MarketTracker East Bay - January 2026 from CharlieBrownSF

Quick Take:

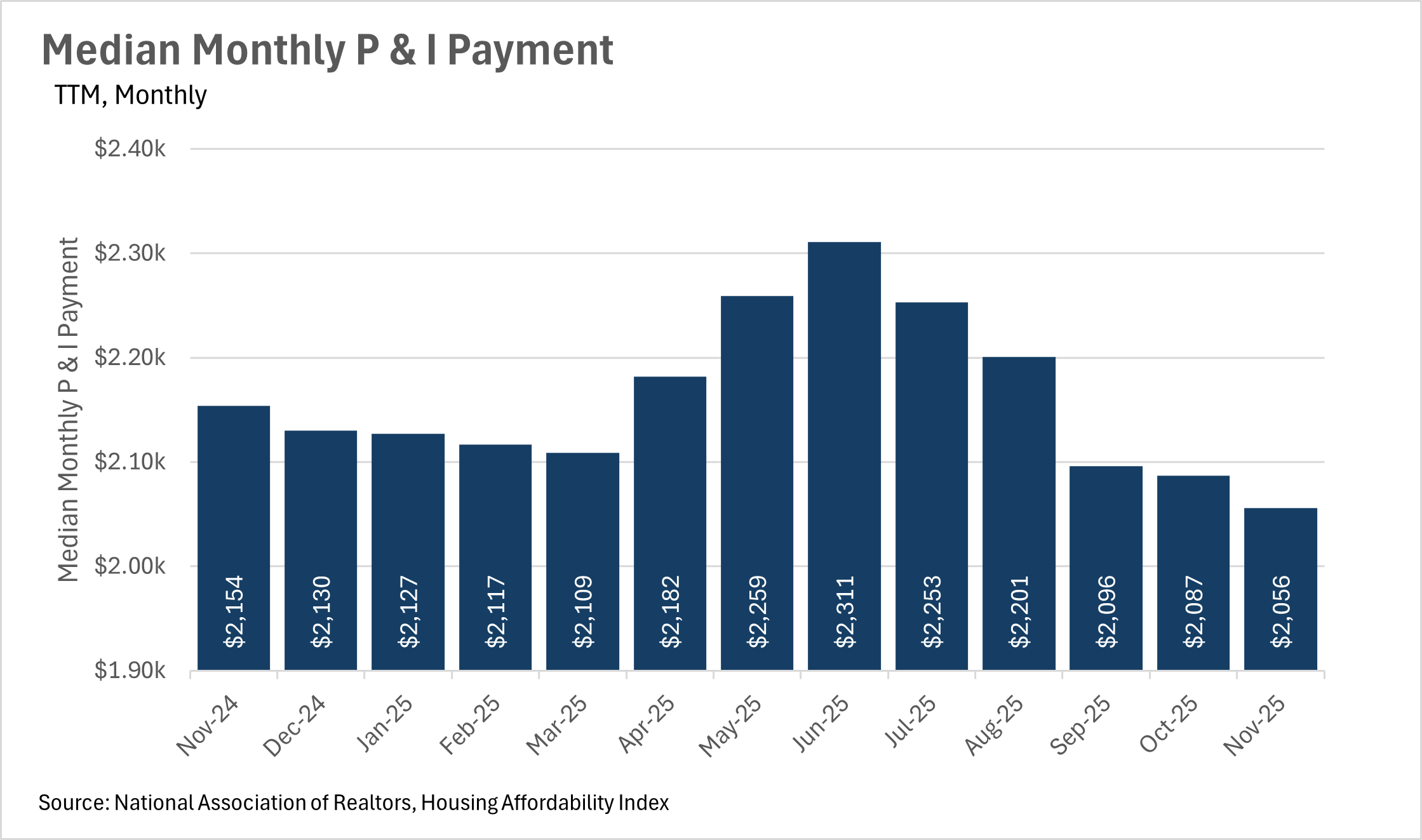

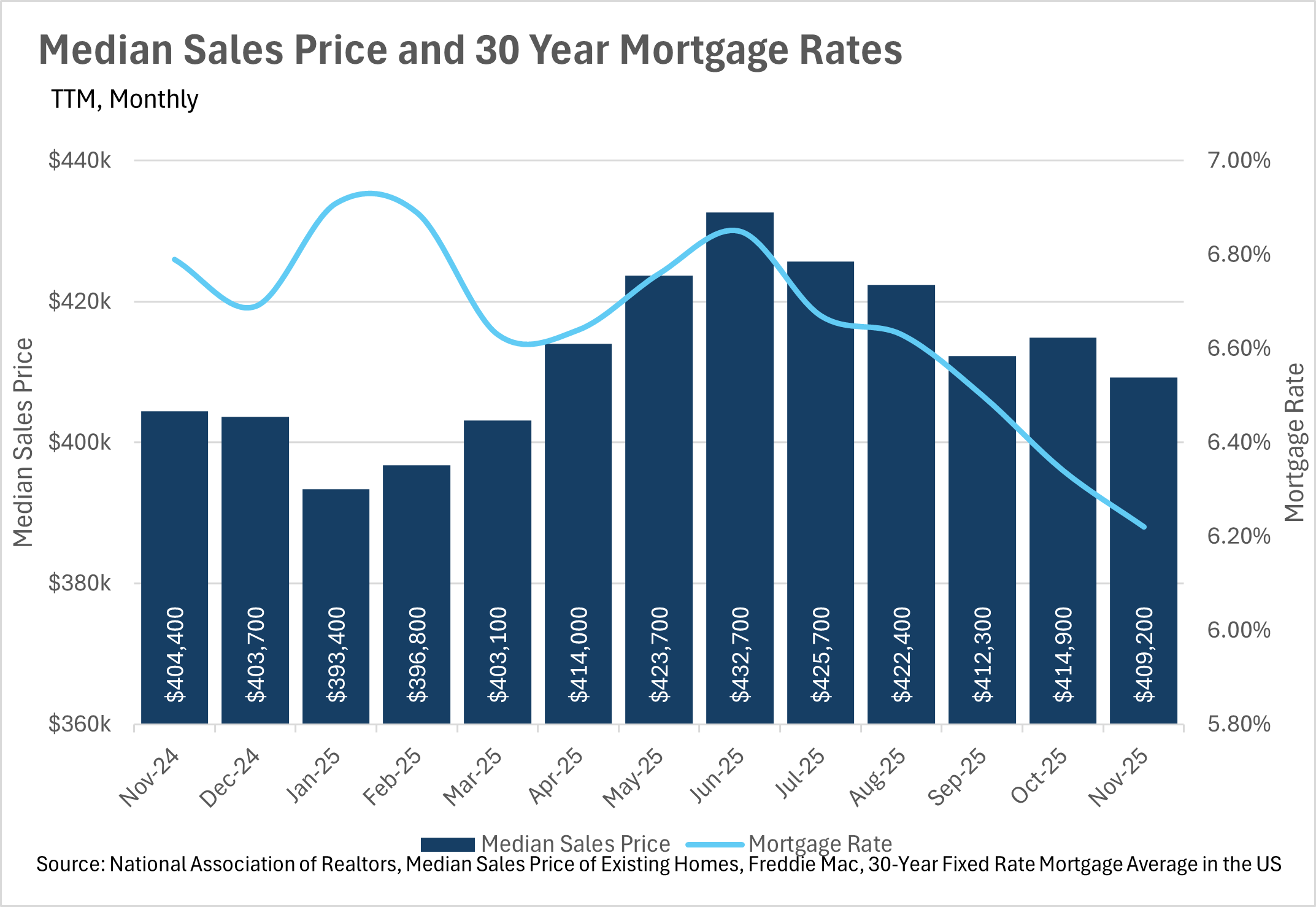

As interest rates continue to fall, median monthly P&I payments do as well, making housing slowly but surely more affordable on a national scale.

Mortgage rates are currently at the lowest point they’ve been at in recent years, as the Fed continues its rate cut cycle.

