MarketTracker East Bay - December 2025 from CharlieBrownSF

The Big Story

Quick Take:

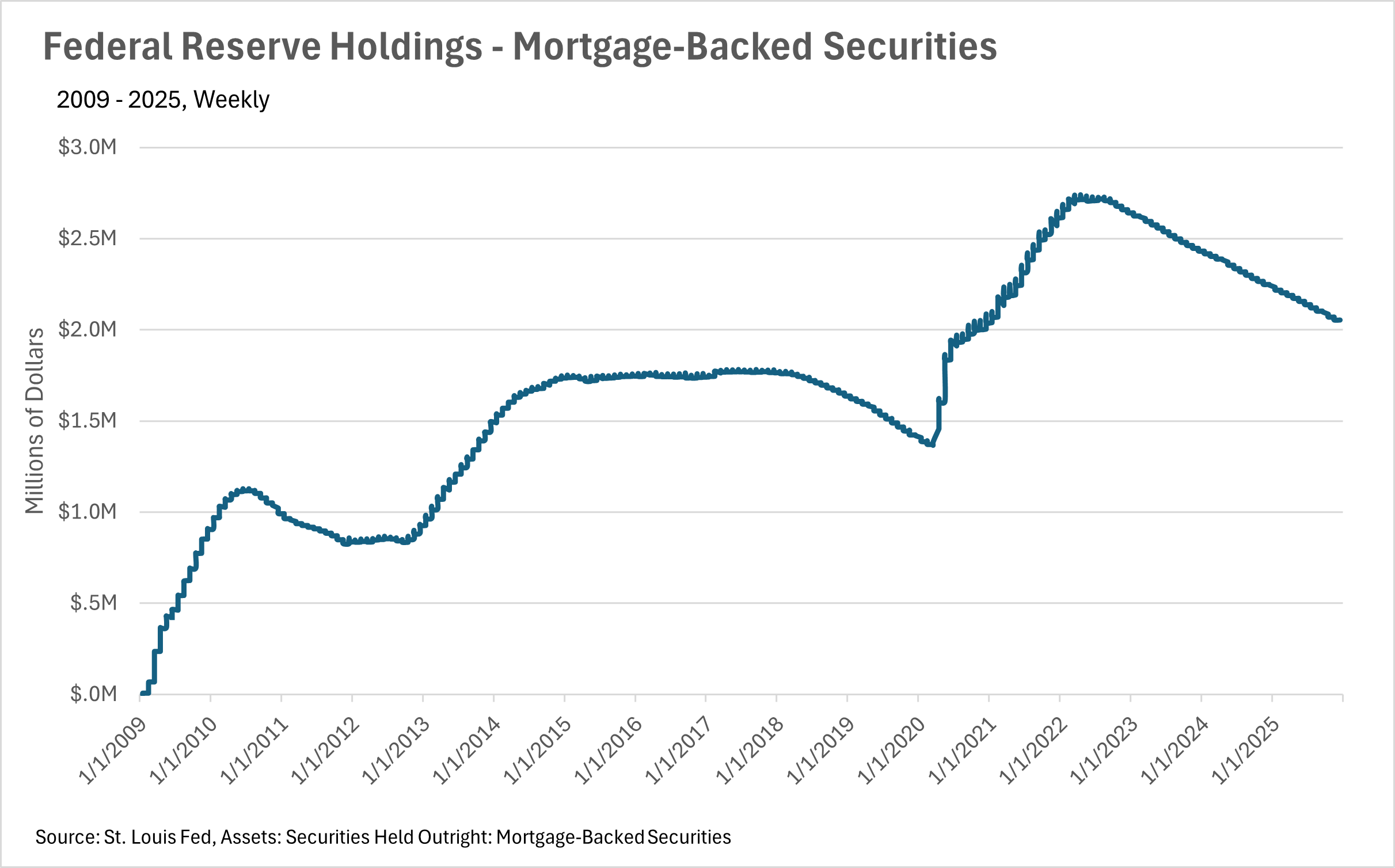

Mortgage rates continue to slowly move downwards, as the Federal Reserve continues its rate cuts.

