MarketTracker Silicon Valley- February 2026 from CharlieBrownSF

Quick Take:

Housing got substantially more affordable on a year-over-year basis in December.

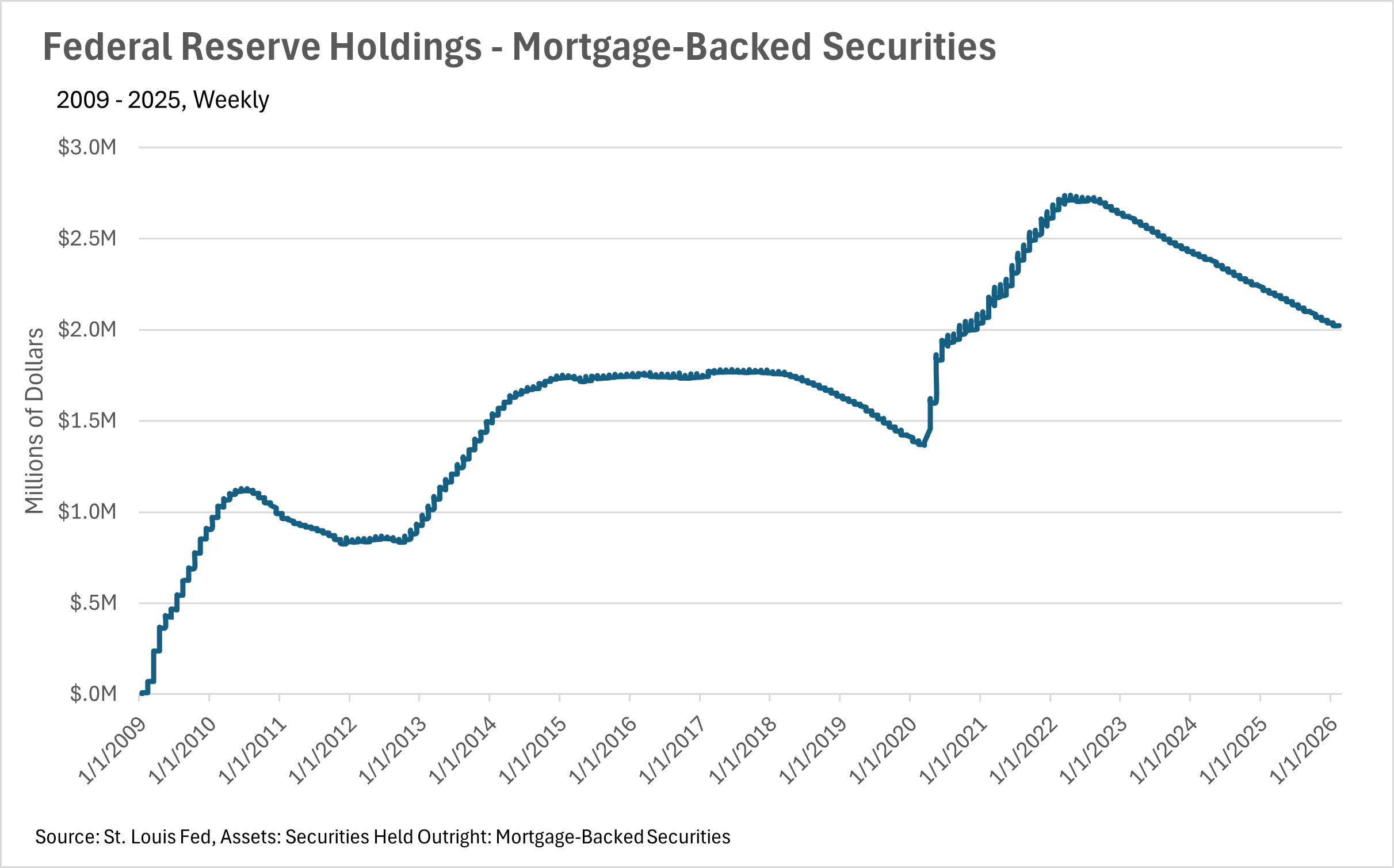

Rates continue to fall, as lending markets price in lower long-term interest rates.

Inventory and sale metrics are roughly in line with what we were seeing around this time last year.

Despite the fact that we’ve seen interest rates come down quite a bit over the last year, median home sale prices are roughly in line with where they were last year!