Despite falling interest rates, inventories still remain higher than they were at this point last year.

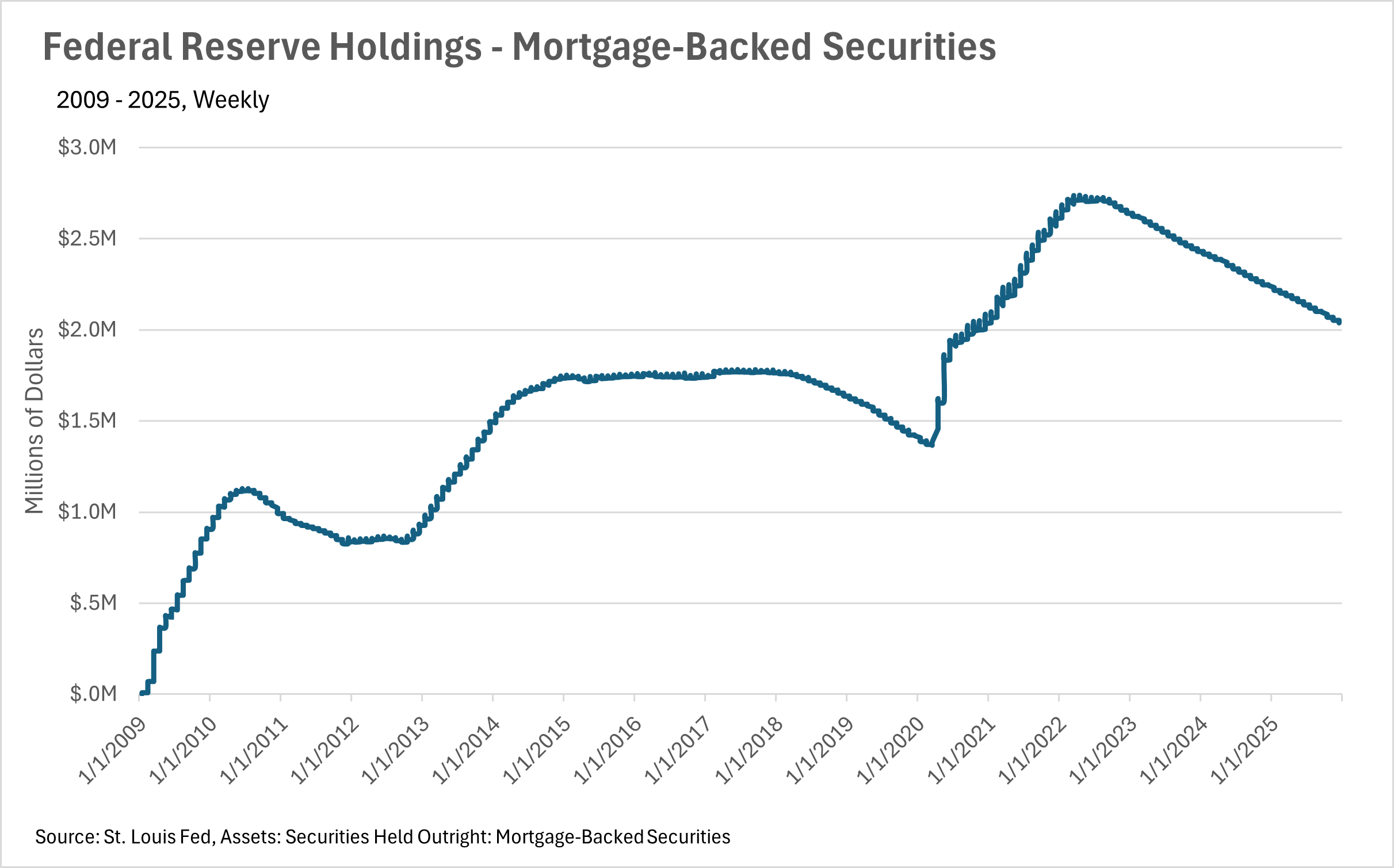

We very briefly saw rates break the 6% mark recently, following some commentary from Trump regarding the purchase of mortgage-backed securities by Fannie and Freddie.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

Homeownership is slowly but surely becoming more attainable

With the median monthly P&I payment hitting $2,056 in November, that marks a considerable decrease from the $2,311 maximum that we hit earlier in the year. As you might have guessed, this is largely due to interest rates declining, as the Federal Reserve continues its rate cutting cycle. In November of 2024, interest rates were at 6.79%, compared to 6.22% in November of 2025. This represents an 8.39% decrease in interest rates on a year-over-year basis, while the median sale price of a home in the US actually increased by 1.19% during that same period of time. As interest rates slowly creep down, we will likely see home values continue to increase, as the deciding factor for most people is not the total purchase amount, but instead the monthly payment that they can afford.

Mortgage rates fall to the lowest levels we’ve seen in years

As we mentioned in the prior section, interest rates continue to creep lower and lower. We saw rates hit 6.22% in November, and have fallen even further since then. As of right now, the average interest rate for a 30 year, fixed rate mortgage is sitting around 6.06%, which is actually a slight increase from what we briefly saw last week. Unfortunately, some recent commentary from the Fed has led markets to believe we won’t see a rate cut as a result of the January FOMC meeting, as CME FedWatch puts the probability of a 25 bps cut at just 5% for January. However, it’ll be important to pay attention to the economic data that’s being released over the coming months, as it’ll give us a good idea of where we can expect rates to go in the near term future.

