MarketTracker Bay Area - May 2025 from CharlieBrownSF

The Big Story

Quick Take:

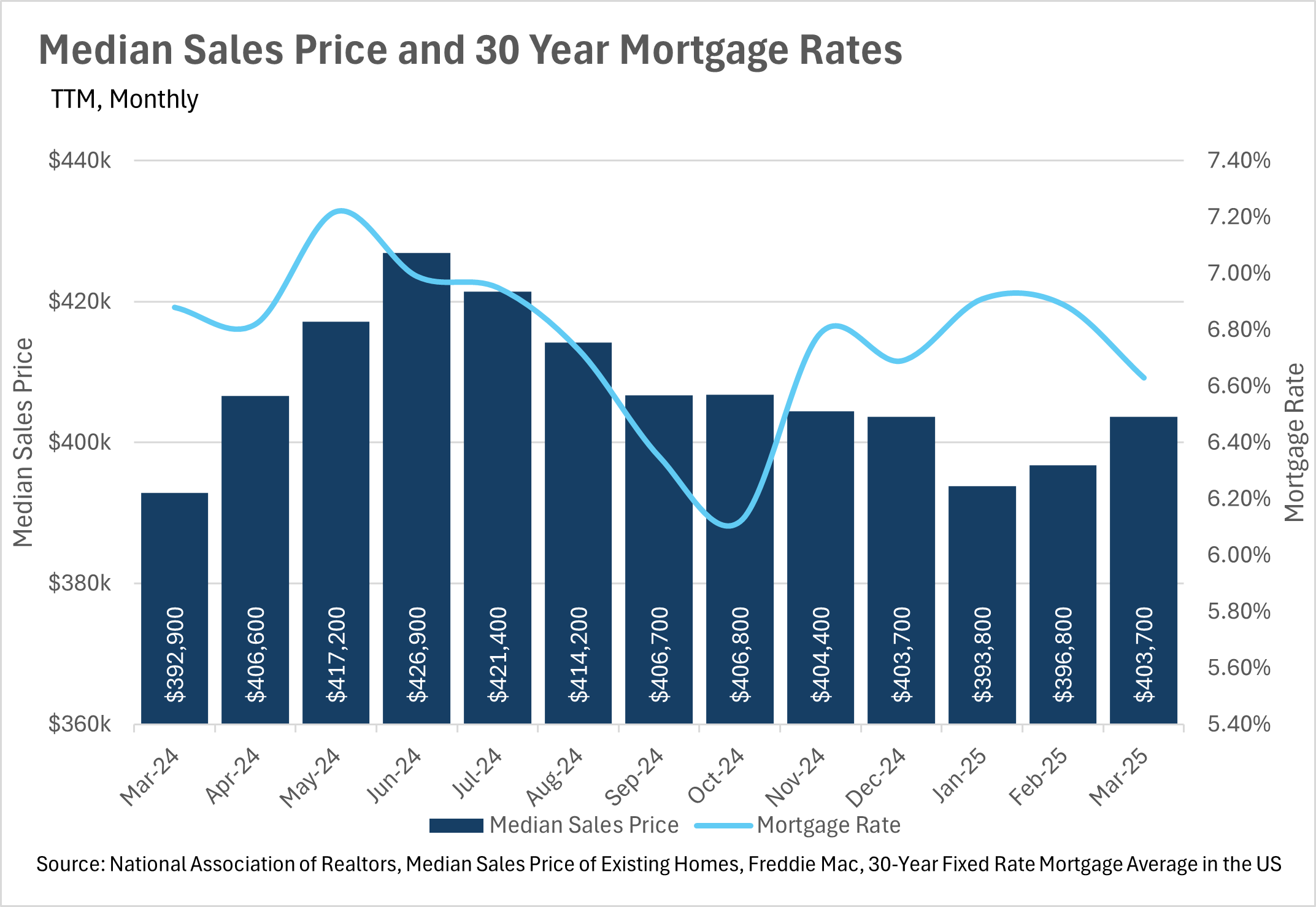

Median purchase price continues to tick up, increasing by 2.75% on a year-over-year basis nationwide.

The average 30-year mortgage rate continues to slowly fall, reaching 6.63% in the month of March.

The number of sales has declined slightly, while inventory skyrocketed on a year-over-year basis.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

Inventories levels explode while existing home sales decline slightly

Although we’re still at the point in the season where inventories are supposed to build, they have increased by nearly 20% on a year-over-year basis, from 1,110,000 to 1,330,000, showing that people are hesitant to purchase a new home. Additionally, while inventories have been increasing, the number of existing homes being sold has decreased slightly on a year-over-year basis, with March 2025 numbers coming in at 4,020,000, which is 2.43% lower than where they were last year. Across the country, people are becoming more uncertain of whether or not they should move to a new home, and that is very clearly showing!

