More Homes for Sale? That’s Not a Red Flag — It’s a Green Light for Smart Buyers

If you've been keeping an eye on real estate headlines, you may have noticed that the number of homes for sale is climbing. Understandably, some people might wonder if this signals trouble ahead—maybe even a repeat of the 2008 crash.

Let’s clear that up right away: it doesn’t. What we’re seeing today is not a warning sign—it's actually your opportunity to invest wisely in a stabilizing market.

Inventory Is Up—But That’s a Good Thing

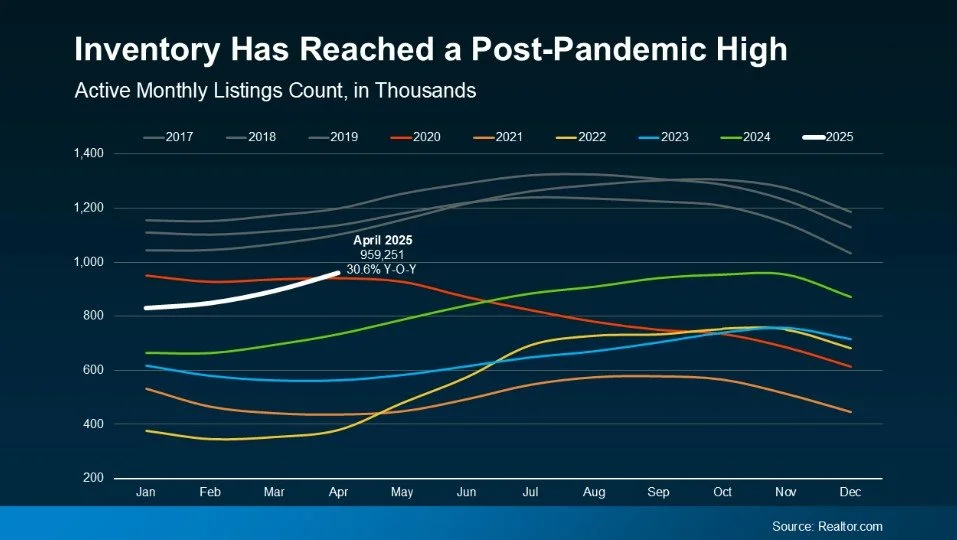

Recent data from Realtor.com shows housing inventory is at its highest level since 2020. That sounds big, but here’s the key context: we’re still not back to pre-pandemic levels. In other words, even with this recent increase, there’s still not enough housing to meet demand.

Think of it this way: after years of extremely tight supply—especially during the pandemic—today’s rising inventory is a breath of fresh air. It’s a move toward a healthier, more balanced market, not an oversaturated one.

Here in Northern California—especially in markets like San Francisco and Redding—we’re finally seeing more listings hit the market. That gives both investors and buyers more breathing room, better negotiating power, and a broader selection of properties to choose from.

Why More Listings Don’t Mean a Crash

Let’s revisit 2008 for a second. Yes, back then inventory exploded just before the crash—but today’s environment couldn’t be more different.

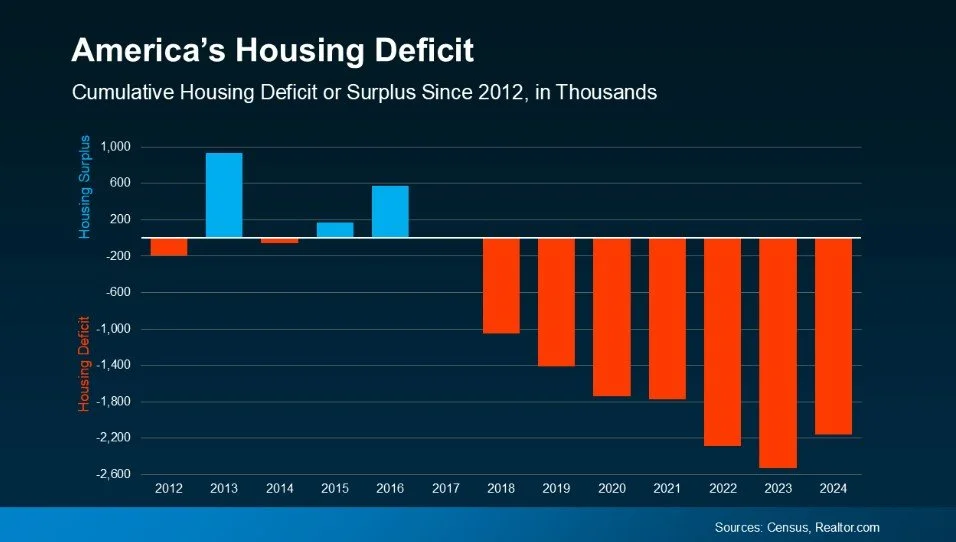

We’re still deep in a housing shortage. For over a decade, new home construction has lagged behind population growth and household formation. In fact, we’re short by millions of homes nationally. According to Realtor.com, at the current pace of construction, it could take 7.5 years to close that housing gap.

Here’s what that means for you: even as more homes come on the market, demand is still outpacing supply. This is especially true in sought-after areas like the Bay Area and nearby growing markets like Redding, where construction constraints, zoning limitations, and population growth all contribute to long-term housing scarcity.

What This Means for You as a Buyer or Investor

Whether you're looking for your next luxury home, an income-generating property, or are monitoring the market from a construction management perspective, this moment offers strategic upside:

More choices without a crash risk

Less buyer competition than in recent years

Room to negotiate and spot undervalued properties

Long-term appreciation potential in underbuilt markets

With more homes finally hitting the market, this could be your window to enter or expand in real estate before prices surge again.

Final Thoughts

Rising inventory is not a threat—it’s a chance to act. In a market still playing catch-up from years of underbuilding, more listings mean more opportunities for savvy buyers and investors like you.

If you’ve been waiting for the right time to invest or move up, this might be it. Let’s talk about how you can make the most of current market conditions—whether that’s securing your dream home or identifying the next great investment property.