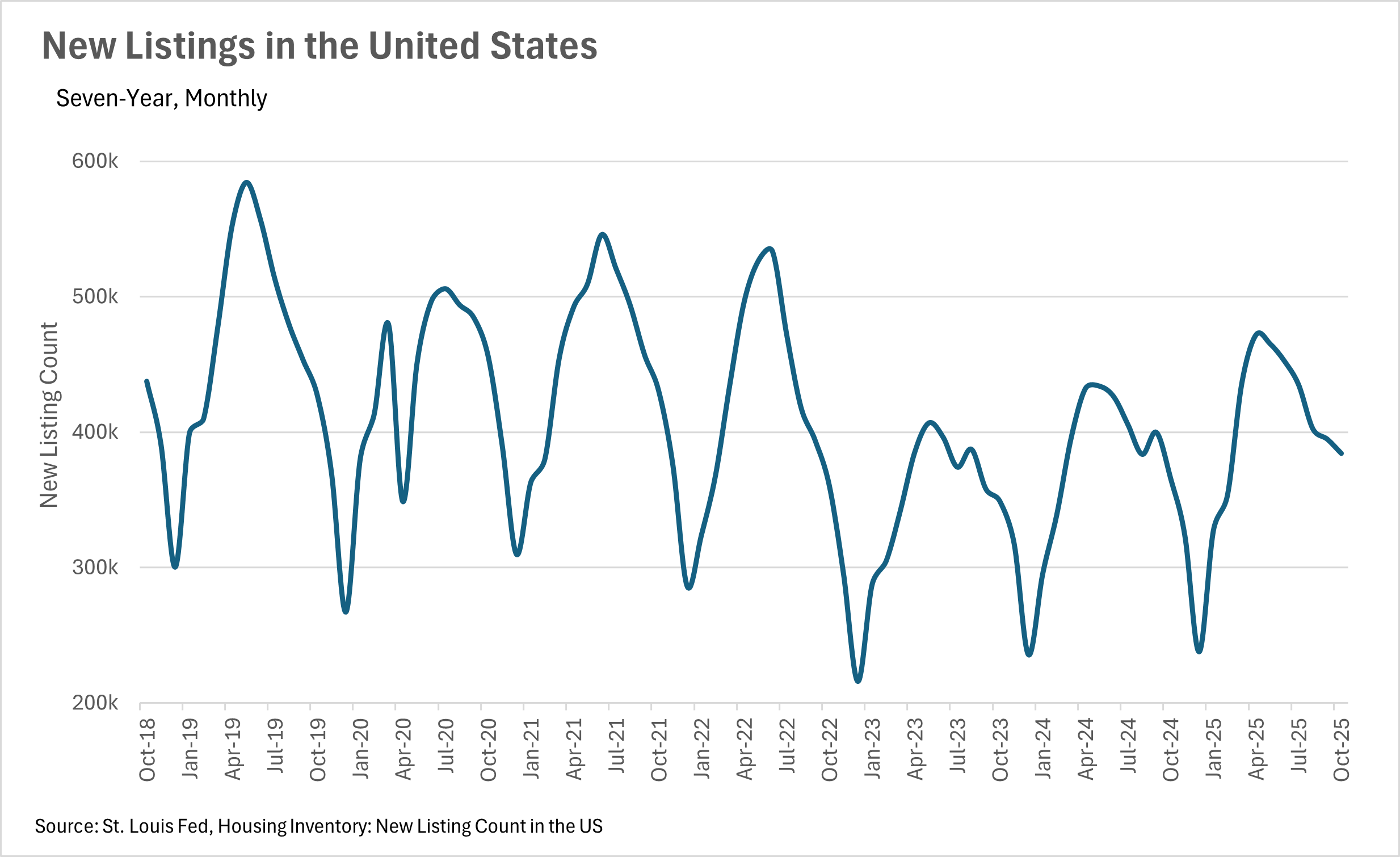

Inventories remain high, as new supply is hitting the market faster than existing homes are being sold.