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

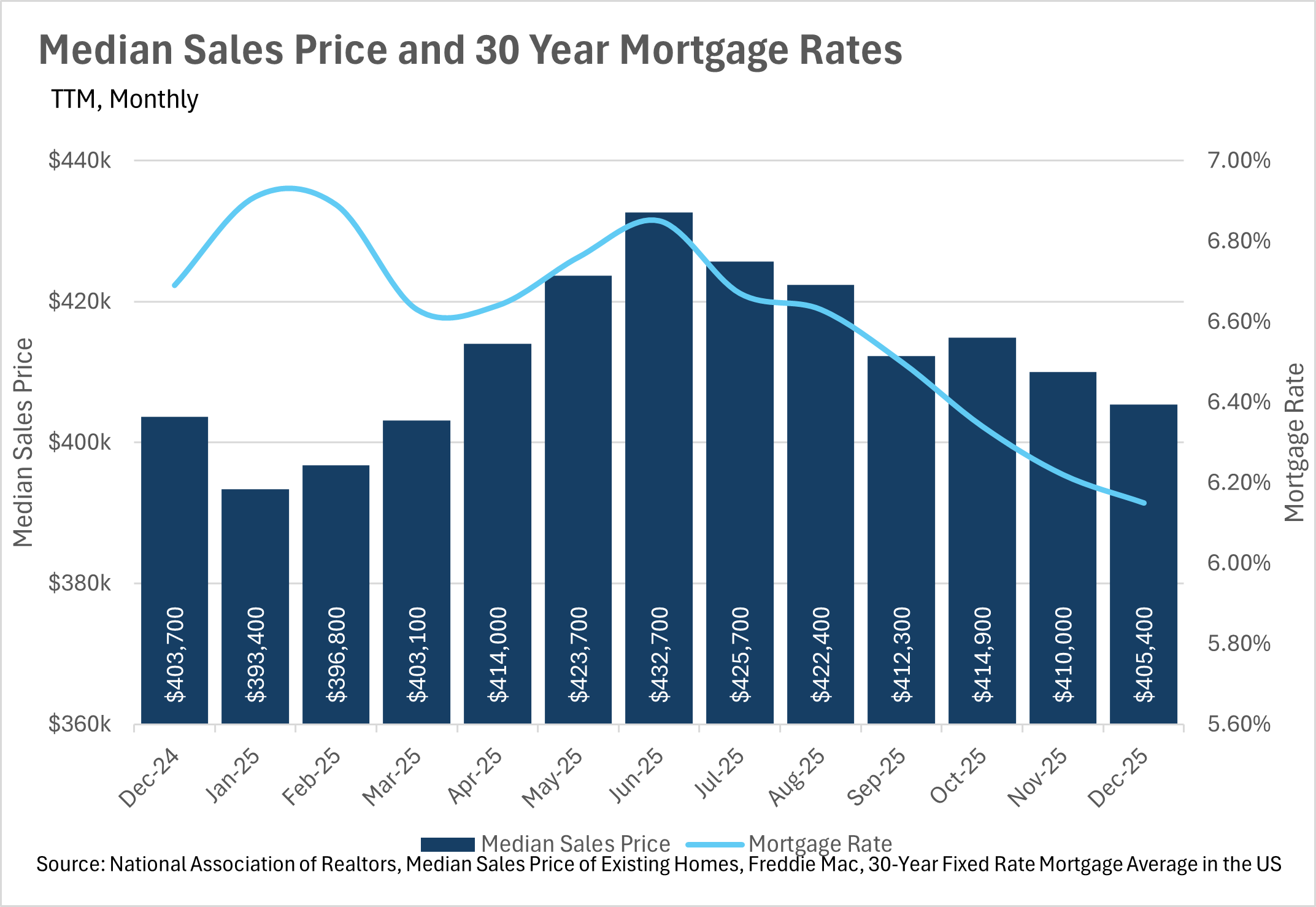

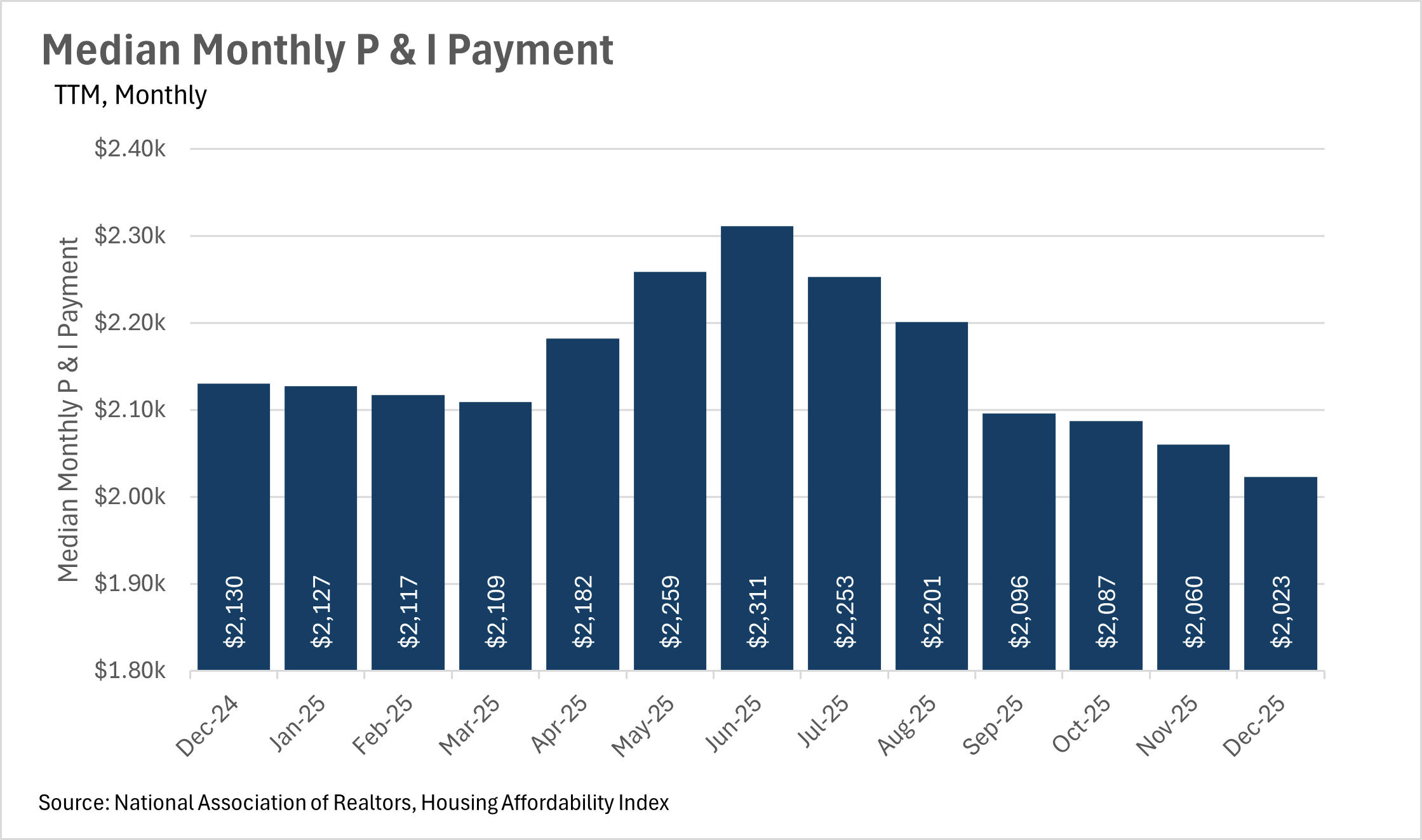

As interest rates fall, median monthly P&I payment has fallen too!

Interest rates have been in a downward cycle for quite some time, as the Federal Reserve has been lowering the federal funds rate. As you might expect, that means that the median monthly P&I payment has declined by quite a bit too. Right now, the median homeowner is paying $2,023 per month to service the P&I on their mortgage, which is down 5.02% from $2,130, just a year ago. This is great for the average American, as it means they have more money in their pocket to spend, or potentially save for their next move! In the beginning of December, the average 30-year mortgage rate was 6.15%, and has continued to fall since!

Mortgage rates are at the lowest level we’ve seen in quite some time!

Fortunately for home buyers and sellers, the lending markets are beginning to believe that interest rates will remain low in the near and medium term future. This has led interest rates to continue inching down almost every month. In the past few weeks, we’ve seen the average 30-year mortgage rate at the lowest level it’s been in the past three years, which is tremendous news for the housing market. Unfortunately though, it doesn’t seem like the Fed will lower rates during the next FOMC meeting, as CME FedWatch currently has the probability of a March rate cut at just 7.9% at the time this was written. However, if you extend your time horizon out a bit, it does seem like there’s a good chance we see a rate cut or two throughout the rest of the year.