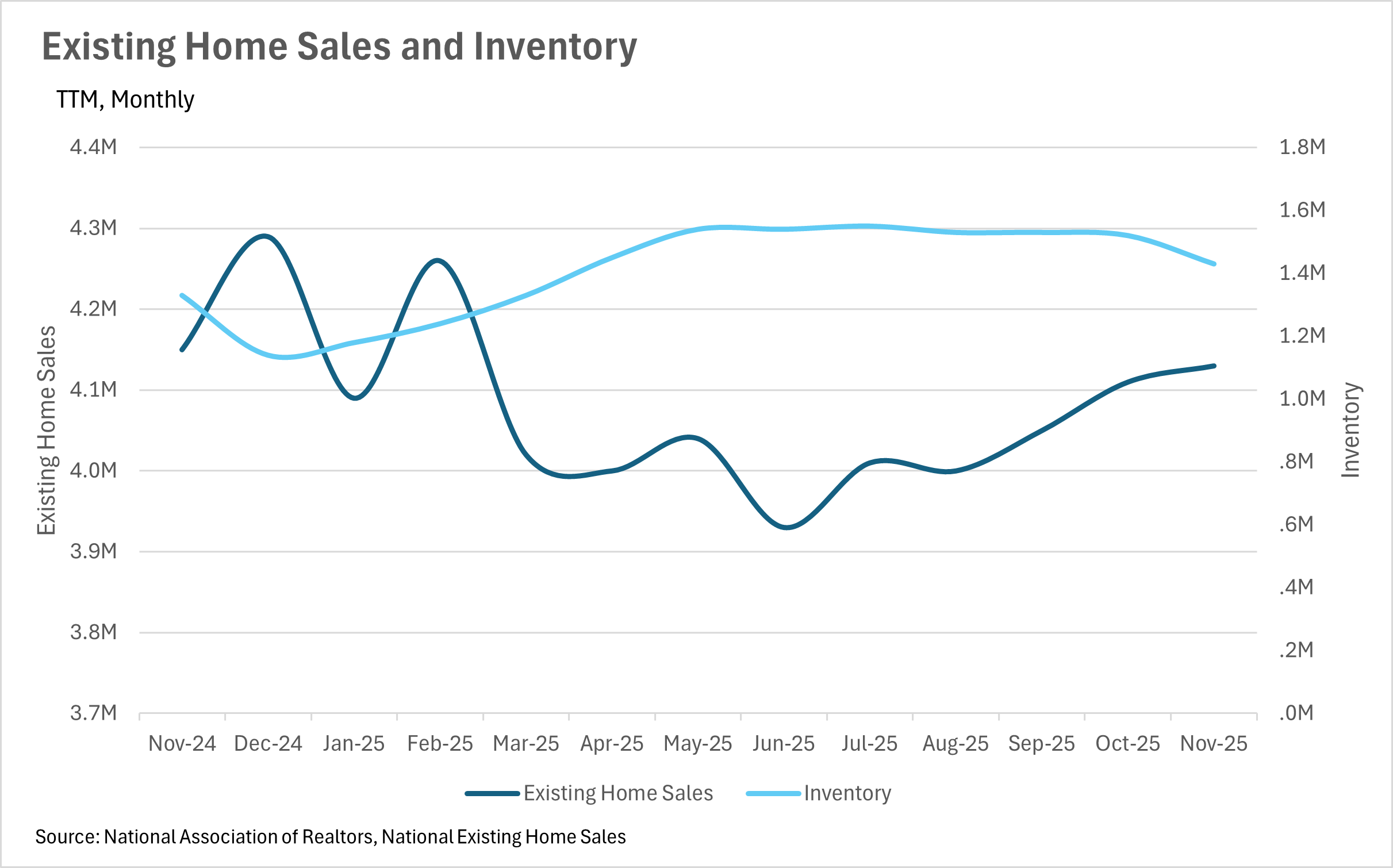

Although mortgage rates are down, inventories are up!

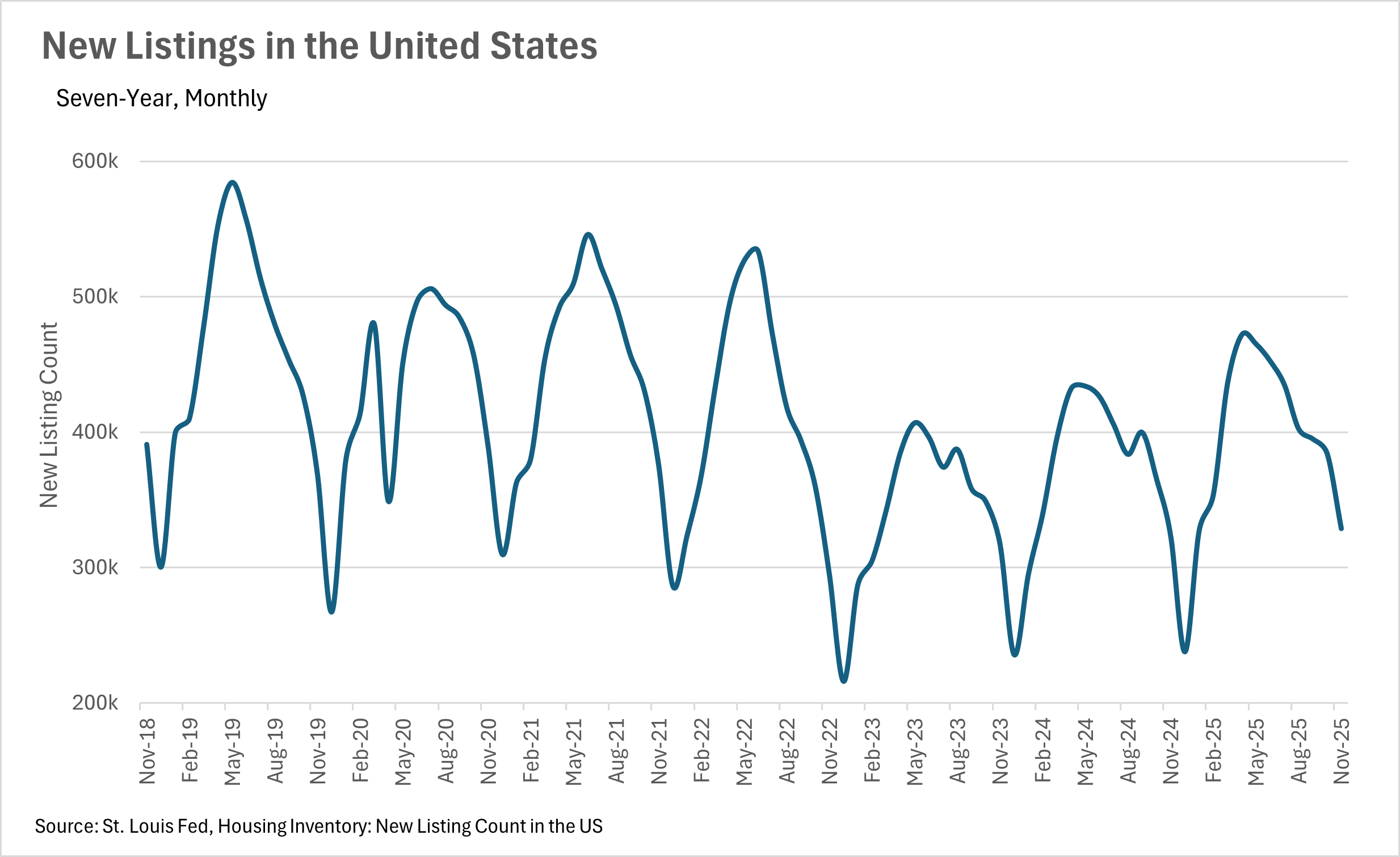

While you might expect inventories to decrease as interest rates decrease, that wasn’t the case in November. In fact, we saw inventories increase by 7.52% on a year-over-year basis, despite falling rates. This is largely attributable to the fact that existing home sales decreased by roughly half a percent while new home listings increased by roughly 1.7% on a year-over-year basis. We’ll likely see inventories continue to increase as we move through the winter months, until the usual spring rush begins and inventories start to move once again. Overally, we had a very different year in terms of market dynamics in 2025, so it’ll be interesting to watch where the market goes in 2026.

Keep an eye on the market as we move through 2026

We’ve gotten to the point where rates have been so high for so long, that there is a considerable cohort of people that’s waiting on the sidelines, carefully watching interest rates. This cohort of people is ready to make a move on their first home, or is looking for a good point in time to sell their existing home and move. Lately we’ve seen quite a bit of commentary out of the Federal Reserve that has markets thinking we’ll see rate cuts, especially when you couple this with the commentary regarding interest rates coming from the executive branch. If we do see some steeper rate cuts (more than the 25 bps cuts we’ve seen recently), then moving quickly will be pivotal for you and your clients, as bigger cuts will likely lead to the floodgates opening.

Of course, this is all what we’re seeing at a national, macro level. As we all know, real estate is a localized game, so be sure to check out your local lowdown below, to see what’s going on in your market!

Big Story Data

The Local Lowdown

Quick Take:

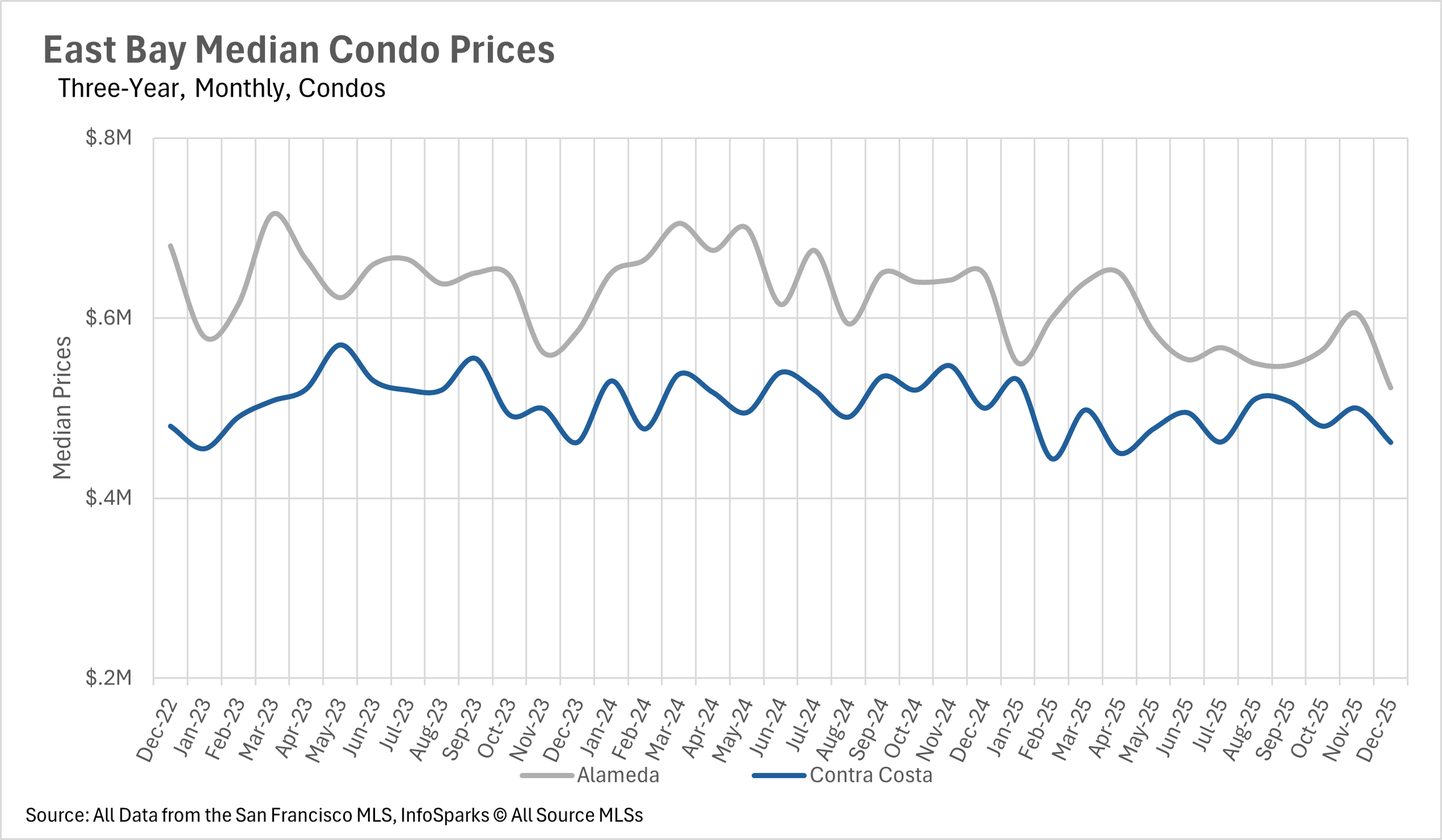

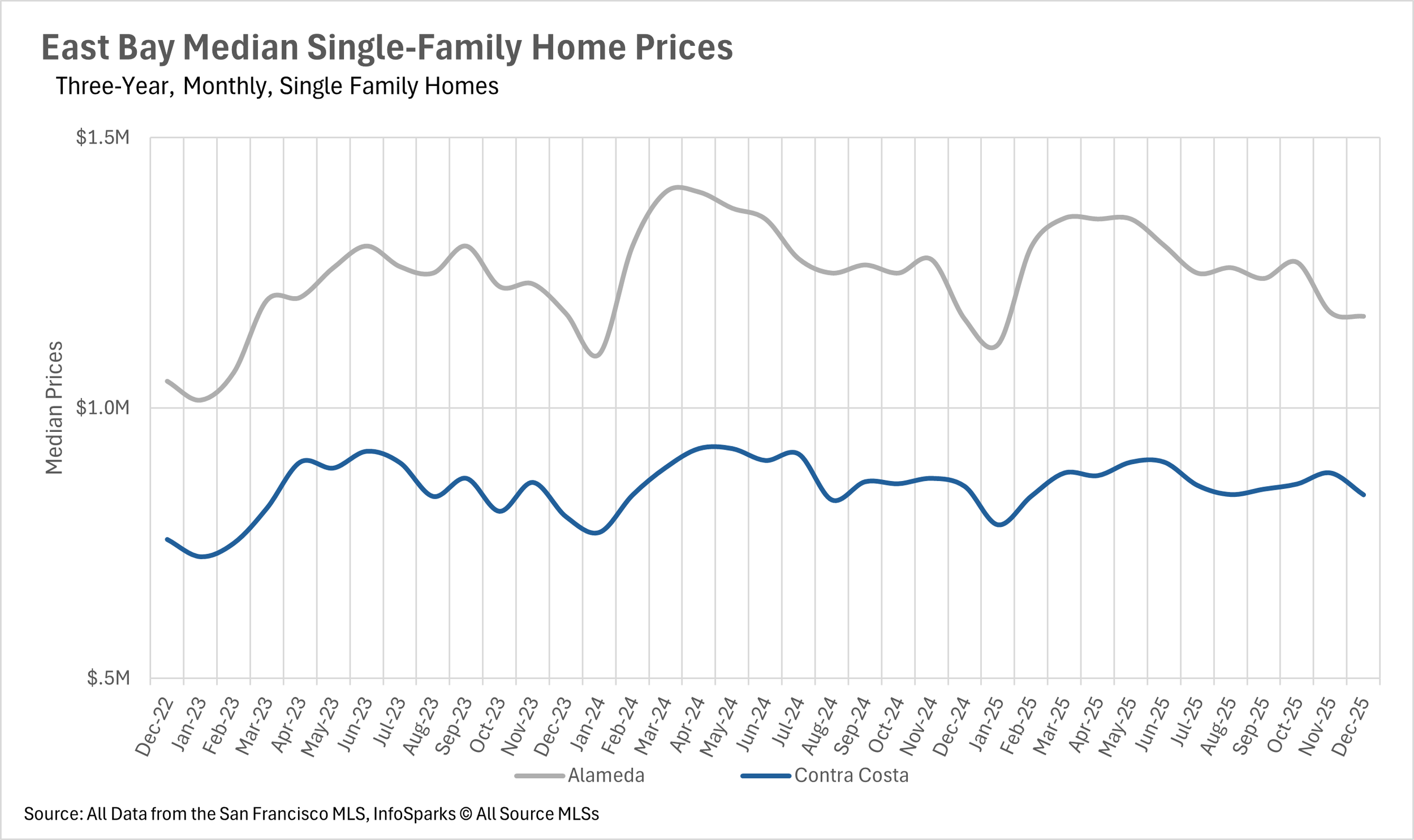

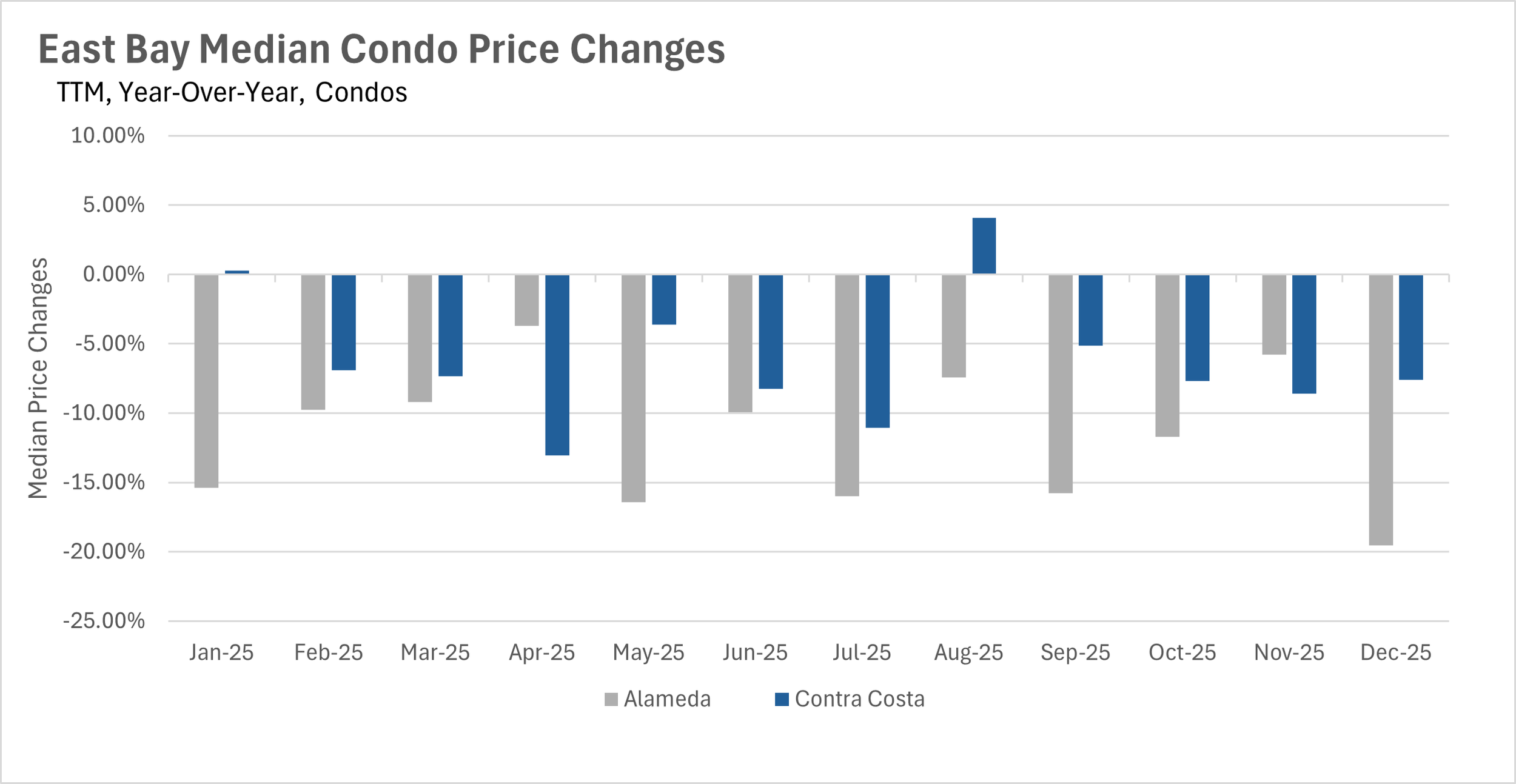

Single-family home prices held relatively steady in December, while the condo market continued its year-long slide with double-digit declines in Alameda County.

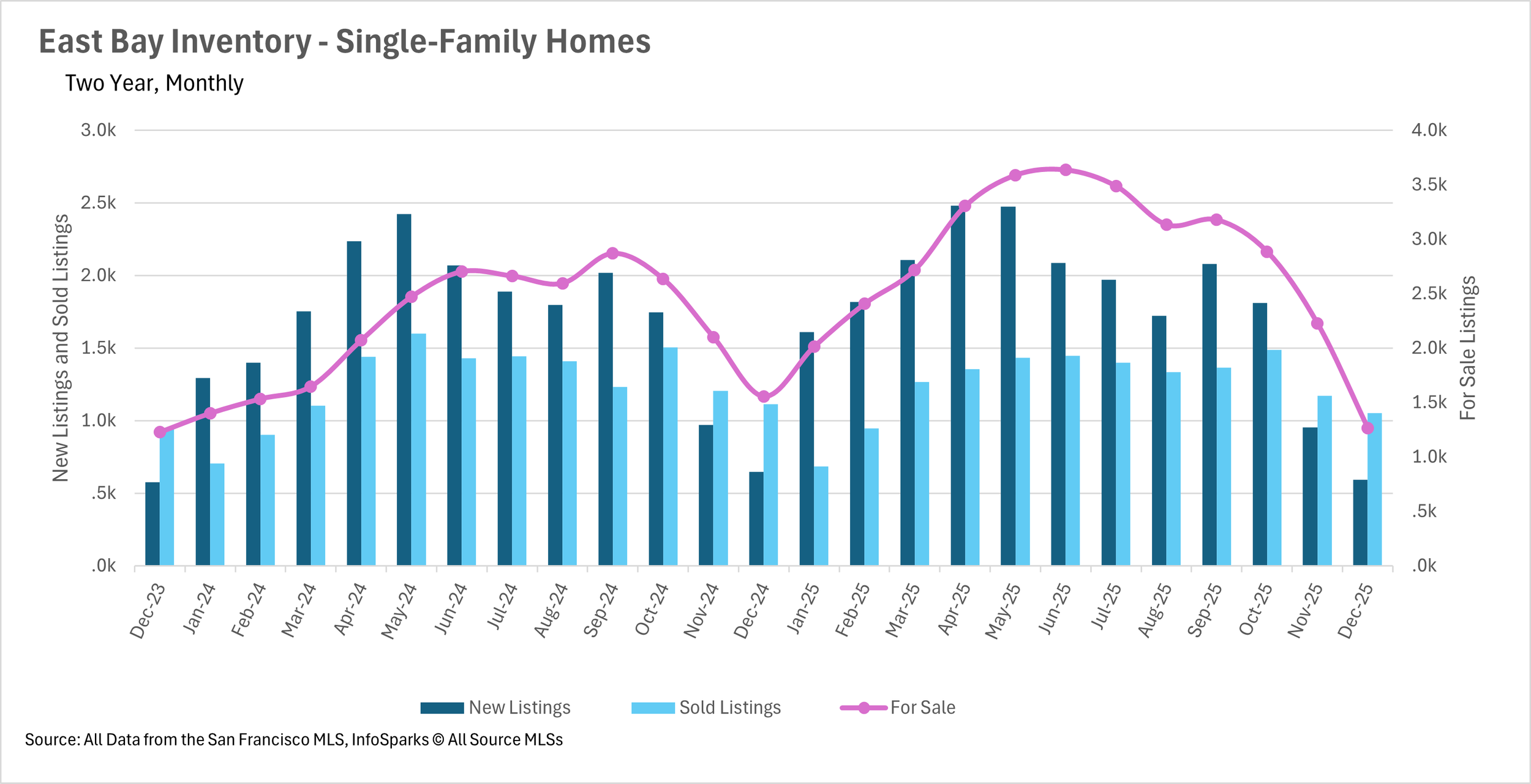

Inventories dropped significantly as the year came to a close, with single-family home inventory down nearly 19% year-over-year.

Single-family homes continue to move quickly, while condos are spending considerably more time on the market.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Single-family homes hold steady while condos continue to struggle