Last Wednesday, the Fed lowered the federal funds rate by another 25 basis points, bringing the target range to 3.50%-3.75%.

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month's data when possible and appropriate.

Although they are on the decline, interest rates remain much higher than the inflation rate

Unfortunately, we have yet to see mortgage rates drop below the 6% mark, as the Federal Reserve continues its cutting cycle, after its third consecutive cut to the federal funds rate in December. Although many are hopeful that we will continue to see rate cuts into 2026, the future of the federal funds rate is relatively uncertain. While there’s still roughly a month and a half before the next interest rate decision, CME’s FedWatch tool is predicting roughly a 25% chance that we see another rate cut in January. As we all know, the federal funds rate is the most important factor in the determination of interest rates, so paying attention to what the Fed is doing is pivotal! We’ll likely see an increase in the probability of another rate cut if some of the new/delayed economic data that’s coming out provides a cause for concern.

Inventory levels have remained remarkably steady throughout the entire year

Throughout much of the year, inventories at a national level have remained remarkably steady, with most months hovering near the 1.5 million mark. With that being said, in the month of October, we saw inventory levels at roughly 1,520,000, representing a 10.95% increase on a year-over-year basis. During that same time period, we saw more than 384,000 new homes hit the market, representing an increase of 5.08% on a year-over-year basis. We also saw the median sale price for a home increase by 2.06%, bringing the median home value to $415,200.

The Fed continues to cut rates, as the broader market faces uncertainty

Right now, we’re in the midst of a relatively interesting period of time, economically speaking. During the government shutdown, not only were there very few publicly released economic datapoints, but many offices responsible for collecting data were unable to. This means we’re receiving economic data that has been tremendously delayed. Uncertainty like this, of course, does not bode well with countless entities, like lenders, markets, and most importantly, the Federal Reserve. Since the Fed is so reliant on public data that has been inaccessible/delayed given the government shutdown, it’s hard to tell what they will do next with interest rates. Luckily for homebuyers and sellers alike, we saw another quarter-point cut in December, but overall, it’s unclear whether or not this cut cycle will continue.

However, this is just what we’re seeing at a national level. As we all know, real estate is incredibly localized, so be sure to check out your local lowdown below!

Big Story Data

The Local Lowdown

Quick Take:

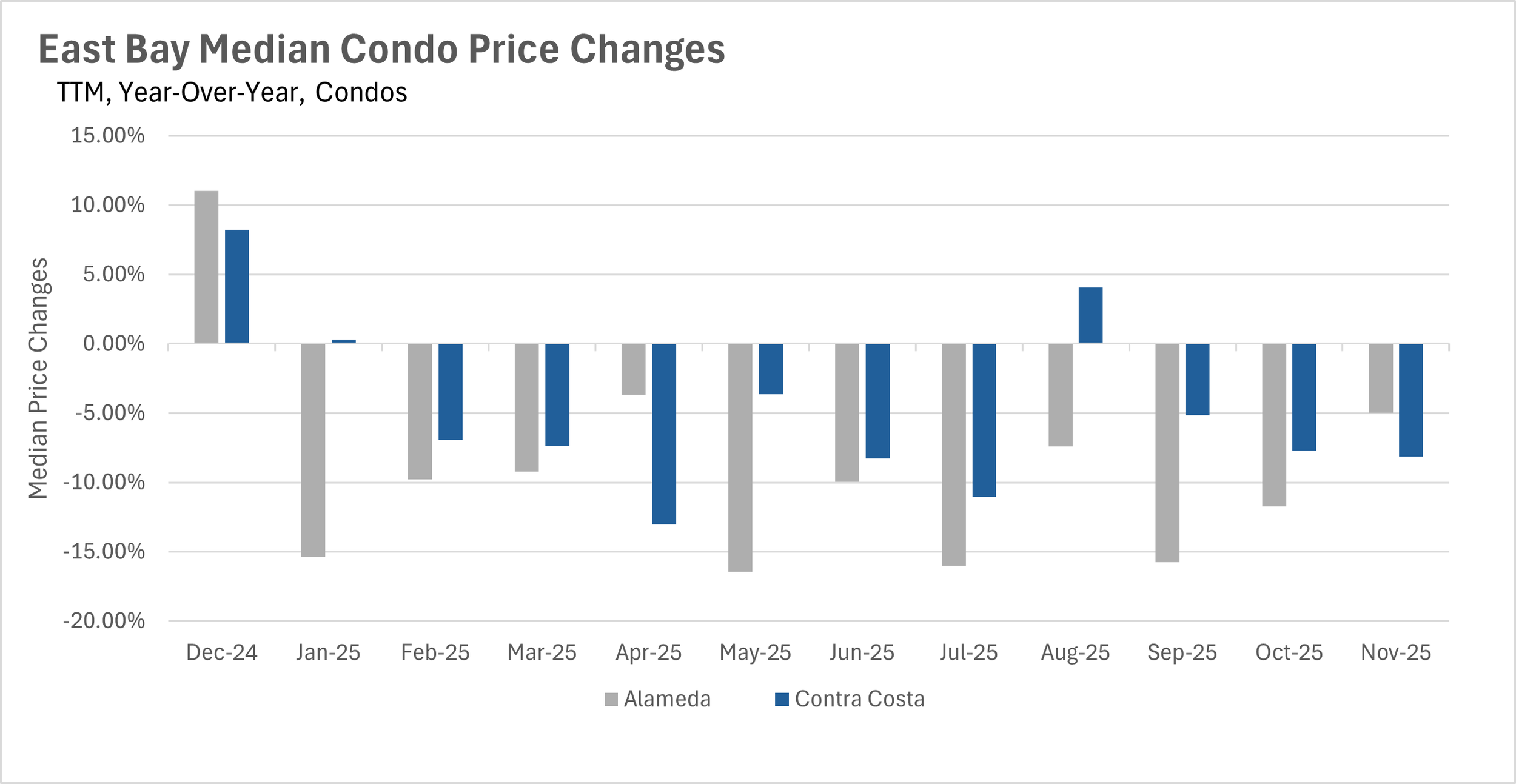

Median sale prices are largely on the decline throughout the East Bay.

The East Bay has continued to buck the trend, as inventories are roughly flat on a year-over-year basis.