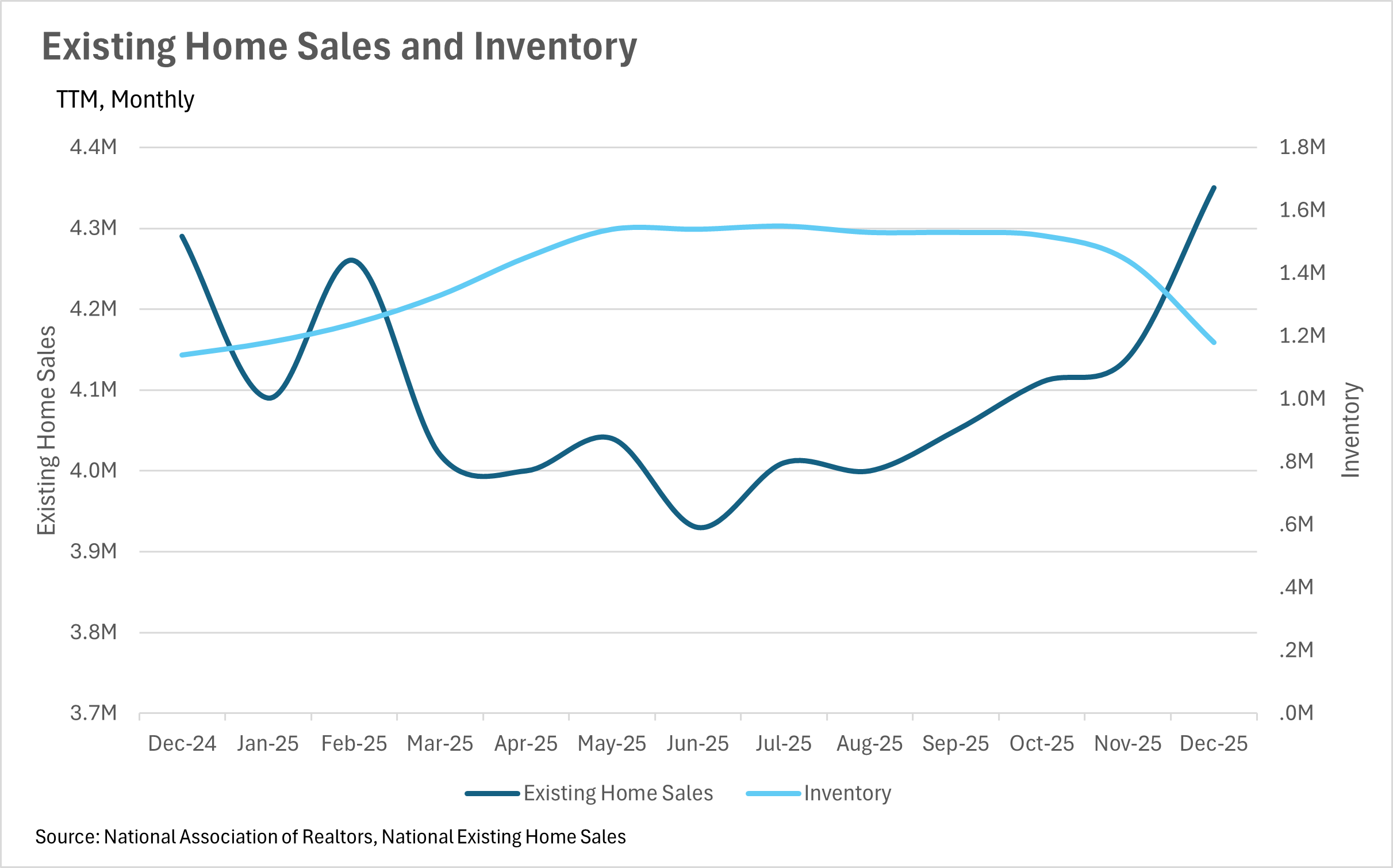

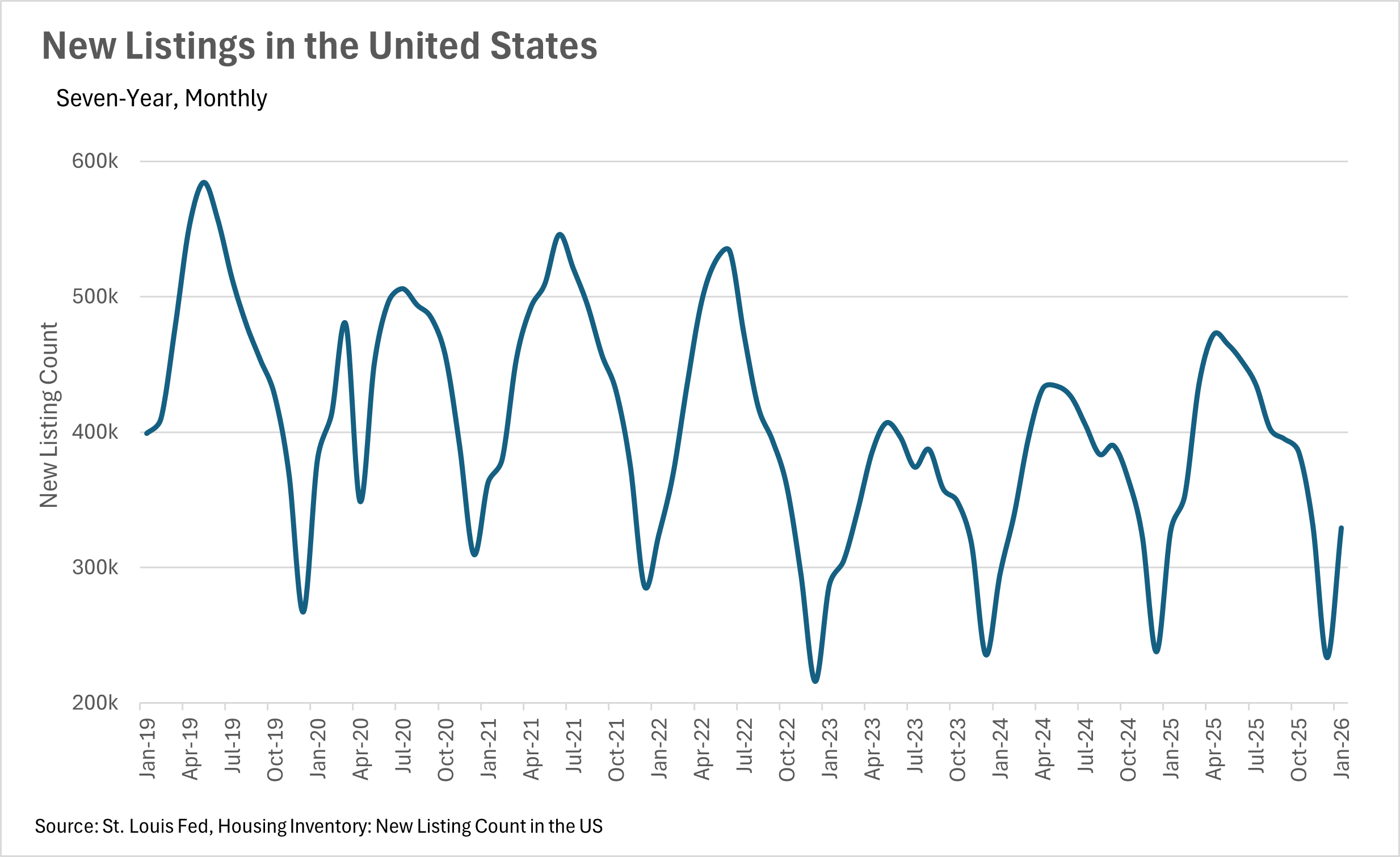

Inventory and sale metrics are roughly in line with last year

Although interest rates are coming down, and housing is becoming more affordable, we’re not seeing much change in terms of inventories, new listings, or existing home sales. Existing home sales and inventories are up 1.40% and 3.51% on a year-over-year basis, respectively. At the same time, new home listings are up just 0.68% on a year-over-year basis. This suggests that there are still a lot of buyers waiting on the sidelines for rates to come down even more before they pounce on their next home. It’ll be worth paying attention to all of the metrics we track as we move through the seasonally slow winter and into the spring and summer when the market really heats up. If we see a rate cut or two prior to the first heat wave of the year, we could see some bidding wars throughout the summer!

We’re likely to see rates stay where they are in the near term

As we mentioned above, we are likely to see rates stay where they are at least in the next FOMC meeting or two. While there was some speculation that the next appointed Fed Chair would create a Fed that is less autonomous in it’s decisions, the market does not believe that future Chairman Warsh will be the wildcard that many were anticipating. This can largely be supported by the fact that we’ve seen precious metals sell off precipitously recently, as these are typically considered a hedge when the dollar is less-than-stable. However, only time will tell, which means it’ll be more important than ever to pay attention to Fed commentary!

It’s important to note though, that all of this is what we’re seeing at a national level. As we all know, real estate is a highly localized asset, which is why you should check out what’s going on in your local market below in the Local Lowdown!

Big Story Data

The Local Lowdown

Quick Take:

