Real Estate in California: A Steady Investment Amid Stock Market Volatility

If you've been following the ups and downs of the stock market recently, you're not alone. The daily fluctuations can leave investors feeling uneasy, especially as the economy experiences more uncertainty. One day, your portfolio is soaring, and the next, it’s taking a hit. This kind of volatility can be unsettling if you’re thinking about long-term financial security.

But here’s the good news: real estate in California, particularly in markets like San Francisco and Redding, tends to be much more stable than stocks.

Why Real Estate Remains Strong

While stocks can swing dramatically based on daily news, economic reports, or market sentiment, the California real estate market—especially in sought-after areas—has a proven history of holding steady or even appreciating over time.

In San Francisco, the demand for housing remains strong, driven by the city’s robust tech industry, world-class amenities, and its position as a global hub. While we may see occasional slowdowns or price corrections, homes in San Francisco tend to recover quickly due to its location and desirability.

Real Estate vs. Stocks: A Clear Comparison

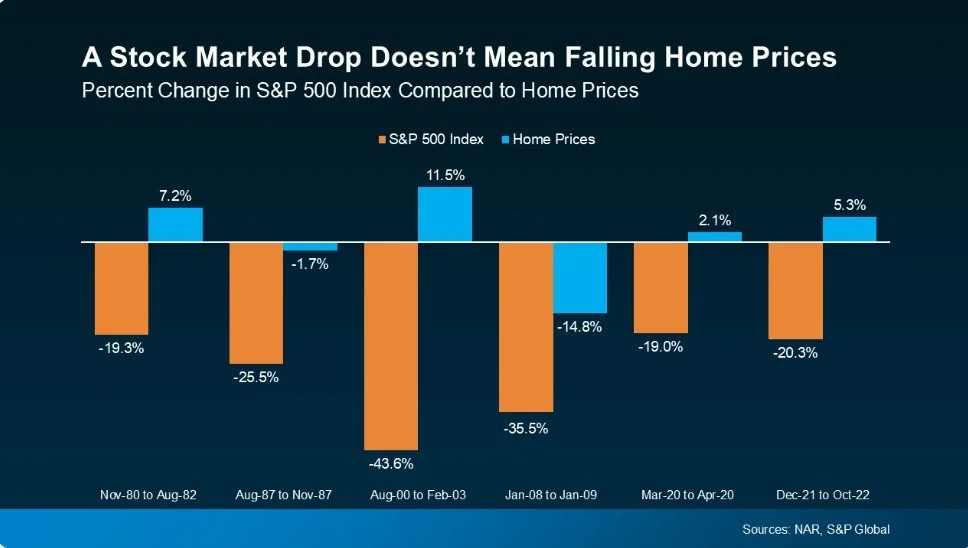

When we compare the historical performance of real estate with stocks, the story becomes clear. Even during significant stock market downturns, home values in many parts of California—particularly in San Francisco and Redding—have remained stable or increased. Why? Because people always need places to live. And in California, housing demand often outpaces supply, creating long-term value for property owners and investors.

For example, while the stock market might fluctuate by 30% or more in a year, home values tend to change much more slowly, giving investors more confidence and stability. Real estate investments allow you to benefit from appreciation, rental income, and long-term equity building without the extreme highs and lows that come with stocks.

The California Market’s Unique Appeal

In both San Francisco and Redding, real estate is a valuable asset for long-term wealth-building. Here’s why:

San Francisco: As one of the most expensive real estate markets in the country, San Francisco continues to be a high-demand market, particularly for luxury properties and investment opportunities. While prices may experience minor fluctuations due to broader market conditions, the city’s economic strength and cultural appeal help maintain its status as a real estate powerhouse.

Why Real Estate is a Strong Investment in California

Both San Francisco and Redding offer opportunities to invest in property types with strong appreciation potential. Whether you’re interested in residential properties, vacation homes, or multi-family investments, real estate provides an opportunity for consistent, long-term growth—something that’s harder to come by in the volatility of the stock market.

In addition to appreciating values, real estate investments offer other benefits, like rental income and tax incentives, which can further enhance your wealth-building strategy.

Final Thoughts

If the volatility of the stock market has left you questioning your financial future, rest assured that real estate in California remains a solid investment. In both San Francisco, property values tend to be much more stable, even during uncertain economic times. Whether you're a first-time homebuyer, a seasoned investor, or someone looking to diversify your portfolio, real estate offers an attractive opportunity for long-term financial growth.

If you’re ready to take the next step and explore real estate opportunities in San Francisco, let's connect. Let’s discuss how you can leverage California’s real estate market to build wealth and secure your financial future.