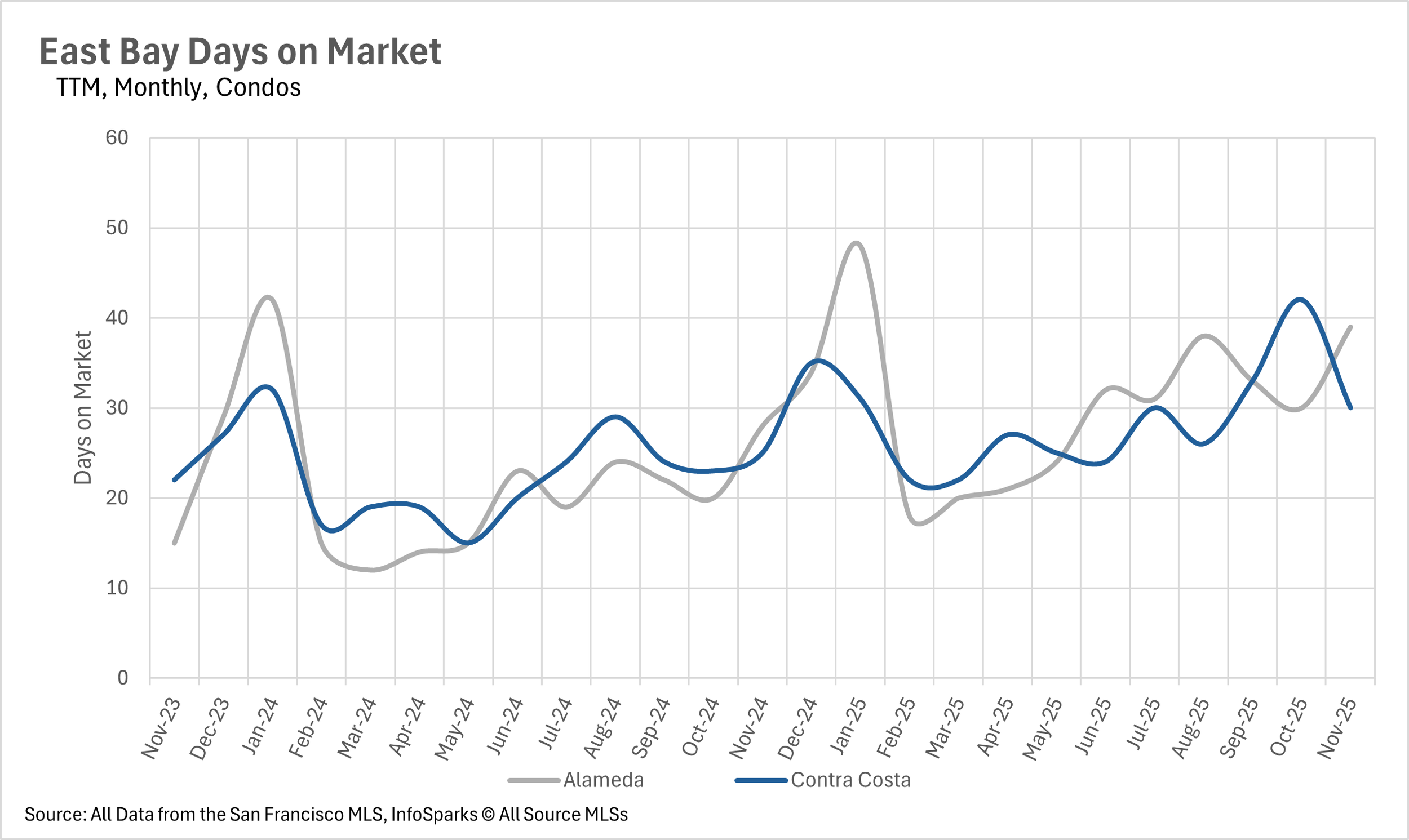

As inventories remain flat, listings are spending more time on the market.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

Alameda single-family homes sold for 7.45% less when compared to last year

Although price movements have been fairly muted in the East Bay over the past couple of months, we saw some pretty big swings (mostly to the downside) this month! The median single-family home sold for 7.45% less on a year-over-year basis in Alameda County, whereas it sold for 1.36% more in Contra Costa County. When we turn to the condo market, there were declines in median sale price across the board, with the median condo selling for 4.98% less in Alameda County and 8.14% less in Contra Costa County.