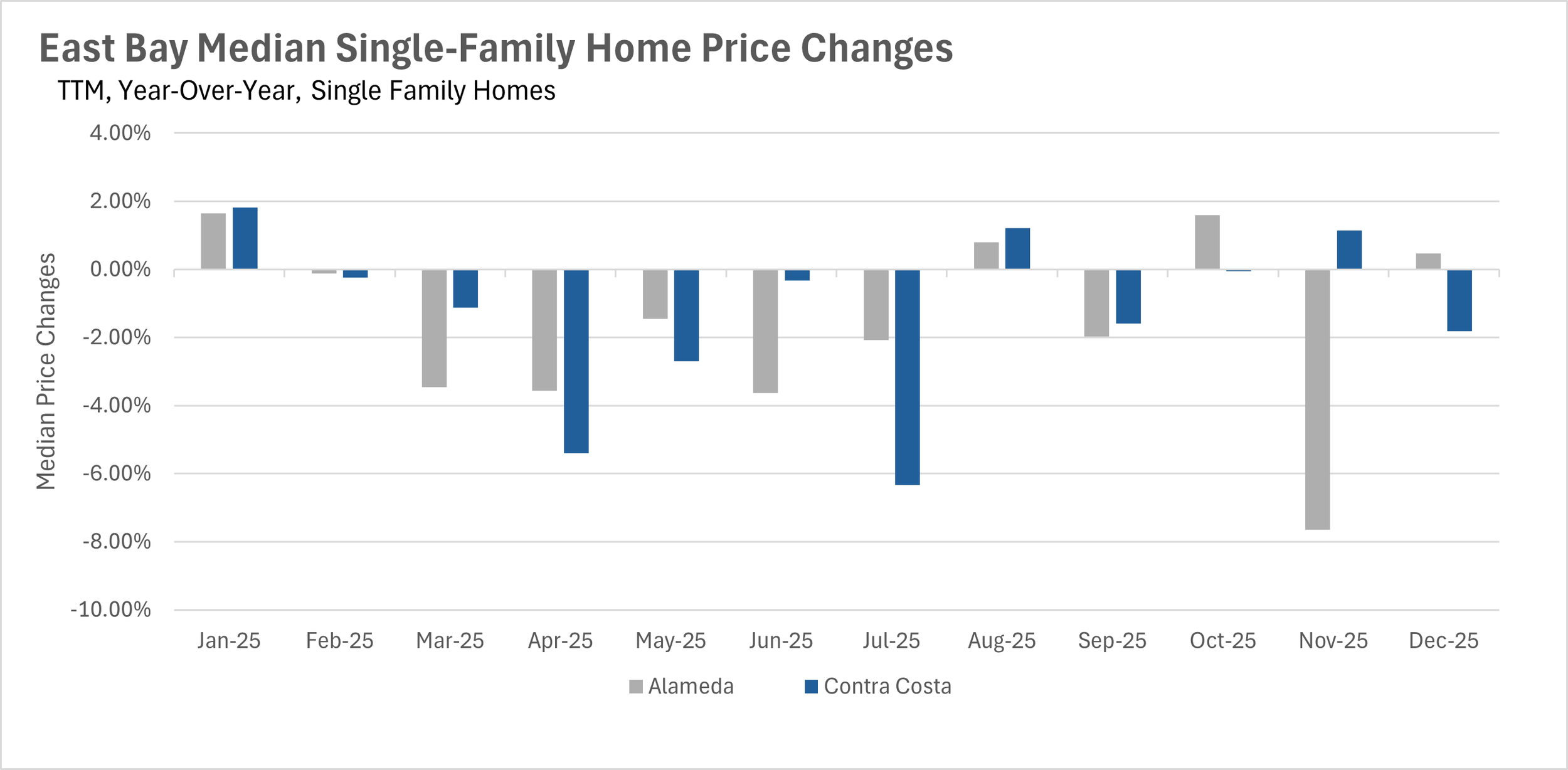

The single-family home market in the East Bay ended the year on a relatively stable note. In December, the median single-family home in Alameda County sold for $1,170,000, representing a modest 0.47% increase on a year-over-year basis. Meanwhile, Contra Costa County saw the median single-family home sell for $839,500, a slight 1.81% decline compared to last year. The condo market, however, tells a very different story. Alameda County condos saw a steep 19.55% year-over-year decline in median sale price, with the median condo selling for just $522,500. Contra Costa County condos fared somewhat better but still declined by 7.60%, with the median condo selling for $462,000. This divergence between single-family homes and condos has been a recurring theme throughout 2025.

Inventory levels plummeted as the year came to a close

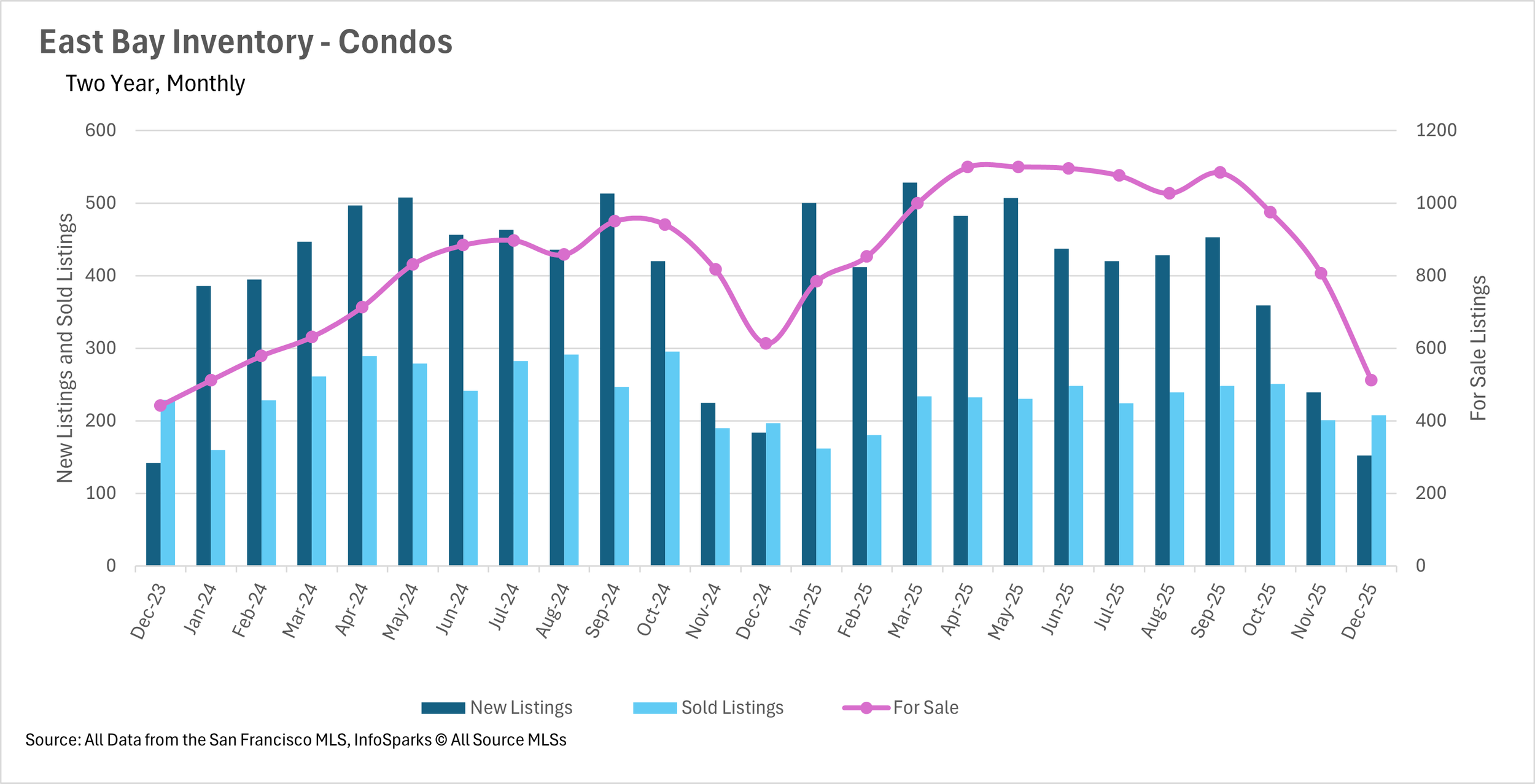

As we moved through the holiday season, inventory levels dropped significantly across the East Bay. Single-family home inventory fell by 18.70% on a year-over-year basis, with just 1,265 homes on the market at the end of December. The condo market saw a similar trend, with inventory declining by 16.48% year-over-year to just 512 units. This steep decline in inventory is fairly typical for this time of year, as sellers often wait until after the holidays to list their homes. However, the magnitude of the decline is notable, especially considering the elevated inventory levels we saw throughout much of 2025.