This data is just for March though; it will be important to pay attention to how the market reacted to the beginning of the trade war when April’s numbers come out in a couple of weeks. While it’s easy to see how things like the stock market and bond market react to big newsworthy events like this, real estate is incredibly illiquid, so it takes some time for things to play out!

As you might have expected, there was a considerable increase in the number of listings that have hit the market too. For a few months in a row we have seen high single/low double-digit percentage growths in the number of new listings hitting the market in the US. This is likely due to the fact that the people who were holding out for the return of lower interest rates are losing hope, and listing their homes anyway.

On the bright side, mortgage rates have continued their slow descent, with the average interest rate on a 30-year mortgage in March coming in at around 6.63%, down roughly a quarter point from the year prior. As you might expect, the median monthly P&I payment ticked down slightly, and the median sale price ticked up slightly to match this move.

Although mortgage rates have come down a bit, it’s important to remember that the biggest drivers behind mortgage rates are, of course, the 10-year treasury and the federal funds rate. In the most recent Federal Open Market Committee meeting, the Fed has decided to keep the federal funds rate in line with where it’s been over the past few months, despite many Americans feeling the effects of the trade war on their wallets.

As we have discussed in prior months, the Fed is in no rush to lower interest rates anytime soon. However, they do see a not-so-distant future where rates are a good bit lower. When you combine this with the fact that inventories are building at a rapid rate, and the number of units being sold has fallen slightly, this could represent a fantastic buying opportunity!

Ultimately though, this is just what we’re seeing at a national level. As we all know, real estate is an incredibly localized industry, so knowing what’s going on in your own market is pivotal. Below is our local lowdown, that outlines everything you need to know about what’s happening around you in your neighborhood and surrounding areas!

Big Story Data

The Local Lowdown

Quick Take:

Bay Area real estate markets show mixed trends in April, with some areas seeing price declines while others maintain growth.

Inventory dynamics vary dramatically by region, with East Bay seeing substantial increases (~43%) while San Francisco continues to struggle with persistent shortages.

The single-family home market remains largely a seller's market across most Bay Area regions, while the condo market generally favors buyers with higher months of supply.

