MarketTracker East Bay - May 2025 from CharlieBrownSF

The Big Story

Quick Take:

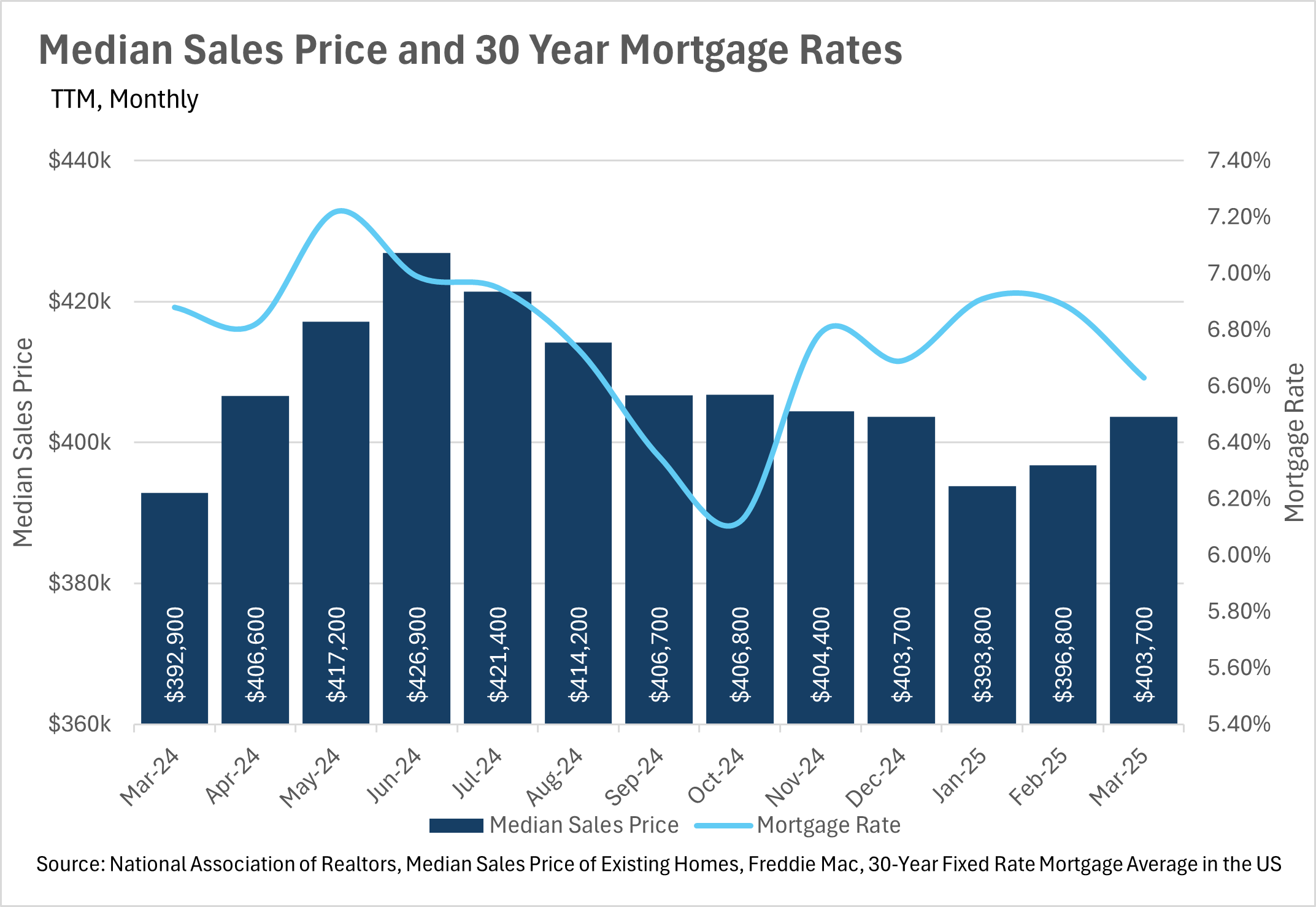

Median purchase price continues to tick up, increasing by 2.75% on a year-over-year basis nationwide.

The average 30-year mortgage rate continues to slowly fall, reaching 6.63% in the month of March.