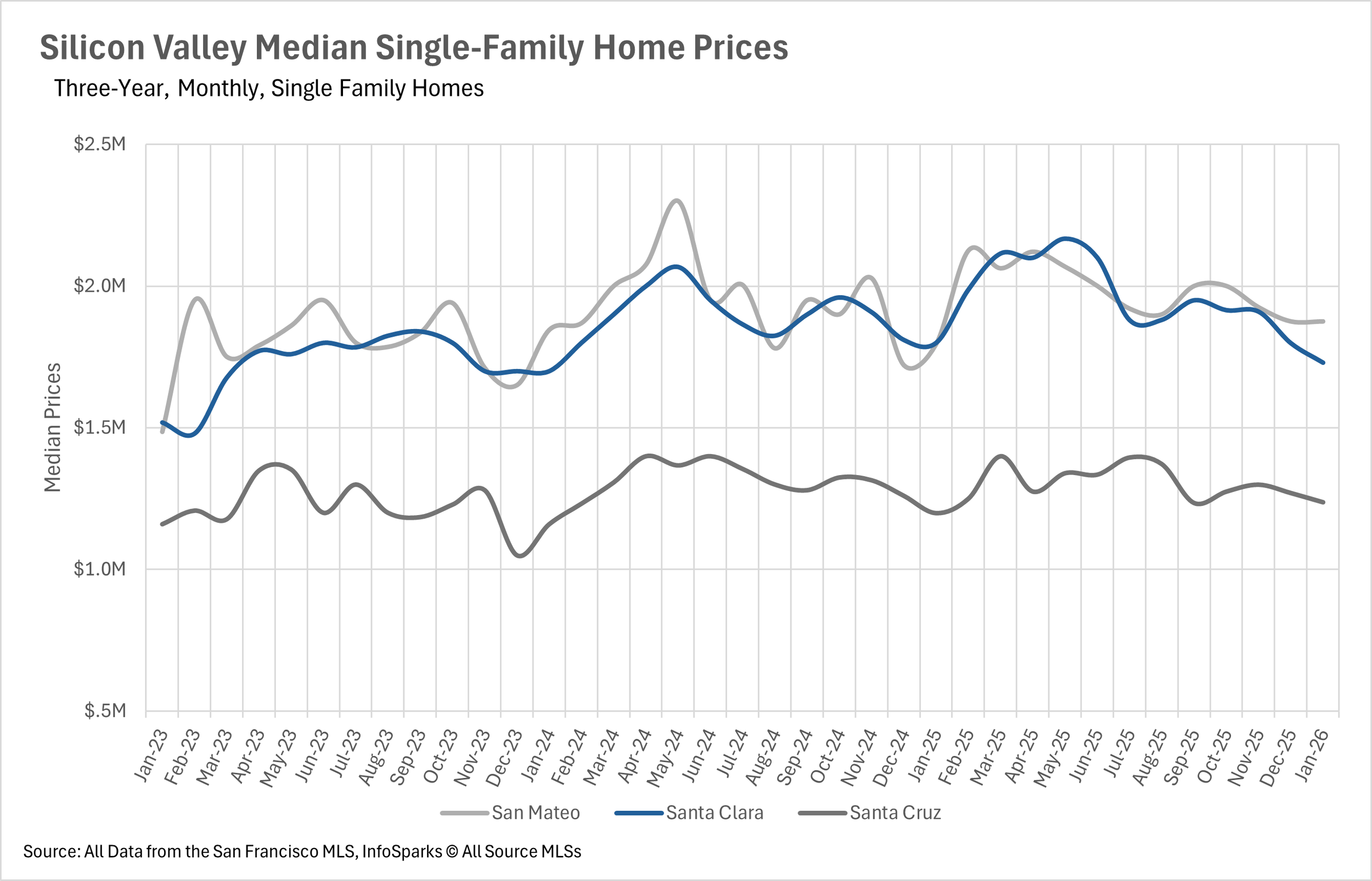

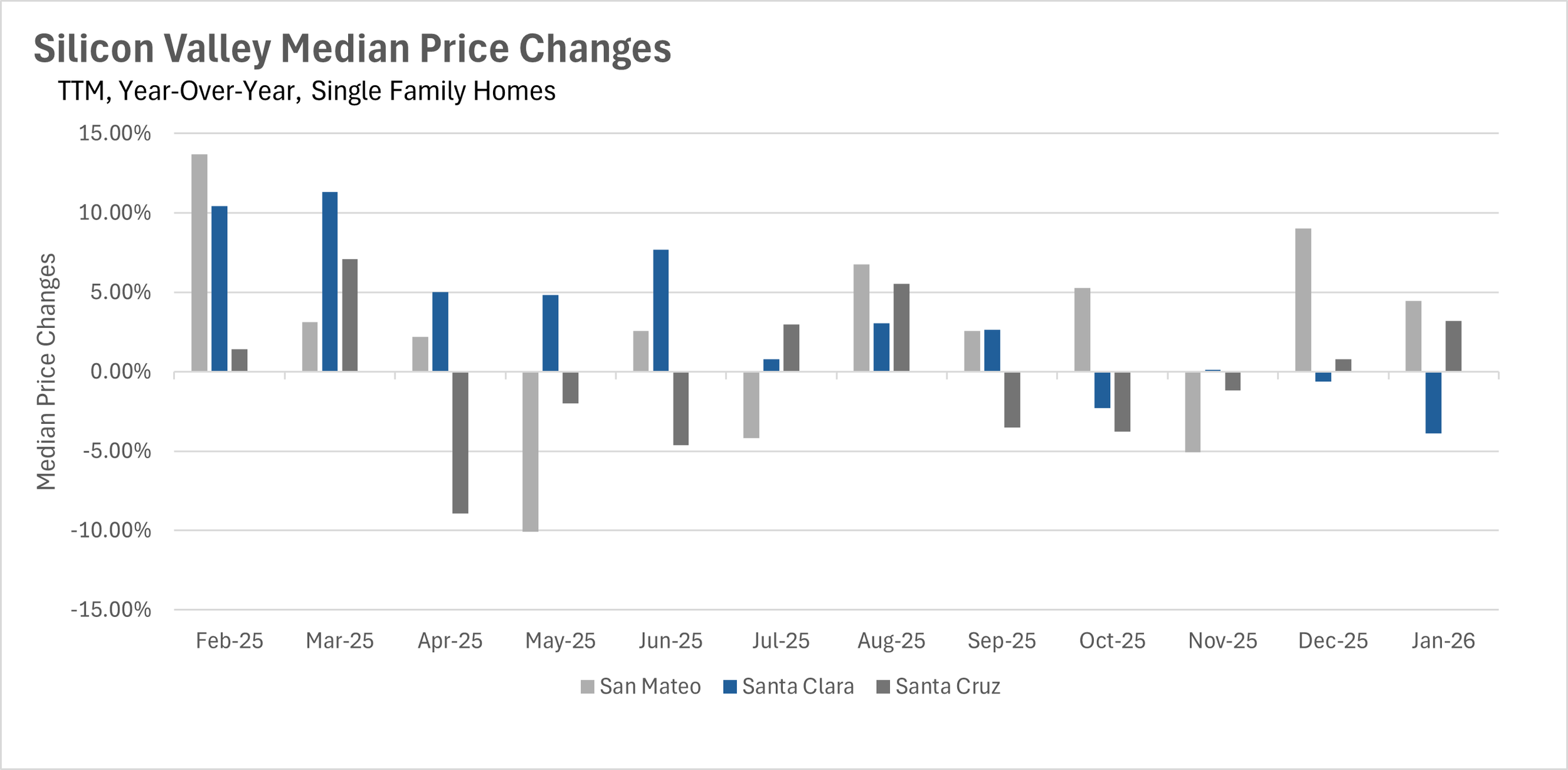

Single-family median sale prices showed a mixed picture in January, with San Mateo and Santa Cruz Counties posting year-over-year gains while Santa Clara County saw a nearly 4% decline.

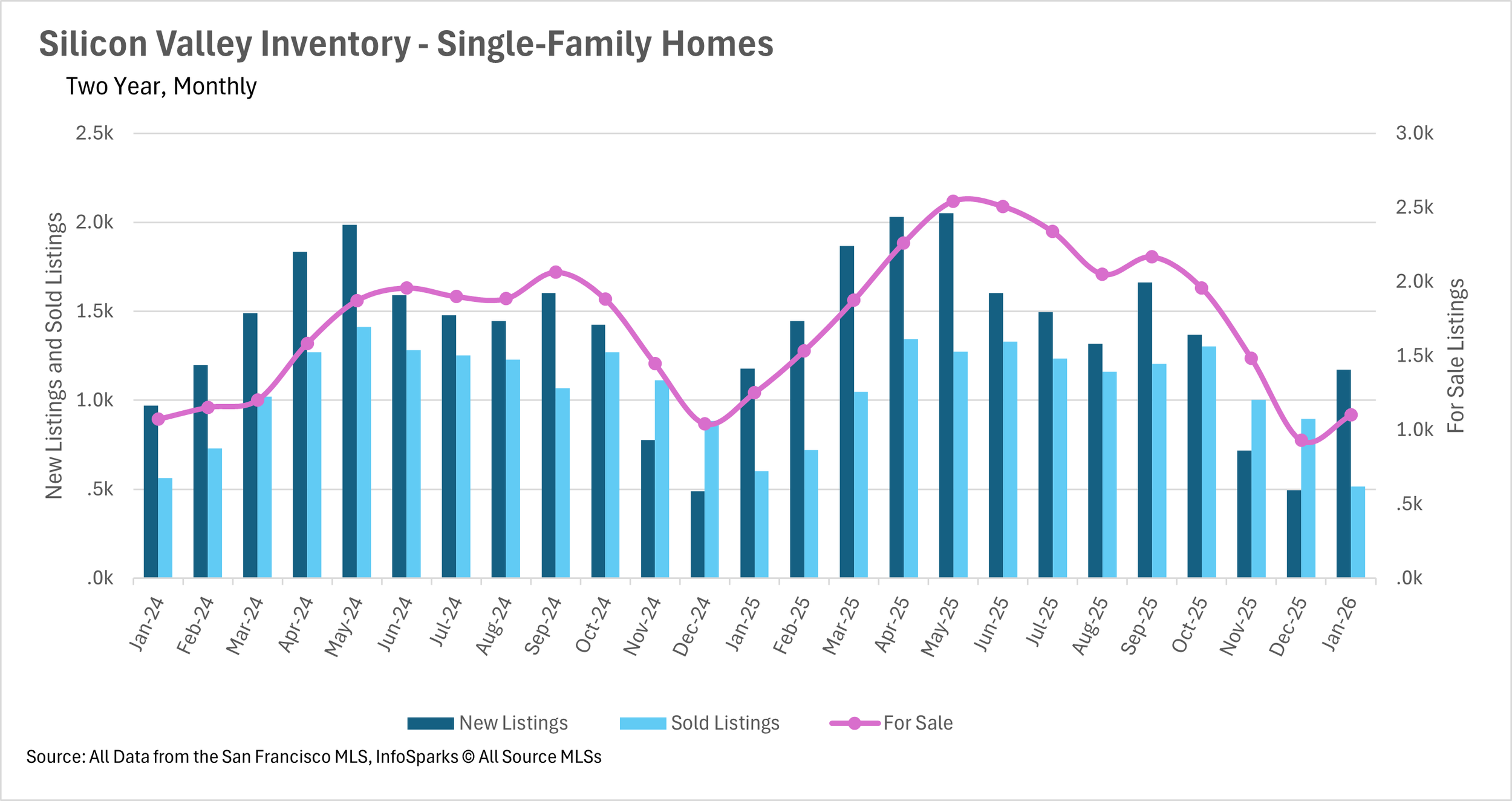

Inventory levels remain constrained heading into 2026, with single-family home inventory down 12% year-over-year despite a strong month-over-month rebound in new listings.