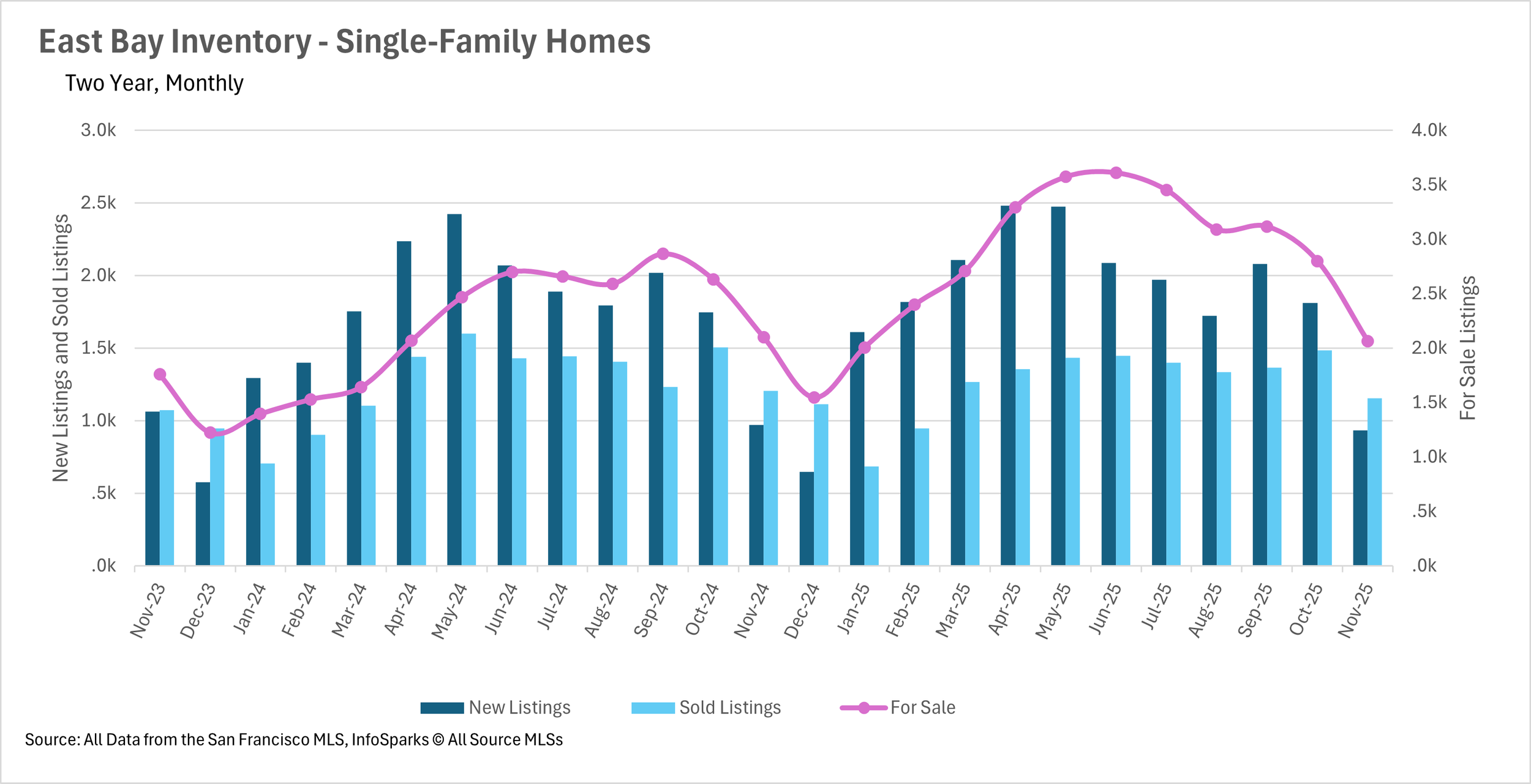

East Bay inventories have remained incredibly resilient

Throughout the late spring and early summer, we saw inventories build throughout California at an incredible rate. Since the beginning of the fall, we’ve seen some pretty big corrections throughout most of the state, as these built-up inventories sell off. However, the East Bay seems to have bucked the trend a bit here, as there hasn’t been a dramatic sell-off. Instead, we’re seeing inventories roughly in line with where they were just a year ago, which is quite remarkable, especially considering the inventory levels we were seeing just a couple of months ago.