The number of sales has declined slightly, while inventory skyrocketed on a year-over-year basis.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

Inventories levels explode while existing home sales decline slightly

Although we’re still at the point in the season where inventories are supposed to build, they have increased by nearly 20% on a year-over-year basis, from 1,110,000 to 1,330,000, showing that people are hesitant to purchase a new home. Additionally, while inventories have been increasing, the number of existing homes being sold has decreased slightly on a year-over-year basis, with March 2025 numbers coming in at 4,020,000, which is 2.43% lower than where they were last year. Across the country, people are becoming more uncertain of whether or not they should move to a new home, and that is very clearly showing!

This data is just for March though; it will be important to pay attention to how the market reacted to the beginning of the trade war when April’s numbers come out in a couple of weeks. While it’s easy to see how things like the stock market and bond market react to big newsworthy events like this, real estate is incredibly illiquid, so it takes some time for things to play out!

As you might have expected, there was a considerable increase in the number of listings that have hit the market too. For a few months in a row we have seen high single/low double-digit percentage growths in the number of new listings hitting the market in the US. This is likely due to the fact that the people who were holding out for the return of lower interest rates are losing hope, and listing their homes anyway.

On the bright side, mortgage rates have continued their slow descent, with the average interest rate on a 30-year mortgage in March coming in at around 6.63%, down roughly a quarter point from the year prior. As you might expect, the median monthly P&I payment ticked down slightly, and the median sale price ticked up slightly to match this move.

Although mortgage rates have come down a bit, it’s important to remember that the biggest drivers behind mortgage rates are, of course, the 10-year treasury and the federal funds rate. In the most recent Federal Open Market Committee meeting, the Fed has decided to keep the federal funds rate in line with where it’s been over the past few months, despite many Americans feeling the effects of the trade war on their wallets.

As we have discussed in prior months, the Fed is in no rush to lower interest rates anytime soon. However, they do see a not-so-distant future where rates are a good bit lower. When you combine this with the fact that inventories are building at a rapid rate, and the number of units being sold has fallen slightly, this could represent a fantastic buying opportunity!

Ultimately though, this is just what we’re seeing at a national level. As we all know, real estate is an incredibly localized industry, so knowing what’s going on in your own market is pivotal. Below is our local lowdown, that outlines everything you need to know about what’s happening around you in your neighborhood and surrounding areas!

Big Story Data

The Local Lowdown

Quick Take:

Bay Area real estate markets show mixed trends in April, with some areas seeing price declines while others maintain growth.

Inventory dynamics vary dramatically by region, with East Bay seeing substantial increases (~43%) while San Francisco continues to struggle with persistent shortages.

The single-family home market remains largely a seller's market across most Bay Area regions, while the condo market generally favors buyers with higher months of supply.

Despite varying inventory levels, homes are still selling relatively quickly throughout the Bay Area, with particularly fast movement in Silicon Valley (8-15 days).

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

What’s Moving: Sold Homes & Upcoming Listings in SF

Looking to buy or sell? Interview me for the job...

Call Charlie 415-722-3493.

The median sale price of a condo in Contra Costa County decreased by 12%!