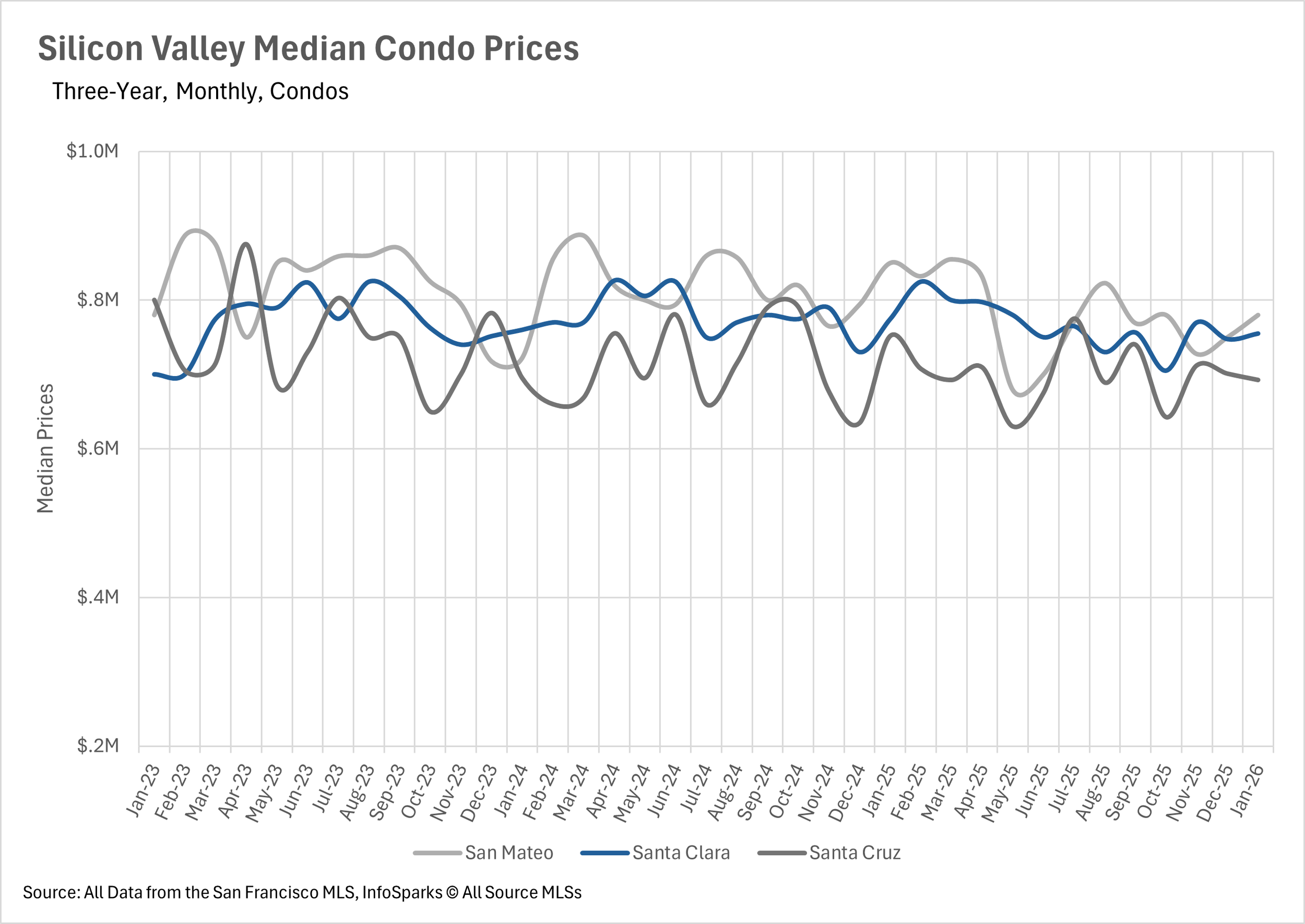

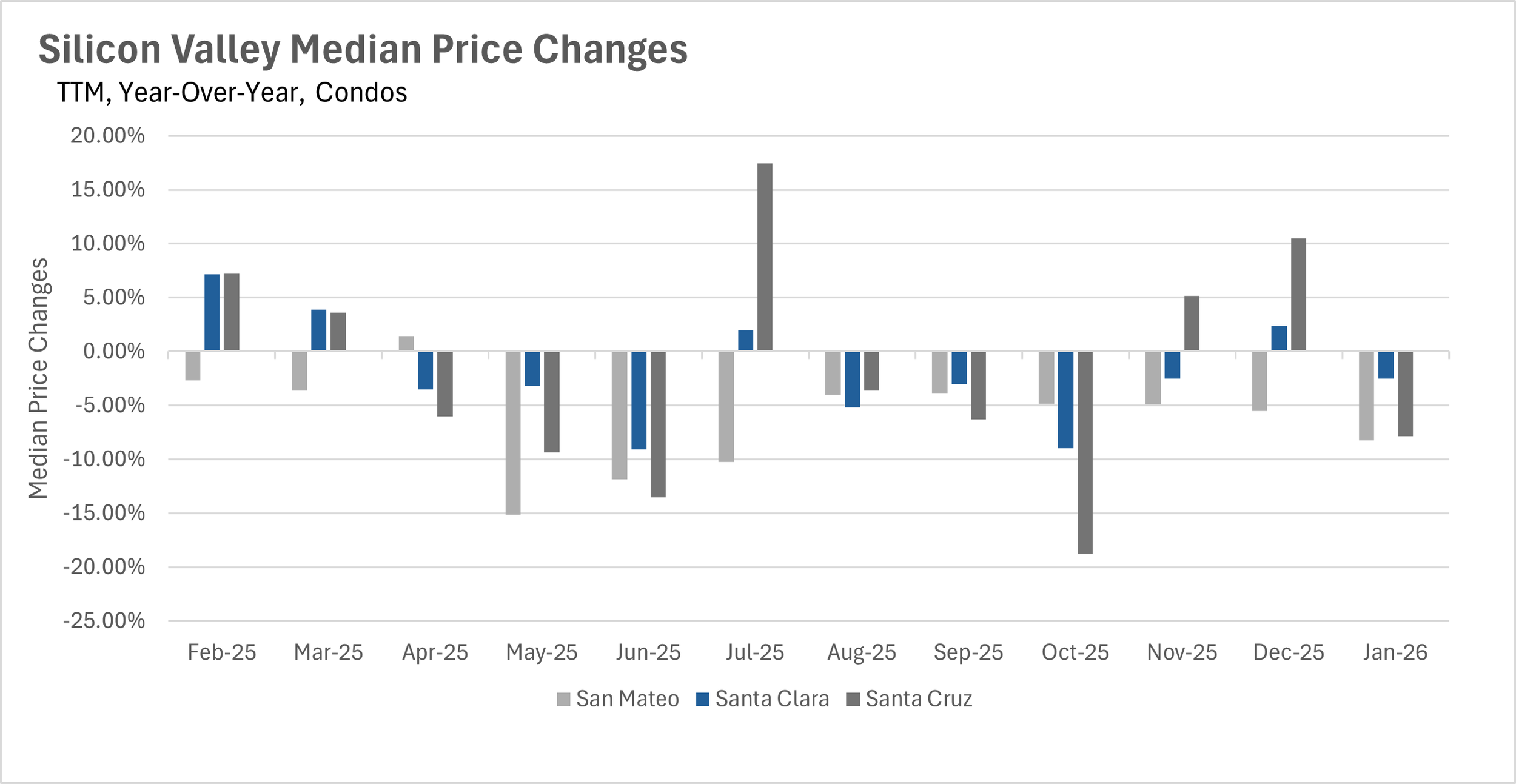

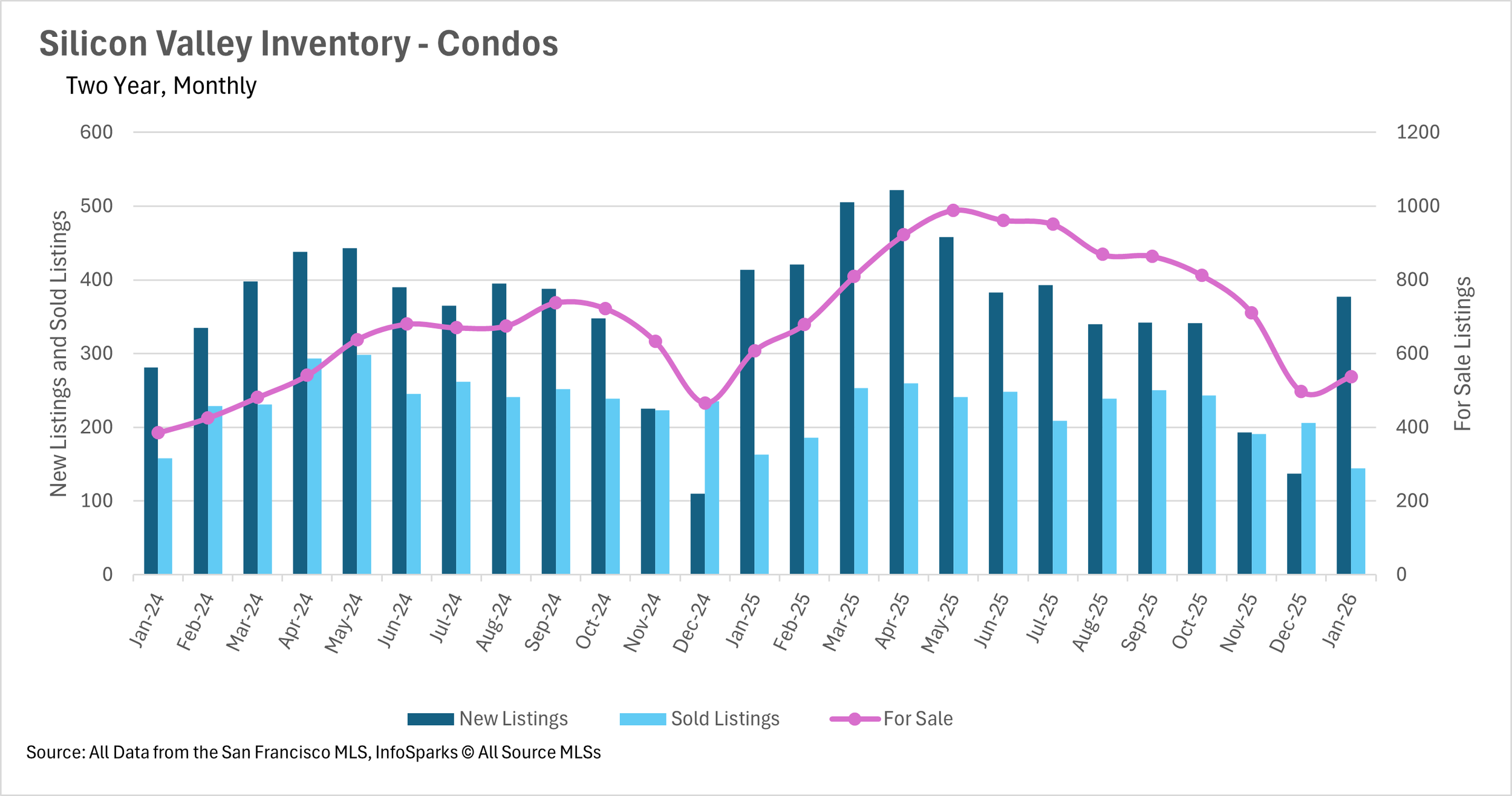

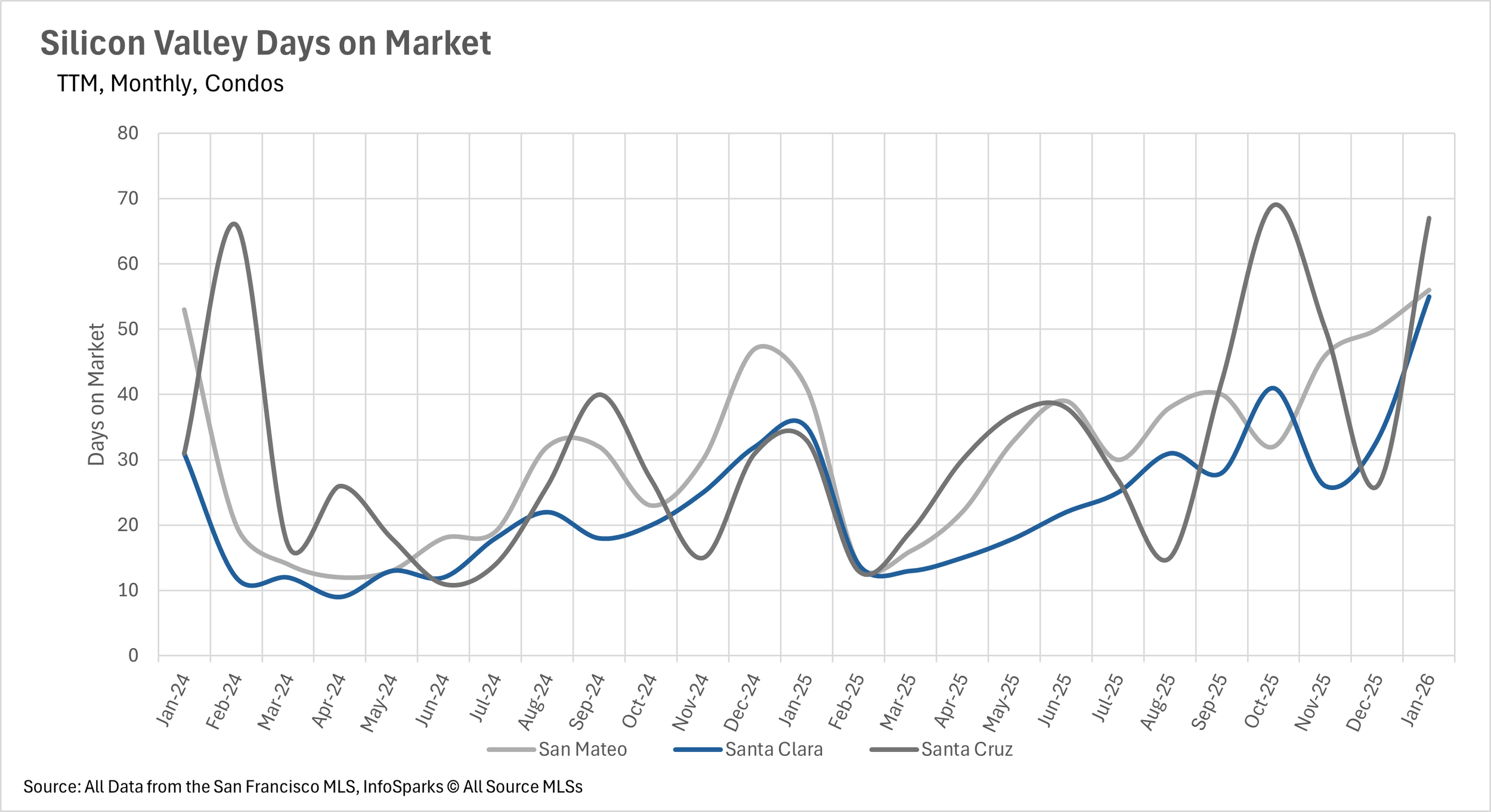

Condos are taking dramatically longer to sell across the region, with days on market increasing by more than 50% in most counties.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

A tale of two markets as we kick off 2026

The single-family home market in Silicon Valley started the new year with divergent trends across the region. San Mateo County posted a solid 4.46% year-over-year increase in median sale price, with the median home selling for $1,875,000. Santa Cruz County also saw gains, with the median home selling for $1,237,500, representing a 3.21% year-over-year increase. However, Santa Clara County bucked the trend, with the median home selling for $1,730,051, a 3.89% year-over-year decline. The condo market told a different story entirely, with declines across the board. San Mateo County condos fell 8.24% year-over-year to $780,000, Santa Clara County condos declined 2.52% to $755,000, and Santa Cruz County condos dropped 7.85% to $692,500.

Inventory remains tight despite a surge in new listings

After the typical holiday slowdown, new listings came roaring back in January, with single-family home new listings increasing by 136.57% month-over-month. However, despite this influx of fresh inventory, overall inventory levels remain well below where they were last year. There are currently 1,100 single-family homes for sale across Silicon Valley, representing a 12% year-over-year decline. The condo market tells a similar story, with 537 condos for sale, down 11.68% year-over-year. This persistent inventory shortage continues to create challenges for buyers looking to find the right property in this competitive market.