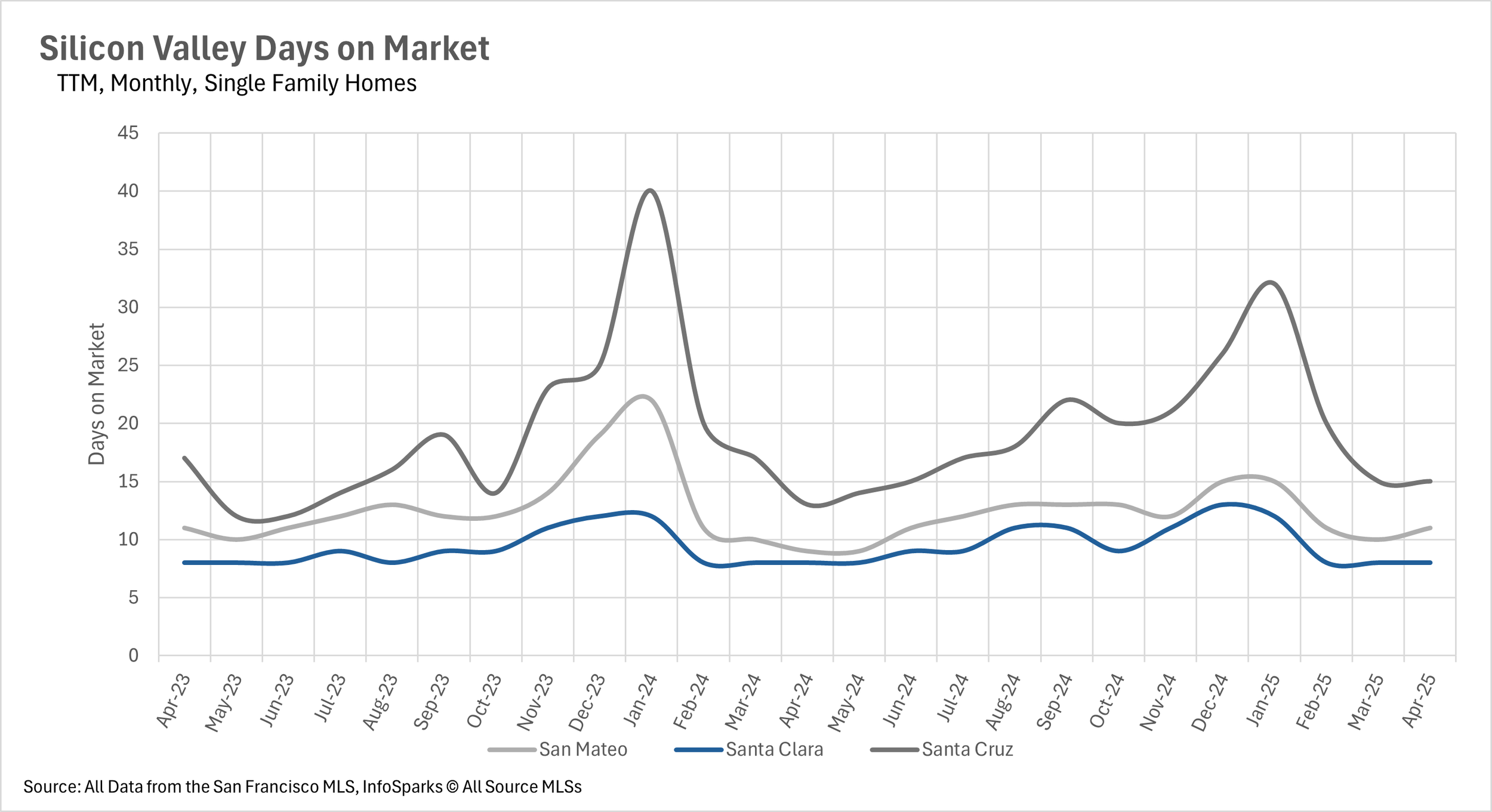

Despite varying inventory levels, homes are still selling relatively quickly throughout the Bay Area, with particularly fast movement in Silicon Valley (8-15 days).

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

What’s Moving: Sold Homes & Upcoming Listings in SF

Looking to buy or sell? Interview me for the job...

Call Charlie 415-722-3493.

Price trends vary significantly across Bay Area regions

April showed considerable variation in price trends across the Bay Area. Silicon Valley presented a mixed picture, with Santa Cruz County breaking its year-long winning streak as median sale prices fell 8.57% year-over-year, while San Mateo and Santa Clara Counties continued positive growth at 1.69% and 5.50% respectively.

