Lets work together!

charlie@charliebrownsf.com

415-722-3493

Welcome to our Blog!

Why Buying a Home Still Pays Off in the Long Run

Renting may feel less expensive today, but owning is what builds real wealth over time. And with affordability starting to improve, the path to homeownership may be opening up more than you think.

If you’re curious what buying could look like for you, let’s connect. We can figure out your next move, pressure-free.

Thinking About Renting Your Home Instead of Selling? Read This First

For some homeowners and properties, renting is a great move. But if you’re considering it only because your listing isn’t selling, it may be wise to first revisit your pricing and marketing strategy with your agent. With the right adjustments, you may be able to attract genuine buyers and close a sale. Before you commit to renting out your property, carefully weigh the advantages and drawbacks. For many homeowners, the added responsibility, stress, and costs of being a landlord may not be worth it.

From Chaos to Calm: Buyers Finally Have Breathing Room

If the past market frenzy kept you from buying, consider this your green light. The pace has shifted, giving you more time, more options, and more negotiating power.

With the right agent by your side, you’re in a stronger position than you’ve been in years. Let’s connect to see what’s happening in our area and whether now could be the perfect time for you to jump back in.

Is It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff

Rates aren't expected to hit 6% this year. But when they do, you’ll have to deal with more competition as other buyers jump back in. If you want less pressure and more negotiating power, that opportunity is already here – and it might not last for long. It all depends on what happens in the economy next.

Let’s talk about what’s happening in our area and whether it makes sense to make your move now, before everyone else does.

A Second Home Might Be the Missing Piece in Your Retirement Plan

Let’s talk about what’s possible and explore whether owning a second home could bring you more security and peace of mind for the road ahead.

If a second home could help you retire earlier or with more freedom, would you want to take a closer look?

Smart Advice for First-Time Homebuyers in Today’s Market

Your first real estate purchase isn’t just a home—it’s a foundation. With the right plan, the right team, and a bit of local knowledge, you can make choices today that position you for serious financial growth down the line.

Ready to take the first step? Let’s talk about your goals, your concerns, and what kind of property could make sense for you. Whether you're buying for lifestyle or for legacy, there’s a smart way to start—and I’m here to help you map it out.

📩 Have a question about down payments, off-market properties, or which neighborhoods offer the best long-term returns? Send me a message—I’d love to help you make a confident move.

Should You Rent or Buy in Today’s Market?

Renting might work for now — but long-term, it could cost you more without giving anything back.

If owning a home or investing in property feels out of reach, that’s okay. The important part is to start with a strategy. Whether you’re dreaming of a luxury condo in Nob Hill, a new construction opportunity in Redding’s expanding west side, or your first investment duplex, let’s talk.

Let’s build a plan that fits your timeline and financial goals — so when the timing is right, you’re ready to move forward confidently.

Should I Buy a Home Now or Wait?

If you’re weighing whether to buy now or wait, ask yourself: *Can I afford to invest in real estate today—*even if it’s not the “perfect” property? Because the sooner you step into the market, the sooner you start building equity, leveraging appreciation, and creating generational wealth.

If you're curious about what your options are—whether it's a luxury home, an income-generating rental, or a development opportunity—let’s talk. I’m here to help you navigate the market with clarity, confidence, and an eye for long-term value

Buying vs. Renting: Making the Right Financial Decision

Deciding between buying and renting a home depends on your financial situation, lifestyle goals, and long-term plans. While homeownership builds equity, offers stability, and can be a smart investment, renting provides flexibility, lower upfront costs, and freedom from maintenance. For families, key considerations like school quality, neighborhood safety, and community amenities play a crucial role. In competitive markets like San Francisco, making an informed decision is essential. Whether you’re looking to buy or rent, expert guidance can help you navigate the process. Explore your options with Charlie Brown SF and make the right move today.

When Will Mortgage Rates Come Down in San Francisco?

If you’re looking to buy or invest in San Francisco real estate, staying informed about mortgage rate trends is important—but it shouldn’t hold you back from moving forward with your plans. Rates are expected to ease, but no one knows exactly when. The key is to focus on what you can control right now and work with a trusted real estate agent who understands the intricacies of the San Francisco market.

Let’s connect to discuss your options and how these trends impact your next move.

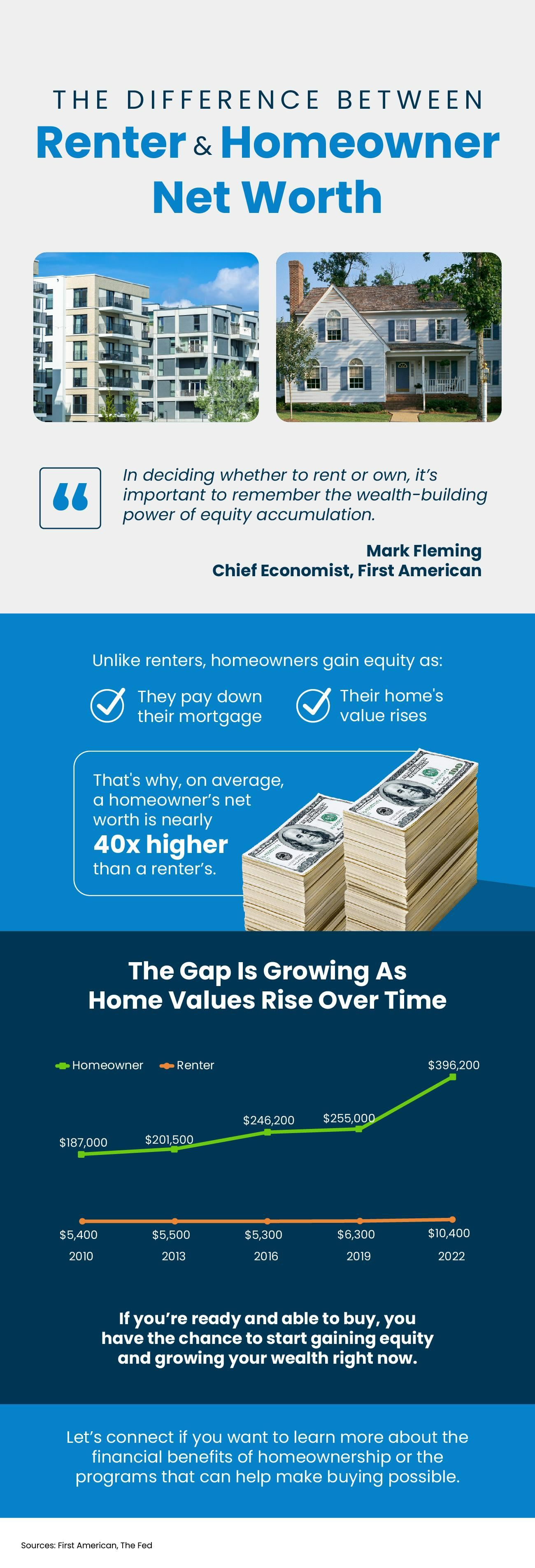

The Big Difference Between Renter and Homeowner Net Worth

If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership. Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s. Let’s connect if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Renting vs. Buying in San Francisco: The Net Worth Gap and Your Wealth-Building Opportunity

If you’re deciding between renting and buying, remember that owning a home in San Francisco can be a powerful tool for wealth accumulation. Even if the initial investment seems steep, the long-term financial benefits are substantial. Let’s connect to explore whether buying is the right move for you and discuss financing options that could make homeownership possible.