Condos are sitting on the market for much longer than last year

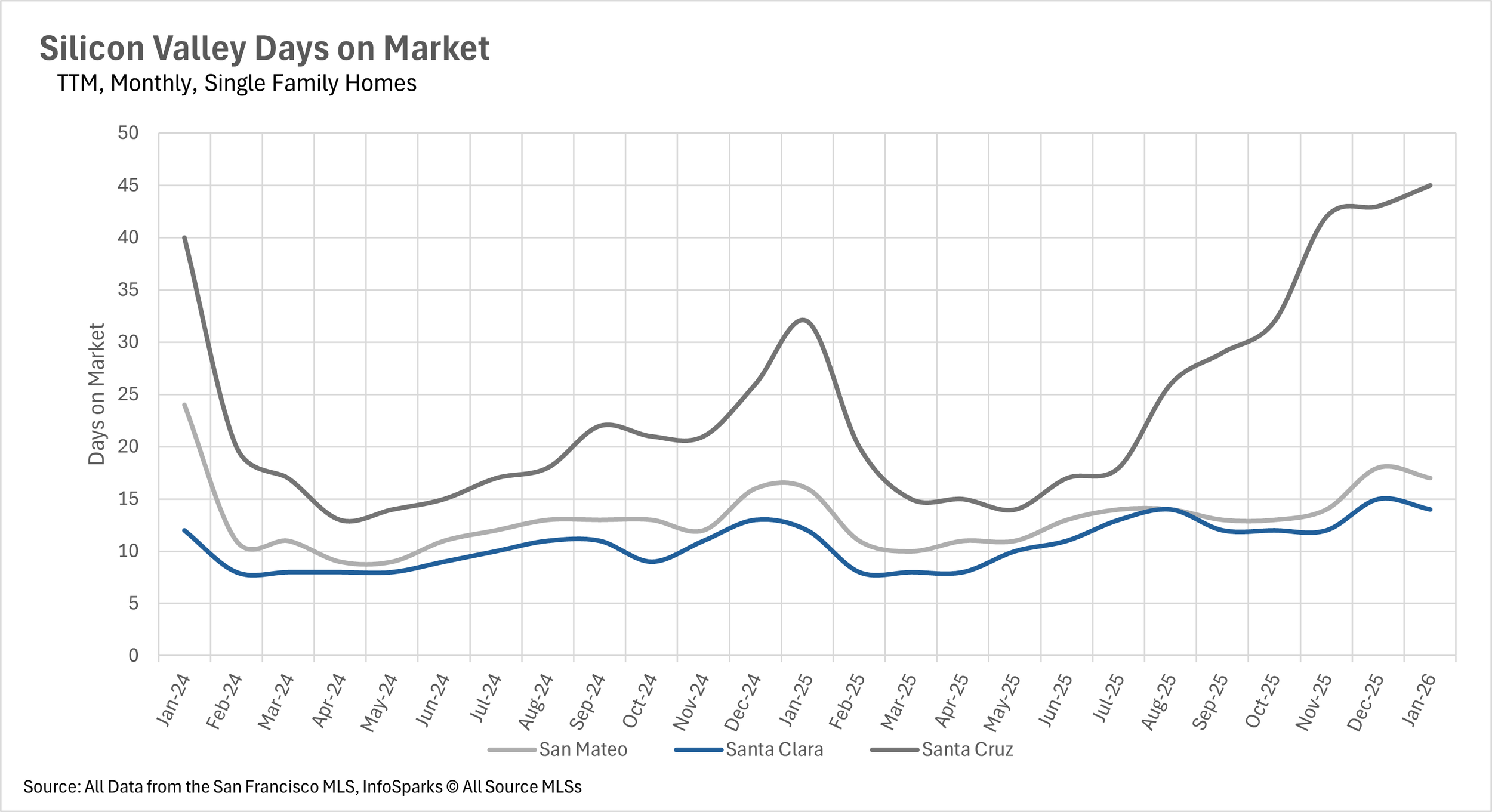

While single-family homes are still moving relatively quickly, the condo market has seen a dramatic slowdown in the pace of sales. In Santa Clara County, the average condo is now spending 55 days on the market, a staggering 57.14% increase compared to last year. Santa Cruz County condos are taking even longer, spending an average of 67 days on the market, more than double what we saw in January 2025. San Mateo County condos are also sitting longer, with a 36.59% year-over-year increase bringing the average to 56 days. On the single-family side, the increases were more modest: San Mateo County homes are selling in 17 days (up 6.25%), Santa Clara County homes in 14 days (up 16.67%), and Santa Cruz County homes in 45 days (up 40.63%).

