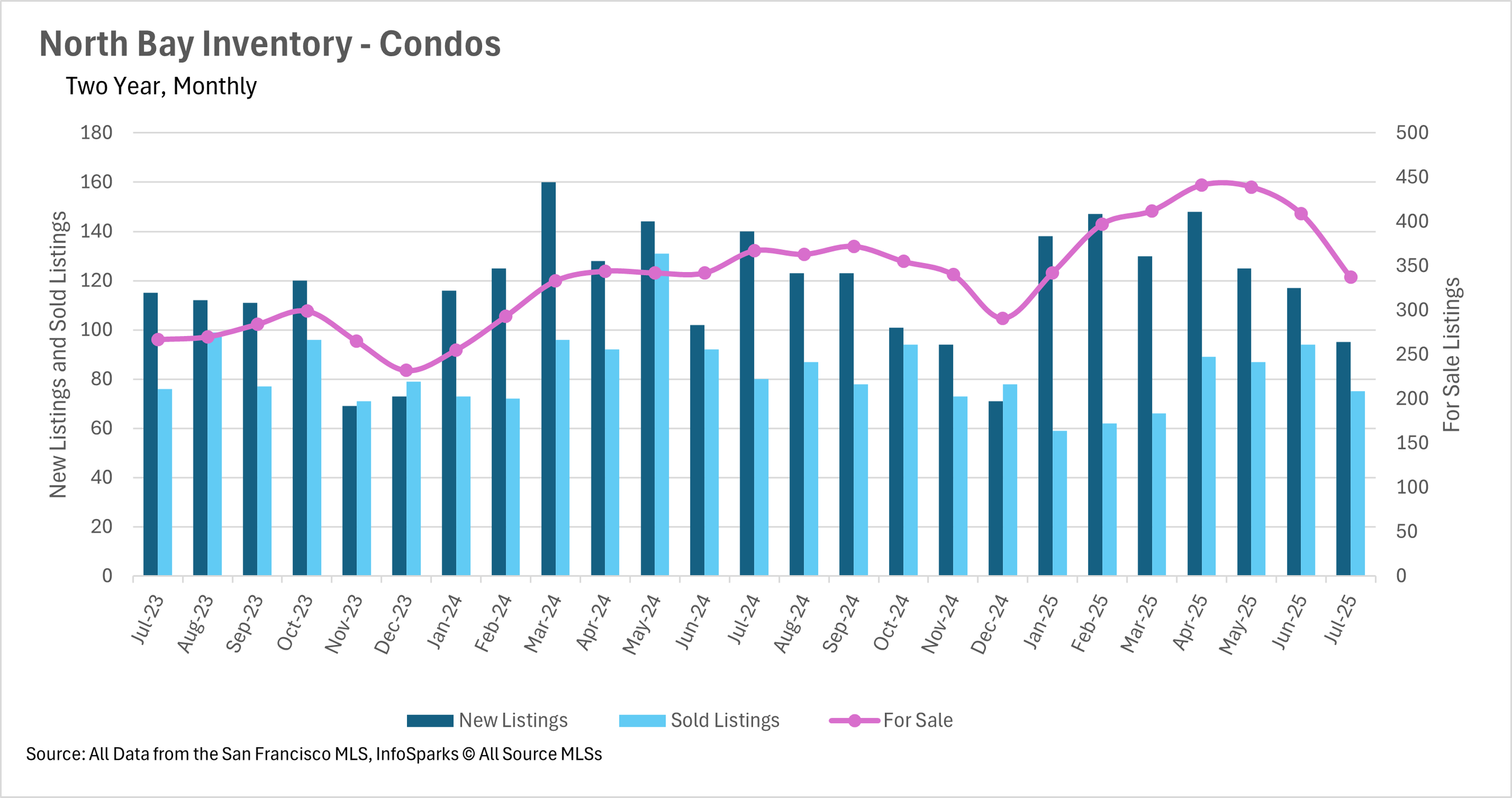

Inventories have dropped dramatically, with substantially fewer new listings hitting the market

Inventories took a nosedive throughout the North Bay last month. In the single-family home market, we saw a 21.98% decrease in inventory month-over-month, representing a 12.24% decrease when compared to last year. Likewise, the condo market saw a 17.60% month-over-month decrease, and an 8.17% year-over-year decrease in inventories. This can largely be attributed to the fact that we saw borderline record-low levels of new listings hitting the market in July. For reference, there were 850 new single-family home listings added in the month of July, representing a year-over-year decrease of 29.28%. This is a level that we typically don’t see until the holidays!

Although inventory levels have fallen, the average listing is still spending 20-30%+ more time on the market

When you see inventories and new listings dropping, you might expect to see listings getting bought up much more quickly. However, that isn’t the case in the North Bay (at least, not yet). In both the single-family home and condo markets, we largely saw listings sitting on the market for considerably longer than they were last year. Most markets saw listings sitting on the market for 20-30% longer on a year-over-year basis, representing an absolute increase of 7-10 days. Some markets bucked this trend though, with condos in Marin and Napa Counties spending 109.68% and 284.21% more time on the market, when compared on a year-over-year basis. On the flip side, single-family homes in Napa County spent the exact same number of days on the market in July 2025 as they did in July 2024.

As inventories fall, competition has picked up in the North Bay

When determining whether a market is a buyers’ market or a sellers’ market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a sellers’ market, whereas markets with more than three months of MSI are considered buyers’ markets.

Inventories are dropping in the North Bay, so naturally, that means competition is heating up. Sellers in every market gained a bit more bargaining power, as options for buyers became more constricted. The Marin County single-family home market flipped to a sellers market, with just 2.3 months worth of inventory available. The single-family home market in Solano County became a more balanced market, with exactly 3 months of inventory on the market. However, all other markets are buyer dominated markets, with the single-family home markets in Sonoma and Napa Counties having 3.5 and 6.8 months of inventory on the market, respectively. Additionally, the North Bay condo market as a whole remains a buyers market.