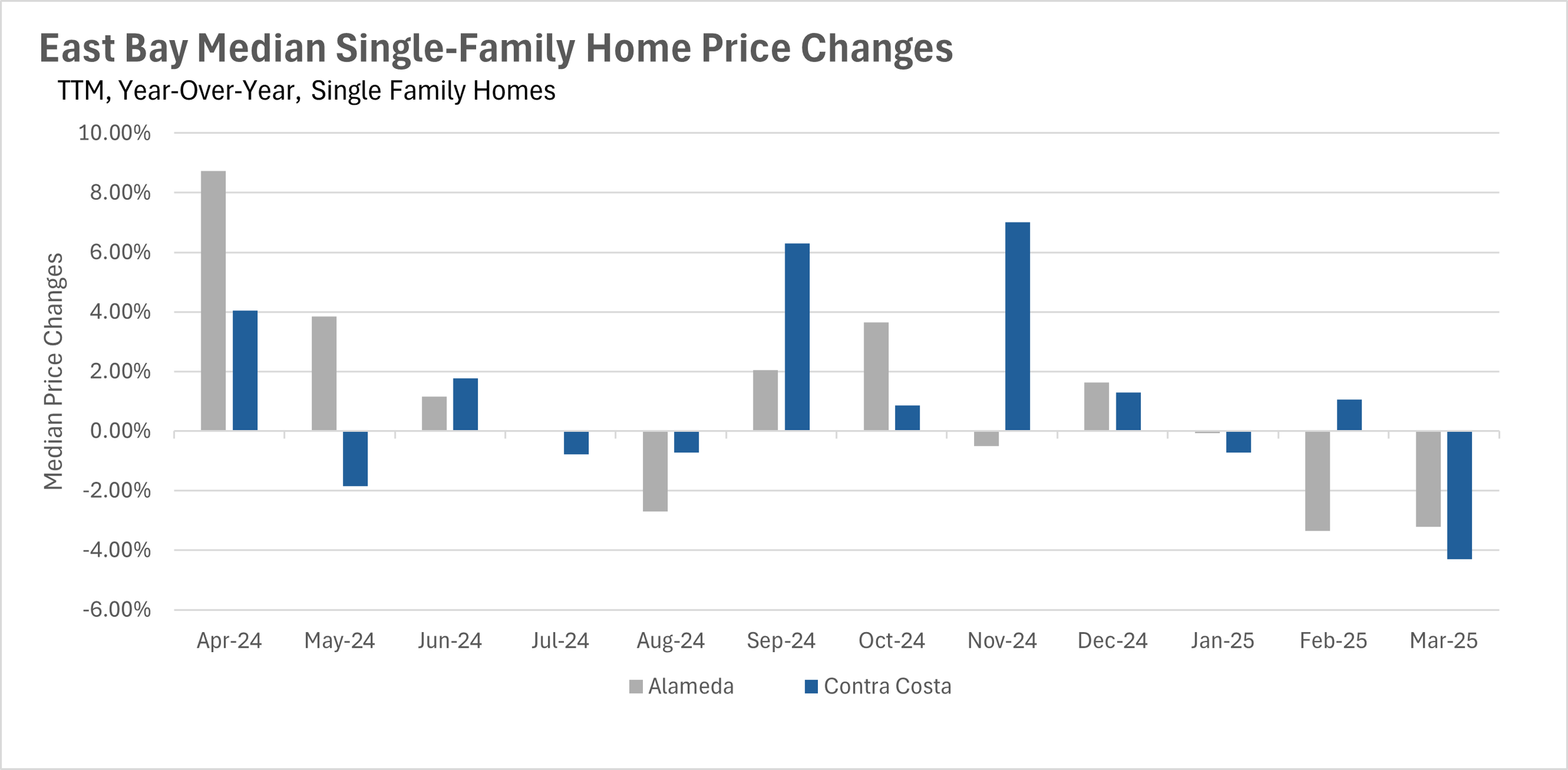

In April, we saw some pretty sharp declines in terms of median sale price throughout the East Bay, with the most prominent of which being condos in Contra Costa County. However, declines elsewhere were quite a bit more modest. The median sale price for a condo in Alameda County decreased by 3.04% on a year-over-year basis. Single-family home prices also dropped, with the median home selling for 3.21% and 4.31% less than this time last year in Alameda County and Contra Costa County, respectively.

Inventories are at the highest level we’ve seen in the past two years

In the month of April, we saw a massive amount of inventory added, without many listings being sold. There was a 7.47% increase in new single-family homes hitting the market, whereas there were 12.21% fewer single-family homes sold. When you couple this with the inventory trends that we’ve been seeing over the past few months, that leaves us with 43.69% more active single-family home listings than this time last year!

We saw similar trends in the condo market as well. While there were fewer new listings added when compared to this time last year, there was an even steeper drop in sold listings. This has led to a year-over-year increase in condo inventories of 42.78%!