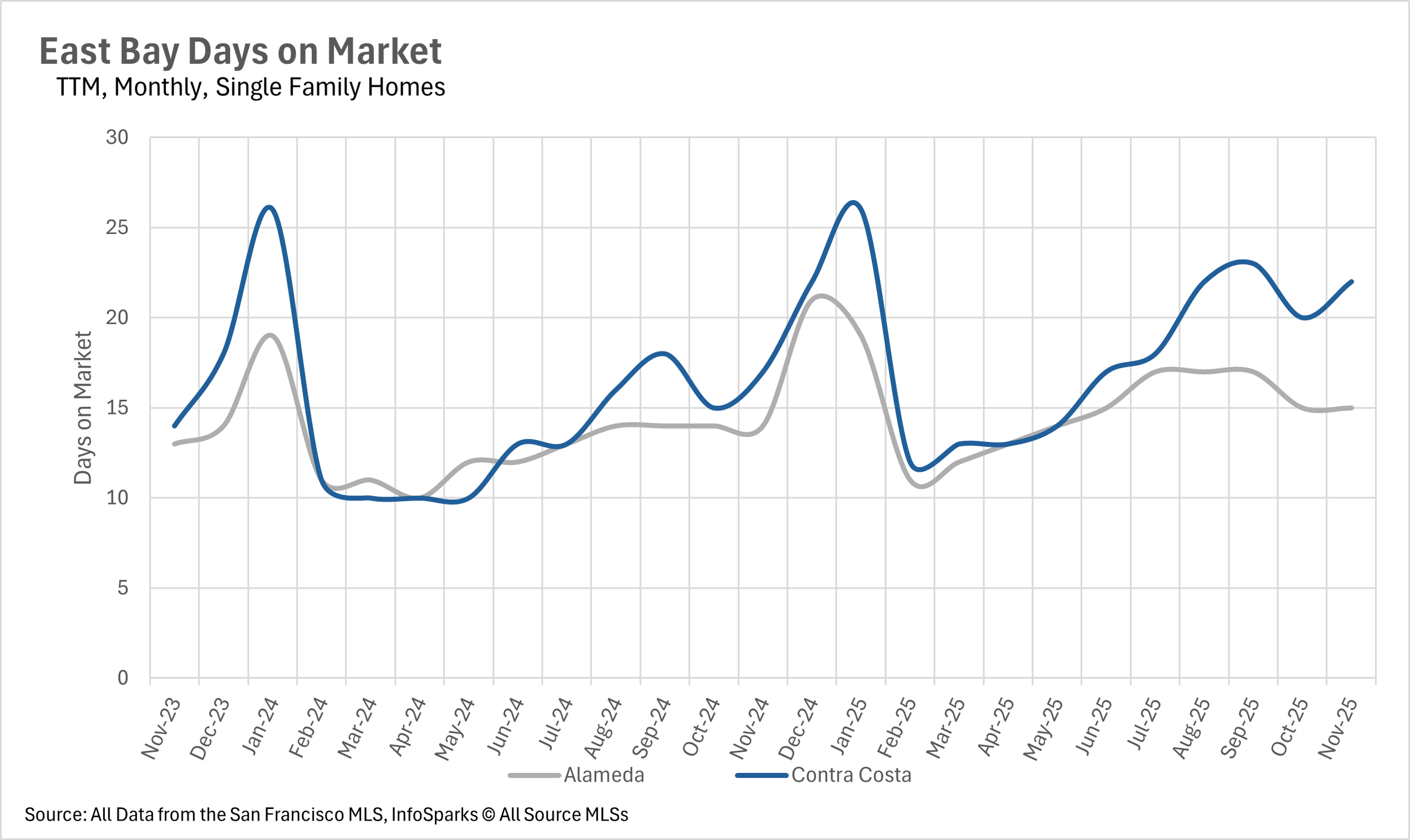

Although inventories are flat, days on the market have increased considerably

Although inventories are roughly in line with where they were last year, we’re seeing the average listing spend quite a bit more time on the market. The average condo spent 39.29% and 20.00% more time on the market in Alameda and Contra Costa Counties, respectively. When we turn to the single-family market, we did see some large percentage jumps on a year-over-year basis, but when you look at the total number of days, listings are still moving relatively quickly. However, this is nothing new, as this has largely been the story in the East Bay single-family home market throughout the entire year!