Single-family homes fly off the shelves while condos linger

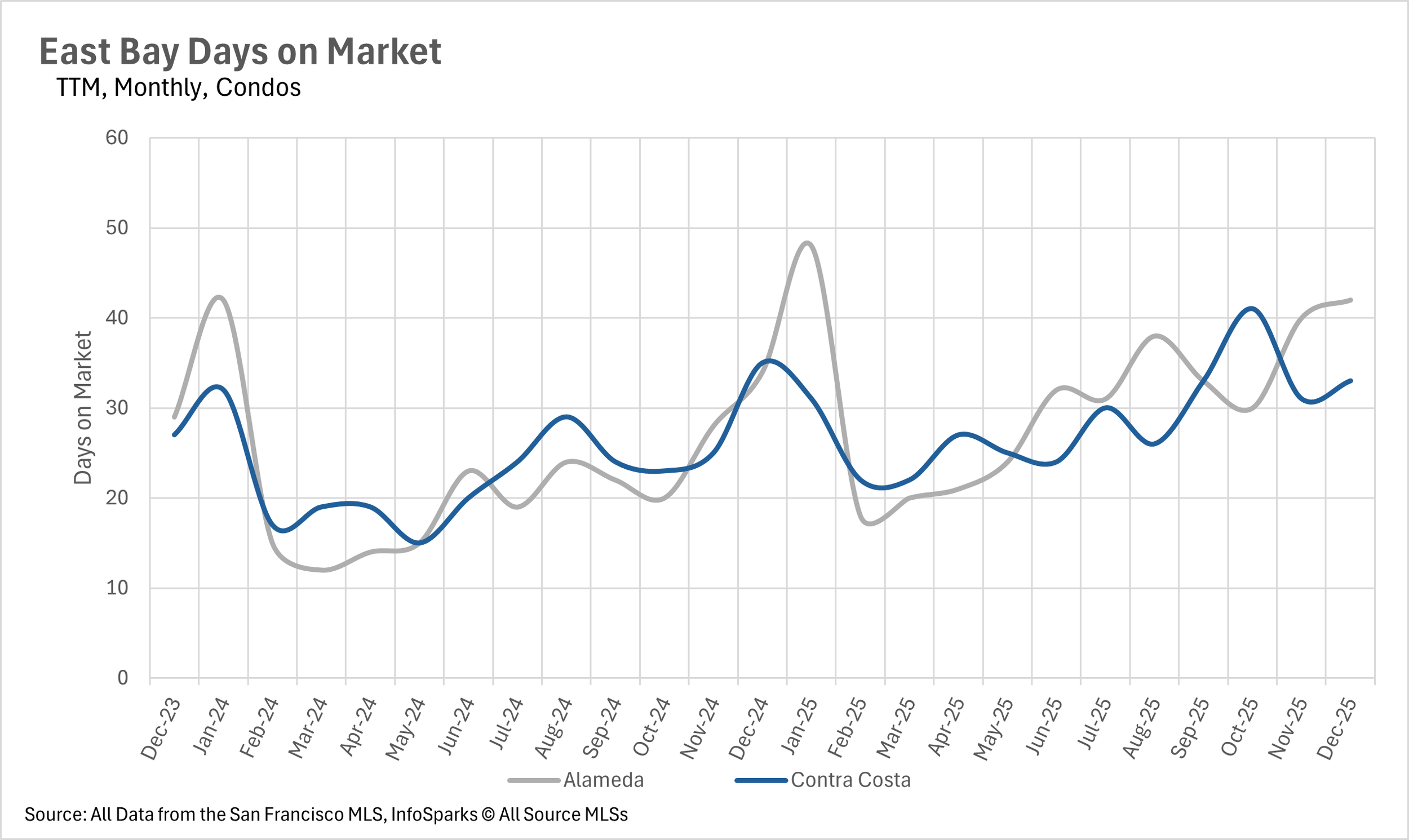

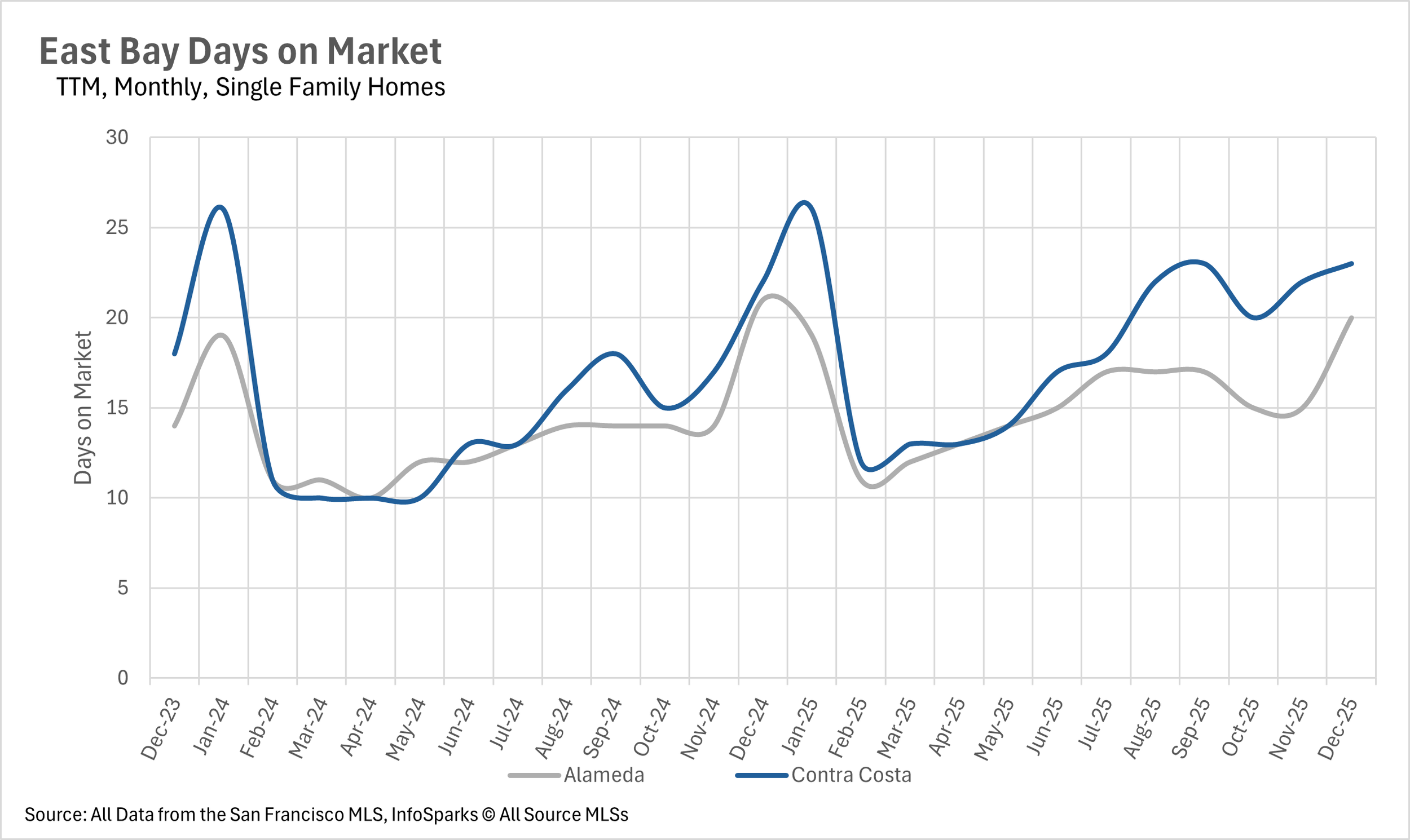

The single-family home market continues to move at a brisk pace, with the average listing in Alameda County selling in just 20 days and the average listing in Contra Costa County selling in 23 days. In fact, Alameda County single-family homes are actually selling slightly faster than they were last year, with a 4.76% decrease in days on market. The condo market, on the other hand, is moving much more slowly. The average condo in Alameda County is spending 42 days on the market, representing a 23.53% increase compared to last year. Contra Costa County condos are faring a bit better at 33 days, but the overall trend is clear: buyers are snapping up single-family homes quickly while taking their time with condos.