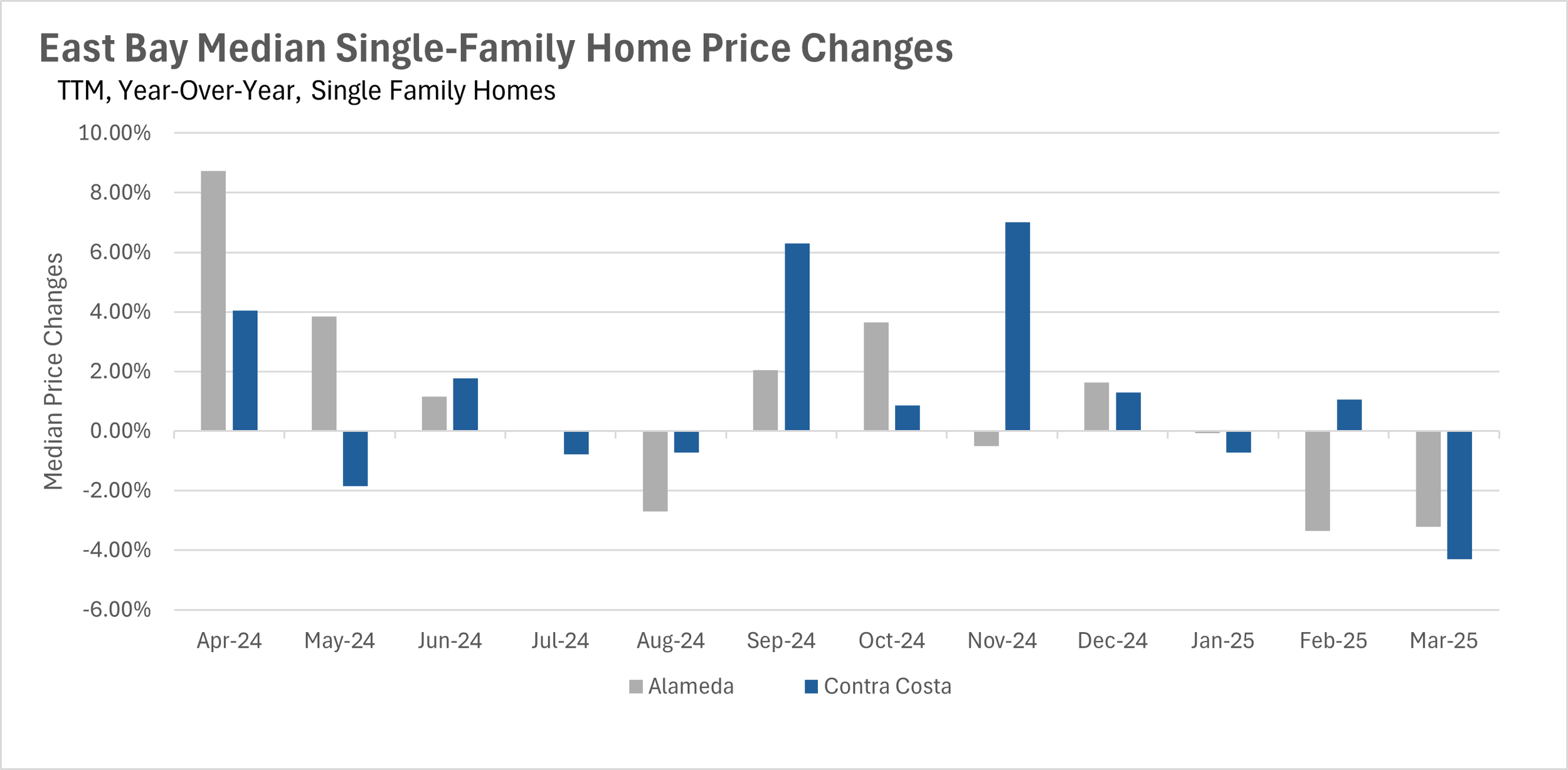

The East Bay saw widespread price declines, with single-family homes in Alameda and Contra Costa Counties dropping 3.21% and 4.31%, and Contra Costa condos experiencing a sharp 12% decrease. North Bay prices remained relatively flat, with minimal movement in Sonoma, Marin, Solano, and Napa Counties (ranging from +2.93% to -0.52%).

San Francisco showed contrasting trends, with single-family home prices increasing modestly by 2.12%, while condo prices reversed their five-month decline with a robust 9.13% increase, possibly signaling a turning point for the San Francisco condo market.

Inventory levels show dramatic regional variations

Inventory trends vary dramatically across Bay Area regions in April. The East Bay experienced a substantial surge, with both single-family and condo inventories increasing by approximately 43% year-over-year, driven by a 7.47% increase in new single-family listings while sales dropped 12.21%.