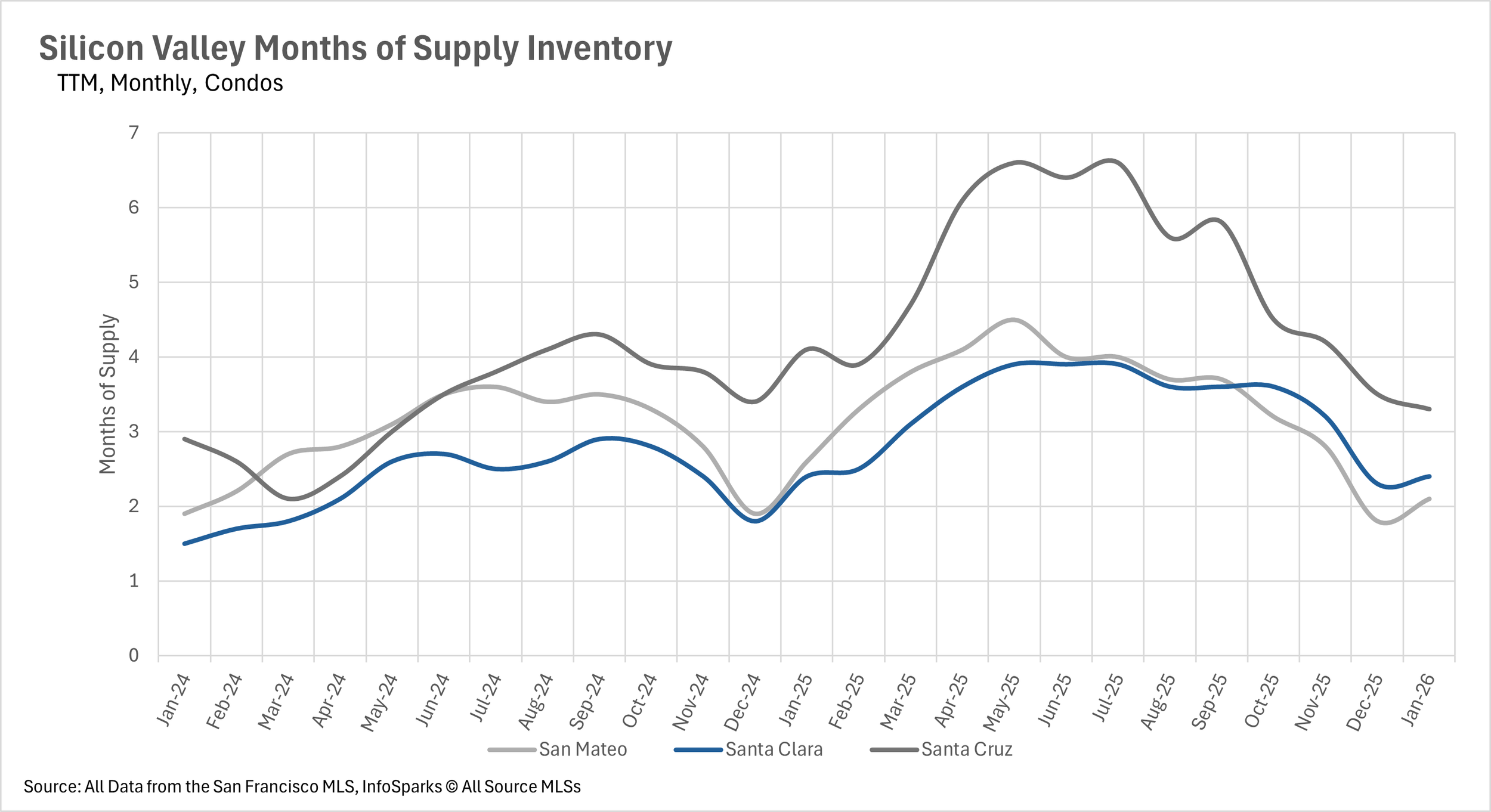

Silicon Valley remains firmly in seller's market territory

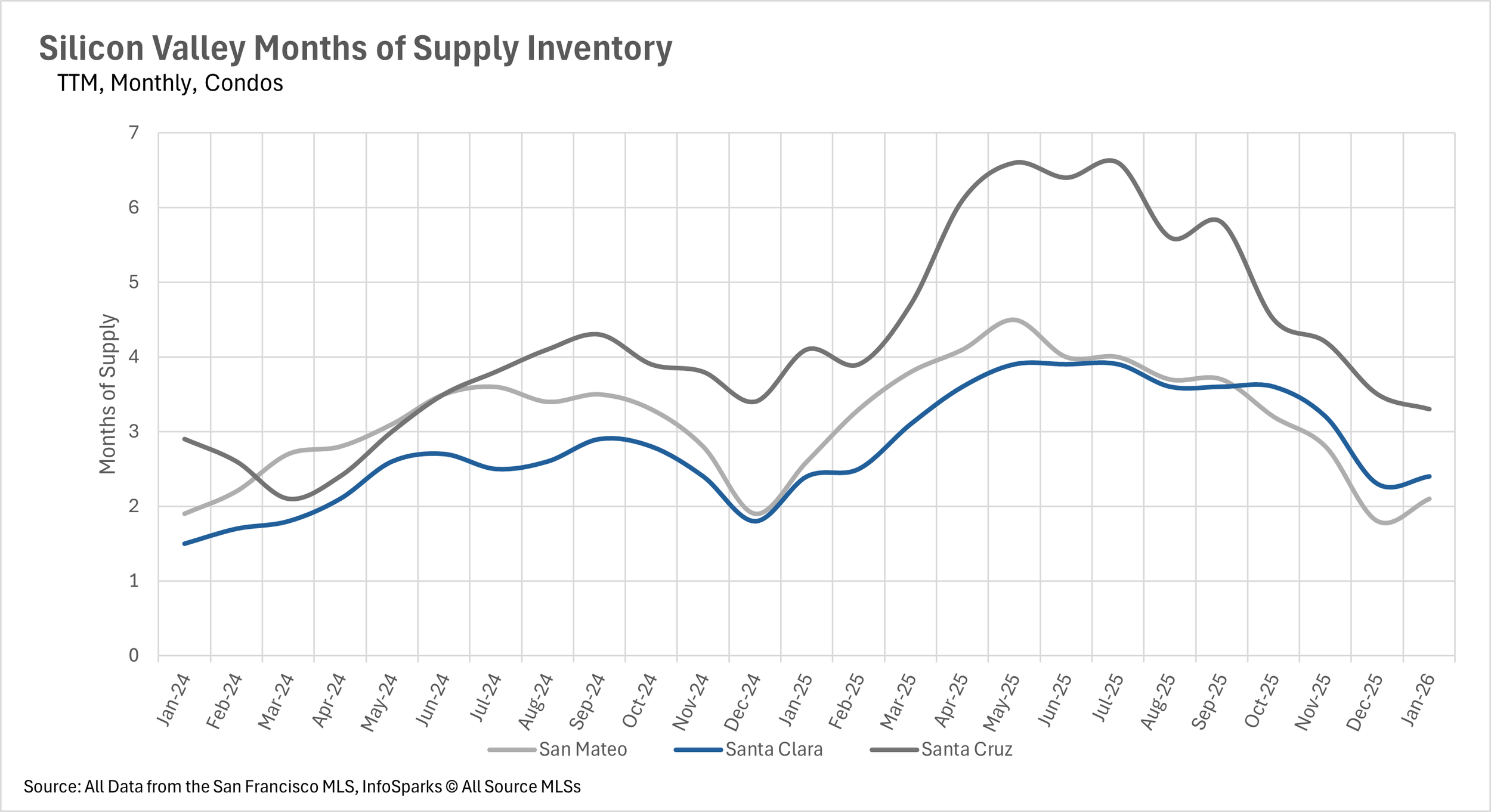

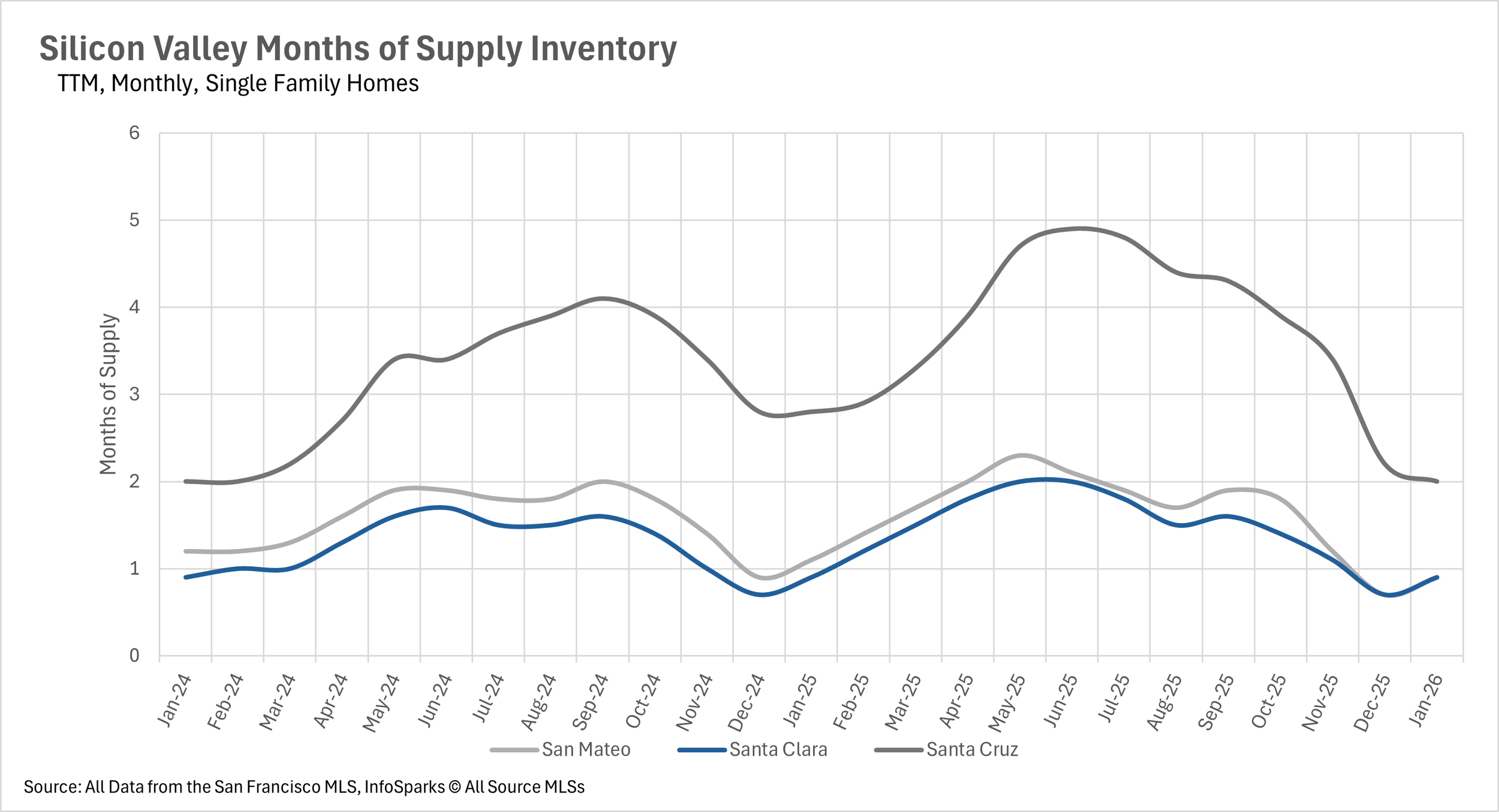

When determining whether a market is a buyers' market or a sellers' market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a seller's market, whereas markets with more than three months of MSI are considered buyers' markets.

Despite the challenges buyers are facing, the single-family home market remains a strong seller's market across Silicon Valley. San Mateo and Santa Clara Counties both have just 0.9 months of supply on the market, while Santa Cruz County has 2 months of supply, down 28.57% from last year. The condo market offers a bit more balance for buyers, with San Mateo County at 2.1 months of supply, Santa Clara County at 2.4 months, and Santa Cruz County at 3.3 months. With inventory levels continuing to lag behind demand, especially in the single-family home market, buyers should expect competition to remain fierce as we head into the spring selling season!