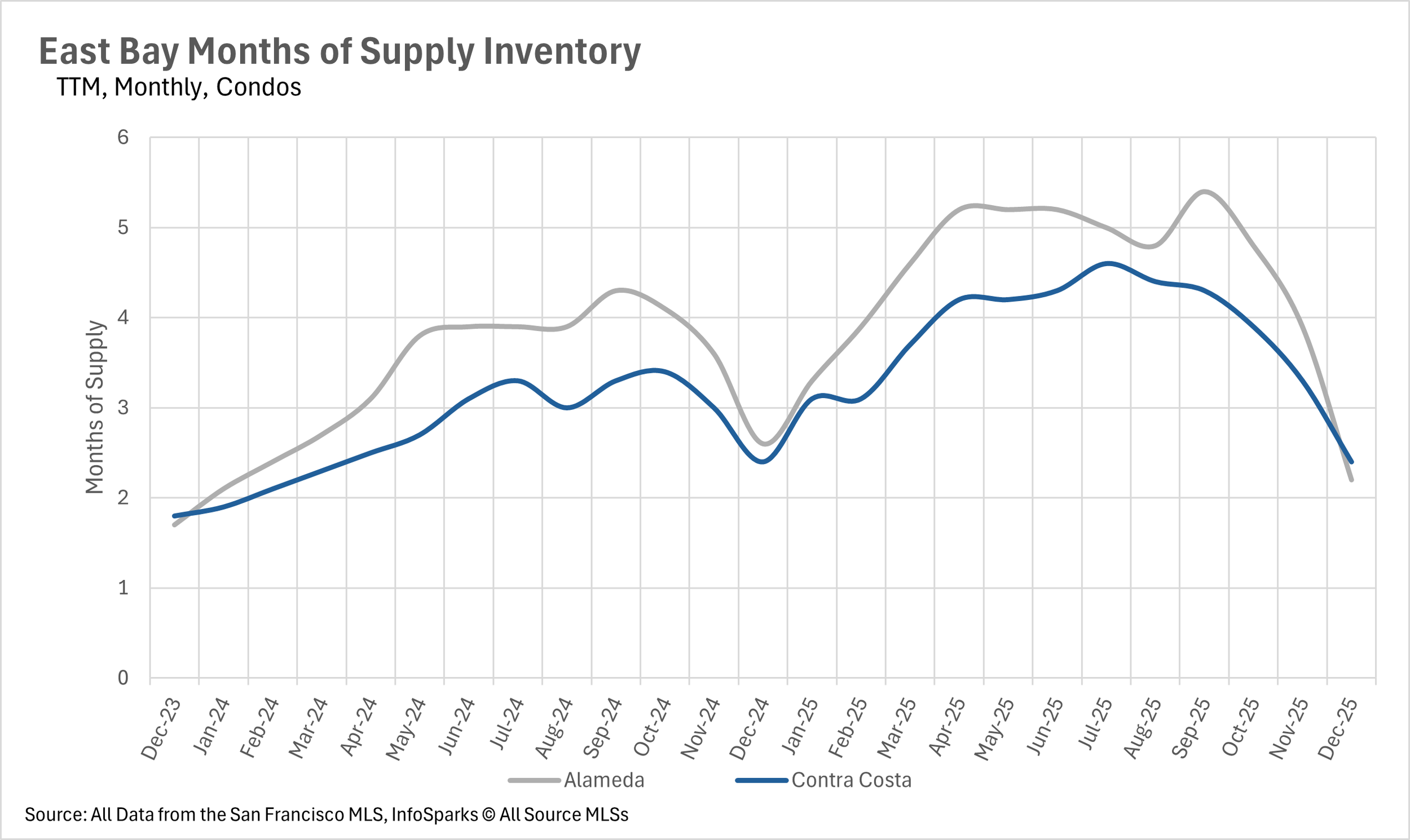

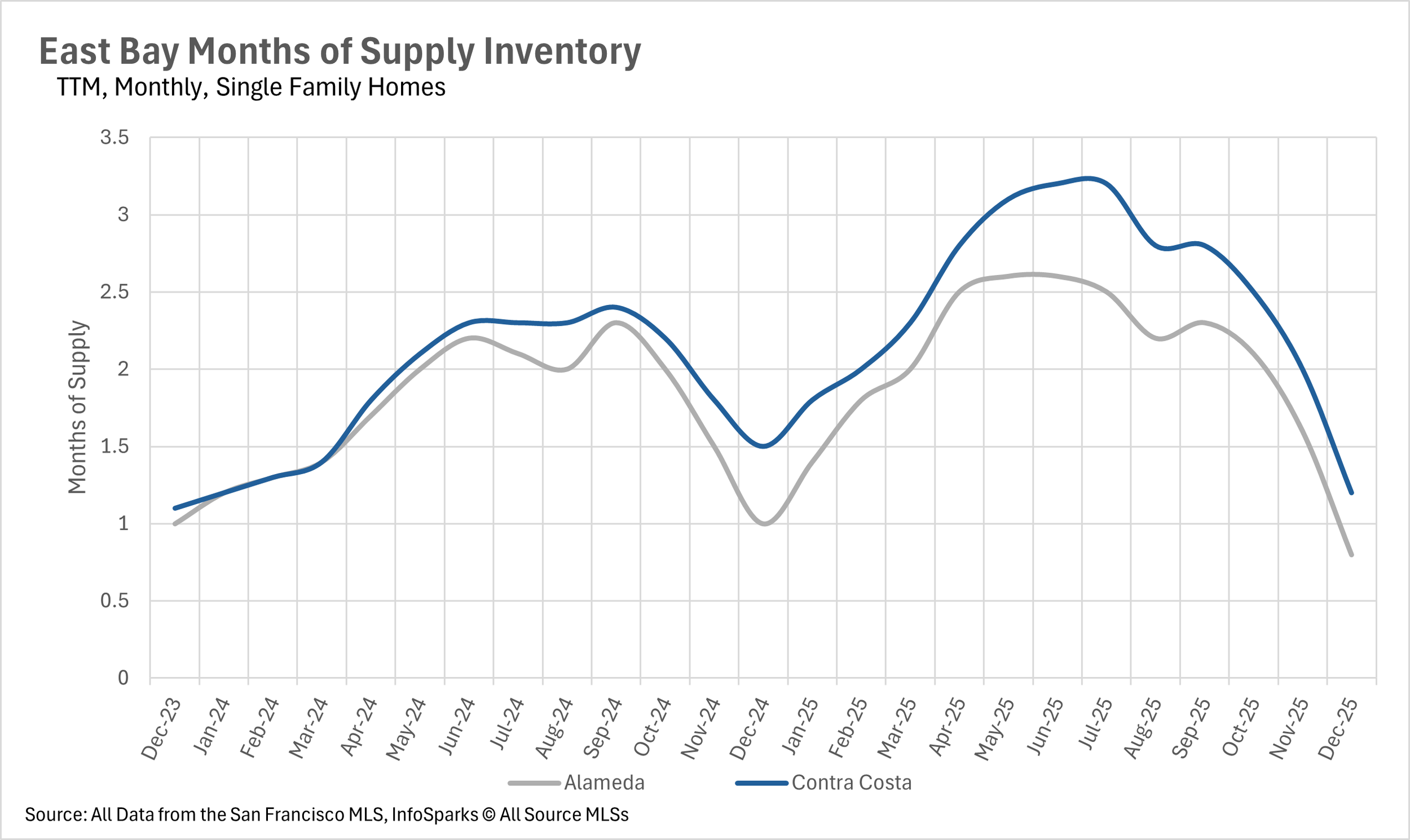

The East Bay ends the year firmly in seller's market territory

When determining whether a market is a buyers’ market or a sellers’ market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a sellers’ market, whereas markets with more than three months of MSI are considered buyers’ markets.

The East Bay ended December as a strong seller's market across the board. The single-family home market is especially tight, with just 0.8 months of inventory in Alameda County and 1.2 months in Contra Costa County. This represents a 20% year-over-year decline in both counties and signals that buyers looking for single-family homes will face stiff competition heading into the new year. Even the condo market, which has struggled throughout 2025, has tightened considerably. Alameda County ended the month with 2.2 months of condo inventory, while Contra Costa County had 2.4 months. Both figures represent significant declines from earlier in the year and put the condo market firmly into seller's market territory as well.