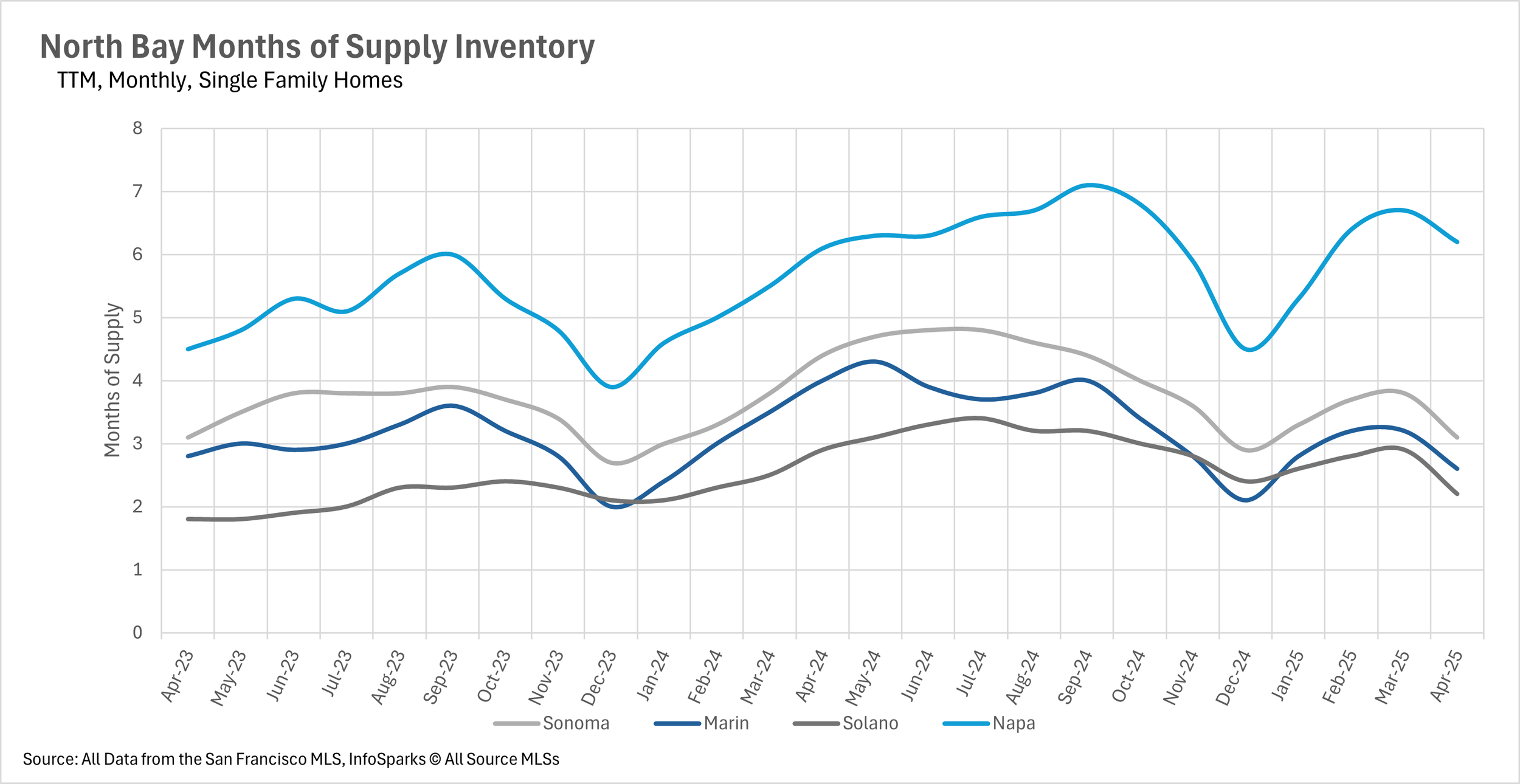

Silicon Valley similarly saw inventory growth, with single-family home supply increasing nearly 30% year-over-year and condo inventory jumping an impressive 51.29%, as new listings outpaced closings. In stark contrast, North Bay inventory levels continued to fall, with a 16.61% year-over-year and 15.87% month-over-month decrease in active listings, largely due to 30% fewer new listings hitting the market compared to last year.

San Francisco's inventory situation remains particularly challenging, with single-family home listings dropping 6.29% and condo listings falling 7.52% year-over-year, with condo sales seeing a substantial 21.17% decrease, one of the most significant declines in recent times.

Homes continue to sell quickly despite inventory variations

Despite varying inventory levels and price trends, homes across the Bay Area are still selling relatively quickly. Silicon Valley continues to lead with the fastest market movement, the average single-family home in Santa Clara County sells in just 8 days, while San Mateo and Santa Cruz Counties follow at 11 and 15 days, respectively.

The East Bay also maintains quick sales with single-family homes typically on the market for only 13 days, and condos selling in 19 days in Alameda County and 26 days in Contra Costa. North Bay is experiencing slightly longer market times compared to last year, but still maintains reasonable timeframes.

San Francisco's single-family homes are not only selling quickly but commanding substantial premiums, with the average home selling for 14.2% above asking price, though condos are selling closer to list price (just 0.4% above asking). These relatively short market times, despite increasing inventory in some regions, indicate that buyer demand remains healthy throughout much of the Bay Area.

The single-family home market favors sellers, while the condo market favors buyers

The months of supply inventory (MSI) metric shows a consistent pattern across the Bay Area, with single-family homes generally remaining in seller's market territory while condos favor buyers. In San Francisco, single-family homes have just 1.7 months of supply (strongly favoring sellers), while condos sit at 3.9 months (favoring buyers).

Silicon Valley shows a similar split, with San Mateo and Santa Clara Counties at 1.7 months for single-family homes, while condos range from 3.2 to 5.6 months of supply. The East Bay single-family market stands at 2.2 months in Alameda and 2.5 months in Contra Costa, suggesting sellers maintain leverage for now, though with rising inventory, this could shift toward a buyer's market this summer.

Meanwhile, East Bay condos clearly favor buyers with 4.7 and 3.9 months of supply in Alameda and Contra Costa Counties, respectively. The North Bay shows more variation, with Napa County at 6.2 months (strongly favoring buyers), Sonoma at 3.1 months (balanced), and Marin and Solano at 2.6 and 2.2 months, respectively (favoring sellers). This consistent pattern of lower MSI for single-family homes versus condos appears throughout the Bay Area, highlighting the continued preference for detached housing.