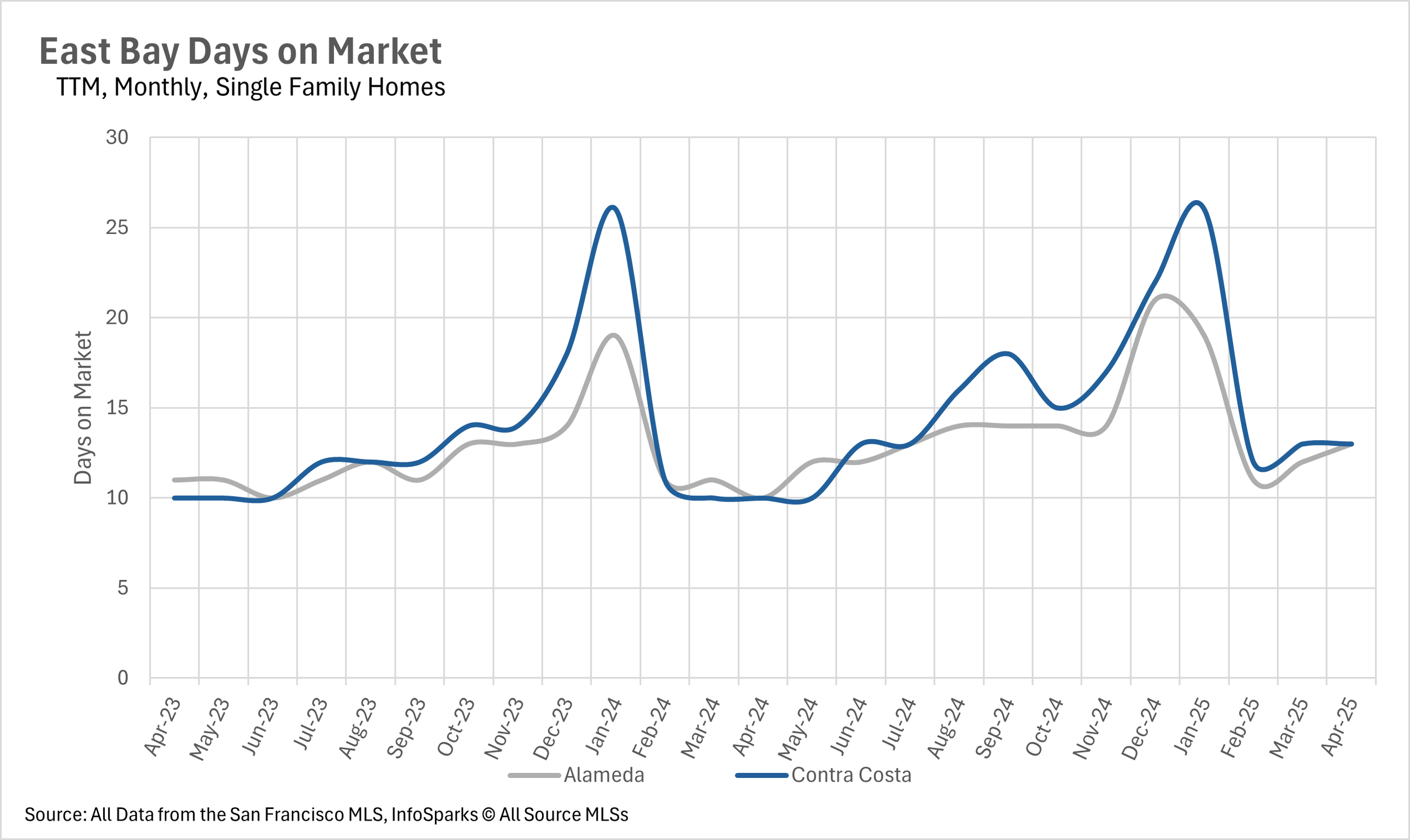

Despite inventory issues, listings are still moving quite quickly

When you hear that inventories are building and prices are falling, you might assume that listings are sitting on the market for considerable periods of time. Although listings are certainly sitting on the market for longer, the average single-family home in the East Bay is still only on the market for 13 days. Condos have always sat on the market for longer than single-family homes, but they’re still moving relatively quickly, with the average condo in Alameda County lasting only 19 days, while the average condo in Contra Costa County lasts 26 days.

The East Bay single-family home market remains a seller’s market - for now

When determining whether a market is a buyers’ market or a sellers’ market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a seller’s market, whereas markets with more than three months of MSI are considered buyers’ markets.

Since inventories have been building in the East Bay, while demand has been stagnant, this means that the number of months worth of inventory on the market is steadily increasing. Typically in the East Bay, we see inventories build throughout the summer, and with 2.2 and 2.5 months' worth of single-family supply on the market in Alameda and Contra Costa Counties, respectively, we could see these markets flip to buyer's markets.

Looking to the condo market, with 4.7 and 3.9 months of supply on the market in Alameda and Contra Costa Counties, buyers retain most of the bargaining power, making it a great time to be a condo buyer in the East Bay!