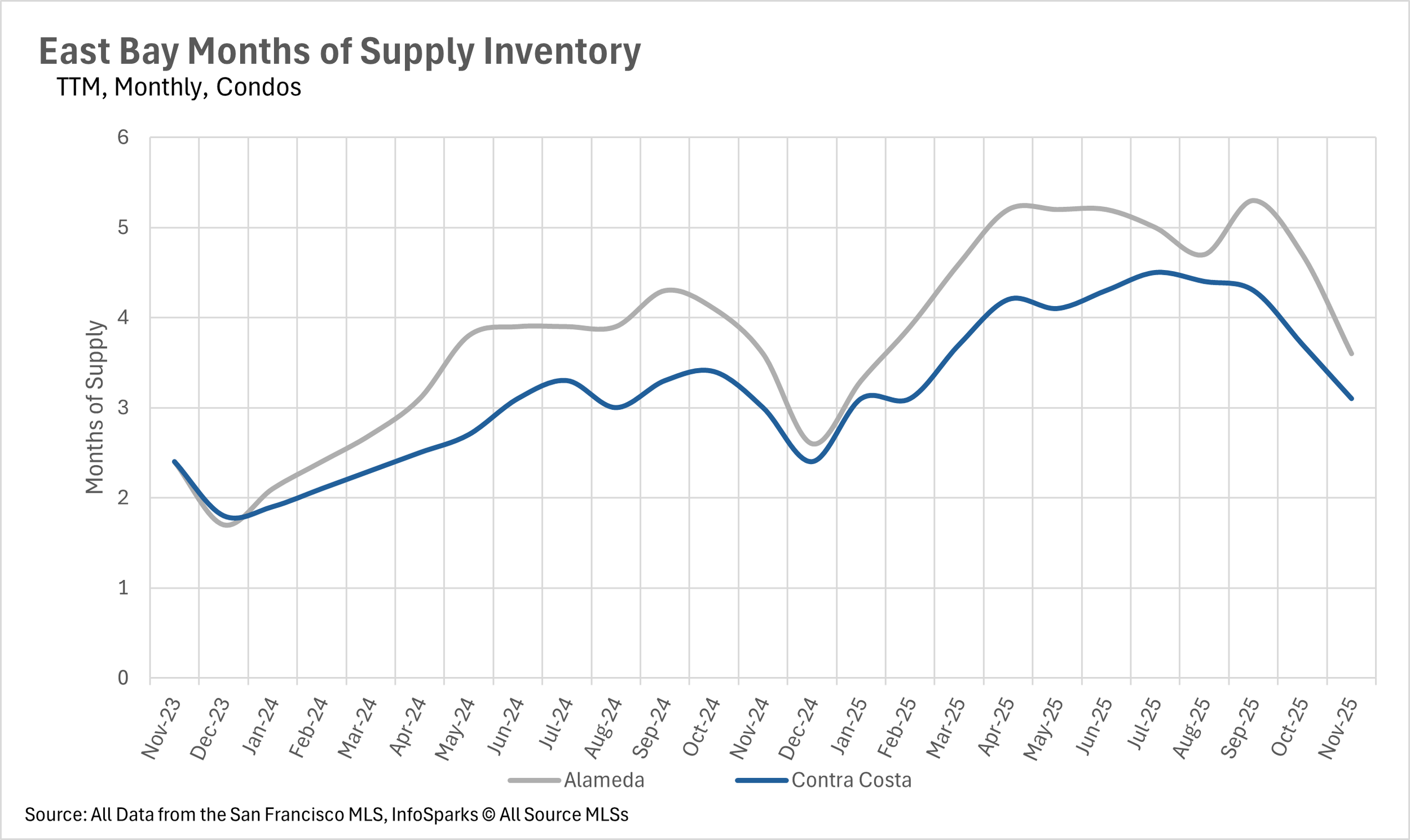

It’s business as usual in the East Bay

When determining whether a market is a buyers’ market or a sellers’ market, we look to the Months of Supply Inventory (MSI) metric. The state of California has historically averaged around three months of MSI, so any area with at or around three months of MSI is considered a balanced market. Any market that has lower than three months of MSI is considered a sellers’ market, whereas markets with more than three months of MSI are considered buyers’ markets.

In the month of November, we saw very little movement on a year-over-year basis in terms of months of supply on the market. There were 1.4 and 1.8 months of single-family inventory on the market in Alameda and Contra Costa Counties, respectively, putting it firmly into sellers market territory. Whereas the condo market is a buyers market, as there were 3.6 and 3.1 months of inventory on the market in Alameda and Contra Costa Counties, respectively.